The Fed’s Impossible Choice, In Three Charts

Interest-Rates / US Interest Rates Feb 11, 2018 - 03:02 PM GMTBy: John_Rubino

Critics of “New Age” monetary policy have been predicting that central banks would eventually run out of ways to trick people into borrowing money. There are at least three reasons to wonder if that time has finally come:

Critics of “New Age” monetary policy have been predicting that central banks would eventually run out of ways to trick people into borrowing money. There are at least three reasons to wonder if that time has finally come:

Wage inflation is accelerating

Normally, towards the end of a cycle companies have trouble finding enough workers to keep up with their rising sales. So they start paying new hires more generously. This ignites “wage inflation,” which is one of the signals central banks use to decide when to start raising interest rates. The following chart shows a big jump in wages in the second half of 2017. And that’s before all those $1,000 bonuses that companies have lately been handing out in response to lower corporate taxes. So it’s a safe bet that wage inflation will accelerate during the first half of 2018.

The conclusion: It’s time for higher interest rates.

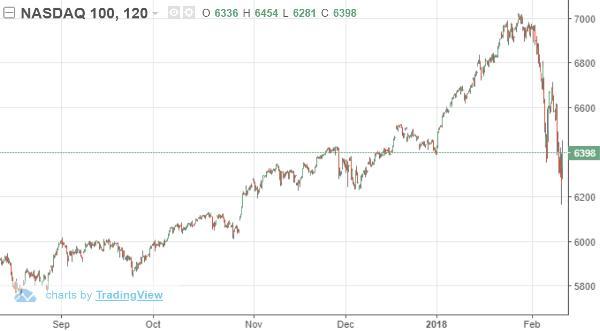

The financial markets are flaking out

The past week was one for the record books, as bonds (both junk and sovereign) and stocks tanked pretty much everywhere while exotic volatility-based funds imploded. It was bad in the US but worse in Asia, where major Chinese markets fell by nearly 10% — an absolutely epic decline for a single week.

Normally (i.e., since the 1990s) this kind of sharp market break would lead the world’s central banks to cut interest rates and buy financial assets with newly-created currency. Why? Because after engineering the greatest debt binge in human history, the monetary authorities suspect that even a garden-variety 20% drop in equity prices might destabilize the whole system, and so can’t allow that to happen.

The conclusion: Central banks have to cut rates and ramp up asset purchases, and quickly, before things spin out of control.

So – as their critics predicted – central banks are in a box of their own making. If they don’t raise rates inflation will start to run wild, but if they don’t cut rates the financial markets might collapse, threatening the world as we know it.

There’s not enough ammo in any event

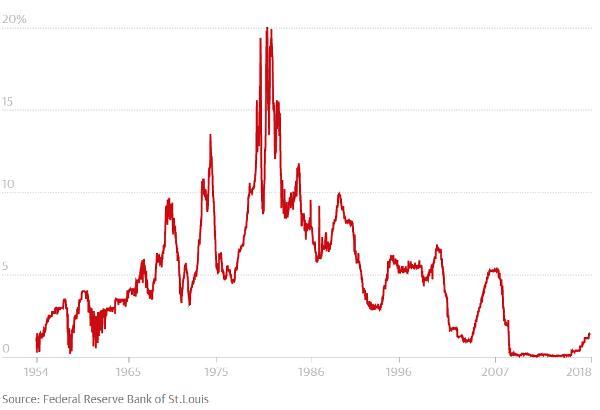

Another reason why central banks raise rates is to gain the ability to turn around and cut rates to counter the next downturn.

But in this cycle central banks were so traumatized by the near-death experience of the Great Recession that they hesitated to raise rates even as the recovery stretched into its eighth year and inflation started to revive. The Fed, in fact, is among the small handful of central banks that have raised rates at all. And as the next chart illustrates, it’s only done a little. Note that in the previous two cycles, the Fed Funds rate rose to more than 5%, giving the Fed the ability to cut rates aggressively to stimulate new borrowing. But – if the recent stock and bond market turmoil signals an end to this cycle – today’s Fed can only cut a couple of percentage points before hitting zero, which won’t make much of a dent in the angst that normally dominates the markets’ psyche in downturns.

Most other central banks, meanwhile, are still at or below zero. In a global downturn they’ll have to go sharply negative.

So here’s a scenario for the next few years: Central banks focus on the “real” economy of wages and raw material prices and (soaring) government deficits for a little while longer and either maintain current rates or raise them slightly. This reassures no one, bond yields continue to rise, stock markets grow increasingly volatile, and something – another week like the last one, for instance – happens to force central banks to choose a side.

They of course choose to let inflation run in order to prevent a stock market crash. They cut rates into negative territory around the world and restart or ramp up QE programs.

And it occurs to everyone all at once that negative-yielding paper is a terrible deal compared to real assets that generate positive cash flow (like resource stocks and a handful of other favored sectors like defense) – or sound forms of money like gold and silver that can’t be inflated away.

The private sector sells its bonds to the only entities willing to buy them – central banks – forcing the latter to create a tsunami of new currency, which sends fiat currencies on a one-way ride towards their intrinsic value. Gold and silver (and maybe bitcoin) soar as everyone falls in sudden love with safe havens.

And the experiment ends, as it always had to, in chaos.

By John Rubino

Copyright 2018 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.