Are These Stock Market Bear Patterns Unfolding Before Us Now?

Stock-Markets / Stock Markets 2018 Feb 22, 2018 - 09:28 PM GMTBy: Harry_Dent

Last week, markets fell out of bed. Yesterday, they got up and dusted themselves off.

Last week, markets fell out of bed. Yesterday, they got up and dusted themselves off.

I’ve been warning for months now that U.S. markets are in a rising bearish wedge. This pattern tends to be the last move in a long bull market.

Stocks go up in a last orgasmic move in a narrowing channel – or wedge – with little volatility. And then, suddenly, the music stops.

It was thanks to me identifying this wedge that I called the May 2013 top in the junk bond market – to the day!

It was also present at many of the great bubbles in our lifetime…

The Nikkei in 1989.

The Nasdaq in 2000.

Gold in 2011.

Each one peaked in rising bearish wedges.

But there’s something even better that this technical pattern enables us to do…

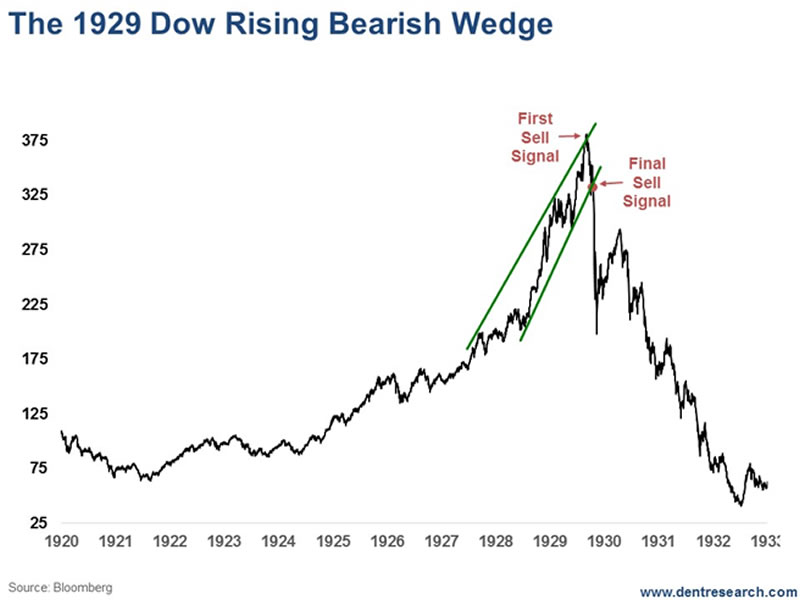

With this pattern, we can see predictable points to exit the market, on the high end… and we get a second chance to get out at the point of break-down, not too far off the top.

But, as with any technical pattern, there’s some art is reading that situation. With rising bearish wedges, there are two scenarios that could unfold…

In Scenario #1, we advance in a rising wedge in a 5-wave up pattern (using Elliott Wave methodology): a-up, b-down, c-up, d-down, and then a final e-wave peak right at or just slightly above the top of the rising wedge.

The infamous 1925-1929 bubble and top occurred this way.

As with junk bonds in 2013, when the market stays within the rising wedge, and when tests the bottom trend-line, it tends to crash right through because the trend is more obvious to traders who drive the markets.

This was also the case with Australia’s ASX 200 bubble into late 2017, and its eventual burst (see you soon Australian readers!).

In Scenario #2, which is unfolding right before our eyes in the Nasdaq, Dow, and S&P 500, we get a “throw-over” rally above the top trend line of the rising wedge, which makes it even more parabolic, and hence, more toppy and bearish.

This is what happened in the Nikkei in 1989, the Nasdaq into 2000, and the Shanghai Composite into late 2007.

Either way, once the crash is confirmed, markets lose more than 40% in the first 2.5 months and 80% two or three years later.

Last week, the Dow, S&P 500, and Nasdaq tested the bottom trend-line of their respective rising bearish wedges three times. Yet each time they rallied back.

On Friday, they broke through that line clearly, but briefly.

Yesterday, they came roaring back.

Based on my study of past rising bearish wedges, and how Scenario #2 typically plays out, it’s likely that markets will move up somewhat and then mostly sideways for a while… then they’ll retest the trend lines… and finally break the critical bottom wedge trend-line in the weeks ahead.

Yesterday, I told Boom & Bust subscribers what to look out for, and what levels on the major indices to take note of. If you’re not already a member, now’s the best time to join.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2017 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.