Stock Market Technical Analysis

Stock-Markets / Stock Markets 2018 Feb 09, 2018 - 03:55 PM GMT  This week’s “flash crash” has inflicted some technical “damage” on the market but nothing too serious, for the moment. However, some caution is warranted.

This week’s “flash crash” has inflicted some technical “damage” on the market but nothing too serious, for the moment. However, some caution is warranted.

To gauge where the markets go from here I believe it important to focus on how the Dow Transport Index behaves, as it is the weaker of the two main Dow Indices. (As was the case in 1998 and 1999, just before the tech crash of 2000). Currently it is trying to consolidate around its 100 Daily Moving Average but I suspect new lows will be tested before too long. Remember technical analysis 101: “when significant moving averages become points of resistance rather than points of support you are in a bearish trend.”

Accordingly, please note: if the 9,440 price level is broken on the trannies the next key price point will be 9,029. Should this level fail, the Dow Transports will be in a bear market. How the Dow Industrials will react in the event of such an occurrence will be fundamental to world stock market behaviour for the rest of 2018/2019.

My major concern now is not simply market technical reality but the functionality of the New York Stock Exchange itself. What the “flash crash” of last Monday has shown us is that there is no real liquidity in the stock market, period. (It fell 800 points in 6 minutes). In many ways it is becoming increasingly obvious that the NYSE is no longer fit for purpose. Too much power has been given to Algo and Quant trading entities to the detriment of market making professionals. How this new system”” is going to operate in a true bear market is anyone’s guess. Should a real bear trend develop, given what we have just experienced, a “recession” could be priced into the market within days or weeks instead of months and years. Under such circumstances it is quite possible standard sell stop execution and normal retail trading will not operate effectively, thus exposing active traders and investors to massive uncontrollable losses. See this note that appeared in the “Wall Street On Parade” blog, by Pam Martens and Russ Martens yesterday:

“The U.S. Senate Banking Committee needs to get its act together and immediately schedule hearings on the trading outages that occurred at numerous discount brokers and mutual funds on Monday. According to thousands of on-line complaints, customers of major firms like TD Ameritrade, Fidelity, Vanguard, and T. Rowe Price could not access their accounts using the firms’ websites and thus could not place sell or buy orders as the market dove 1,597 points in mid-afternoon, then partially recovered to close down 1,175 points.”

Complaints against Fidelity included this one from a client named Lee Yih:

“The Fidelity Active Trader Platform finally loaded after 80 minutes of trying. I put in 4 orders, but nothing. No indication of orders received, no indication of an execution. I do have the order numbers, however. The website should not be giving the appearance it is up, when orders entered are swallowed up and we do not know where we stand. I called them and waited for 32 minutes on hold before giving up.”

Given this “crisis of market functionality” investors and traders who have benefited greatly from this bull market, which commenced in March 2009, might consider going to 100% to cash right now thus avoiding the inevitable train wreck I see coming down the tracks. The recession catalyst I see will be the FED forced to raise interest rates quickly due to imported inflation as a result of an ever weakening dollar. Rising interest rates will destroy sovereign fiscal policies worldwide and force growth crushing personal taxation increases. In other words austerity will return with a vengeance.

This market position exit strategy may mean losing some profits from future hyperbolic market action but it means one is liquid and in pole position to take advantage of any “flash recession” and the inevitable eventual “flash recovery”. It is now obvious we are living in an altered trading environment.

Chart: Dow Transports: Daily.

Chart: Dow Transports: Weekly.

Chart: Dow Industrials: Daily.

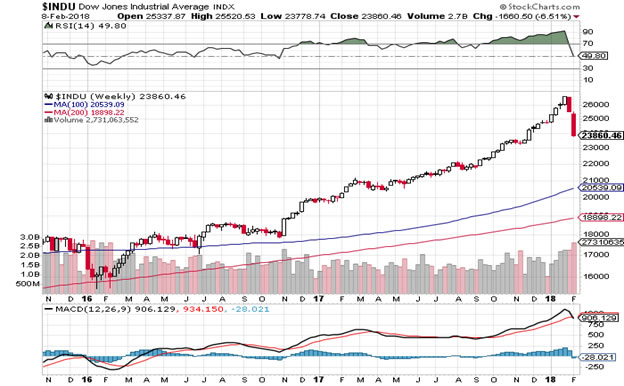

Chart: Dow Industrials: Weekly.

Charts: Courtesy of StockCharts.Com

Source: “Wall Street On Parade” 8th February article by Pam Martens and Russ Martens,

Christopher Quiqley

B.Sc., M.M.I.I. Grad., M.A.

http://www.wealthbuilder.ie

Mr. Quigley was born in 1958 in Dublin, Ireland. He holds a Bachelor Degree in Accounting and Management from Trinity College Dublin and is a graduate of the Marketing Institute of Ireland. He commenced investing in the stock market in 1989 in Belmont, California where he lived for 6 years. He has developed the Wealthbuilder investment and trading course over the last two decades as a result of research, study and experience. This system marries fundamental analysis with technical analysis and focuses on momentum, value and pension strategies.

Since 2007 Mr. Quigley has written over 80 articles which have been published on popular web sites based in California, New York, London and Dublin.

Mr. Quigley is now lives in Dublin, Ireland and Tampa Bay, Florida.

© 2017 Copyright Christopher M. Quigley - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Christopher M. Quigley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.