Big Conflict Ahead in the Financial Markets

Stock-Markets / Financial Markets 2018 Feb 15, 2018 - 03:08 PM GMT TNX futures are in focus this morning as yields creep ever higher. The overnight high was 29.44, and while the 150% Fib level is at 29.66. Since then it has pulled back, but there does not seem to be an end to higher rates, yet. There may possibly be one more probe higher to the top. Possible targets range from 30.18 to 31.36.

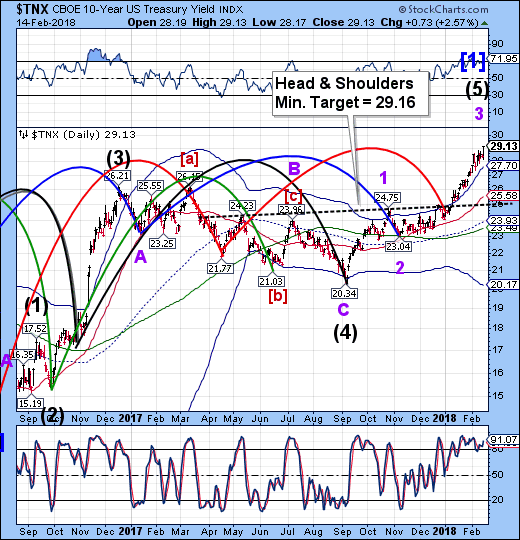

TNX futures are in focus this morning as yields creep ever higher. The overnight high was 29.44, and while the 150% Fib level is at 29.66. Since then it has pulled back, but there does not seem to be an end to higher rates, yet. There may possibly be one more probe higher to the top. Possible targets range from 30.18 to 31.36.

As Northman Trader pointed out yesterday, there is a Cup with Handle formation with the Lip at 27.00 that suggests a probable target for Wave 5 near 37.00. However, the Cycles Model suggests a probable retracement to the neckline may occur first.

ZeroHedge comments, “Global stocks, bond yields and commodities all jumped higher on Thursday while the dollar plunge continued, as investors suddenly seemed to forget the inflation fears blamed for a brutal market sell-off in recent weeks.

Last week's volocaust is a fading, distant memory, and this morning global stocks - albeit without China which is on weekly holiday for the Lunar New Year - continue their relentless surge with the Dow set to open back over 25,000, even as yields rise and the 10Y is fast approaching 3.00%, thanks to a plunging dollar which fell for a firth day, keeping financial condition well lubricated. As a result, global stocks and futures are a sea of green this morning despite growing inflationary noise in the background.”

SPX futures probed to the 50-day Moving Average at 2722.00 in the overnight session before pulling back closer to the 50% retracement level at 2705.00. The retracement appears to be nearly complete, so we must stay on the alert for a reversal. It is difficult to say whether there is a large institutional interest in the long side of the market going into opex. Rising rates may have an impact on how much further this retracement has to go. A market failure going into opex will have a dramatic effect on the size and intensity of the decline.

Bloomberg reports, “The global stock rally marched ahead as investors took in stride a jump in benchmark Treasury yields toward 3 percent. The dollar fell for a fifth day, while the the yen and crude oil advanced.

The Stoxx Europe 600 Index took its cue from a rally in Asian equities to advance for a second day. Futures on the S&P 500 Index signaled U.S. stocks will open higher. The yield on 10-year Treasuries climbed for a second day and held above 2.9 percent. Metals gained, while South Africa’s rand traded at its strongest level in almost three years after President Jacob Zuma resigned.”

