Stock Market Once in a Lifetime Rally

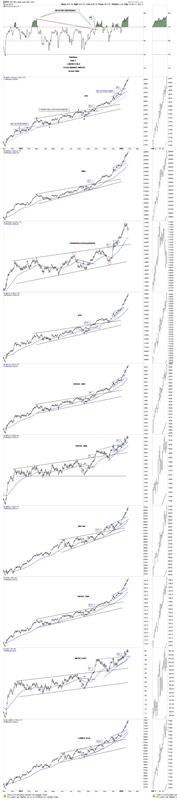

Stock-Markets / Stock Markets 2018 Jan 28, 2018 - 05:51 PM GMT “With the rally continuing to power higher in the stock markets I’m going to update the portfolio combo charts so you can see how this once is a lifetime rally in unfolding. When this impulse move finally burns itself out we will get a decent sized correction that may take a year or two build out. Until then the hardest thing for most investors riding this bull is to hang on for dear life.

“With the rally continuing to power higher in the stock markets I’m going to update the portfolio combo charts so you can see how this once is a lifetime rally in unfolding. When this impulse move finally burns itself out we will get a decent sized correction that may take a year or two build out. Until then the hardest thing for most investors riding this bull is to hang on for dear life.

For over six months or longer we’ve heard the never ending story about how overbought this market is, but the stock market doesn’t care what we think. The investors that have missed this rally are crying the loudest that the stock market has to crash because they’re not in it, if they were they would be enjoying the ride of a lifetime. At any rate the correction is going to come at some point and I can guarantee you that we won’t hit the absolute top tick. We have some price objectives that hopefully will get us out in time to enjoy our profits.

I’m going to start off by looking at the daily stock market combo chart. When looking at all the combo charts to follow note the two dominate chart patterns, the H&S’s and the rising flags and wedges. So far there is nothing on these charts that are suggesting a top is in.”

Click on chart for Large View

“I would like to reiterate once more that our current rally is not normal and doesn’t happen very often in ones trading career. To have missed this opportunity because of emotions, trading discipline or trying to use fundamentals that tell you how the markets are supposed to work, is tough when you see a market like we have right now leaving you behind. More than anything else it is psychological warfare. If it was easy then everyone would become millionaires and we know the markets don’t work that way.

I’ve stated many times in the past that we are going up against all the best minds in the world that want every penny you have. They could care less how you feel as long as they get your hard earned capital. It’s a dog eat dog world and to the victor goes the spoils. Have a great weekend. All the best

All the best

Gary (for Rambus Chartology)

FREE TRIAL - http://rambus1.com/?page_id=10

© 2018 Copyright Rambus- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.