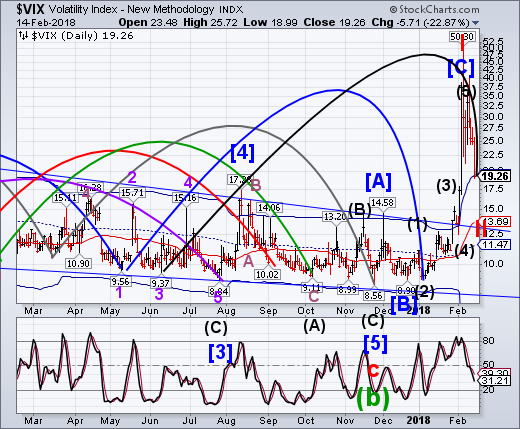

VIX futures are lower this morning, as they fall beneath the Cycle Top support at 19.41. I have rearranged the EW structure a bit to reflect the size of the decline. In addition, I have also modified the degree so that the top (50.30) of the Cycle may have become Cycle Wave 1 or A.

The reason why is that the VIX usually makes its Cycle high at the bottom of SPX Wave [3]. That may only make room for one more surge higher. The alternate is that what we see may be Wave I of a five wave Ending Diagonal to the upside.

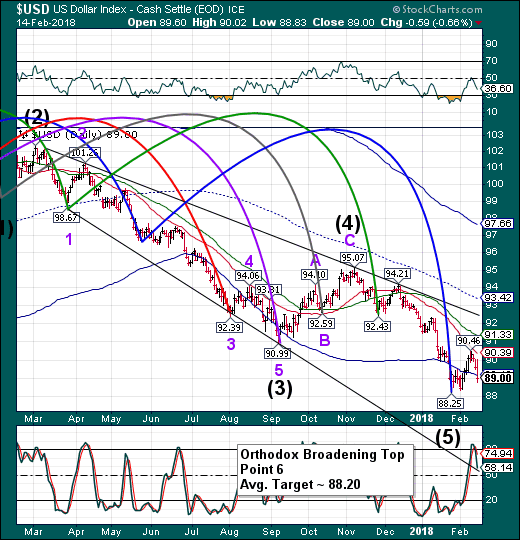

USD futures have declined to a low of 88.49, which is getting dangerously close to the previous bottom. This may end up being either Wave 5 of (5) or an expanded Wave B. Again, there seems to be no end, but there may be a Trading Cycle low due this weekend that would fit the bill.

ZeroHedge comments, “t was a plea for help: as we reported on Wednesday afternoon, a macro trader at one of the world's biggest banks virtually lost it after watching yesterday's bizarre market response to a blistering CPI report - which paradoxically sent yields and stocks soaring even as the dollar tumbled - a reaction which makes zero sense in any rational universe - and penned the following note:

So somehow we have embraced the theme that was with us through January. On a day when inflation beats in the US (incidentally retail sales missed): stocks are up, yields are up and the USD lower does not add up.”

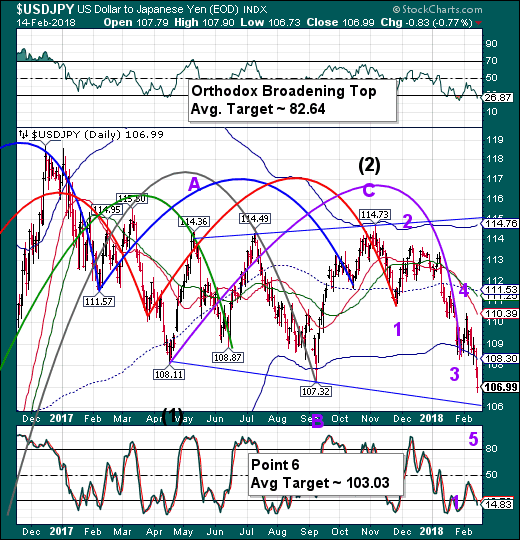

Even if the USD reverses its course, USD/JPY appears to be headed for Point 6 of its Orthodox Broadening Top formation at 103.30. Wave 5 has reached equality with Wave 1, but it appears that it may expand even further. Wave 5 may need to be double the size of Wave 1 in order to hit its target.

This may suddenly drain what little liquidity is left in the markets, IMO.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.