SPX, NDX, INDU and RUT Stock Indices all at Resistance Levels

Stock-Markets / Stock Markets 2018 Jan 16, 2018 - 02:09 PM GMT Good Morning!

Good Morning!

SPX futures challenged the 2800.00 round number resistance, rising to 2803.50 over the extended weekend.

ZeroHedge comments, “When markets open for trading today, the S&P will rise above 2,800 and the Dow Jones will not only make a new record high (those have become a bit of a boring daily occurrence lately) it will do so in historic fashion with just 12 days needed to move from 25,000 to 26,000, the fastest 1,000 point move in history, nearly twice as fast as the previous record when it took just 23 days for the DJIA to move from 24,000 to 25,000. And yes, get ready for the imminent (self-)congratulatory tweet from Donald Trump...”

The reversal may be even faster than ;the rally.

NDX futures have also reached round number resistance at 6800.00 as it reached its second Fibonacci target of 6795.00 over the extended weekend.

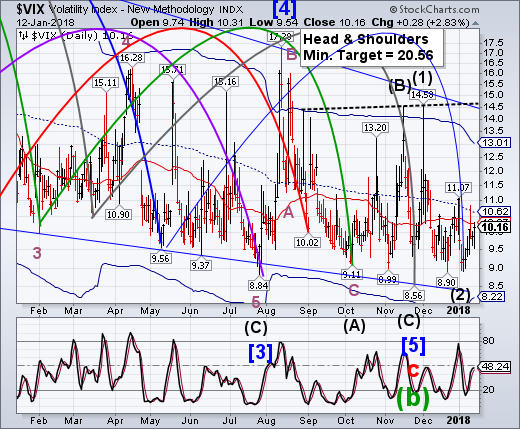

VIX futures are rising even faster than the SPX this morning. VIX is currently above the 50-day Moving Average at 10.27 and may threaten mid-Cycle resistance at 10.62. This may be considered an aggressive buy signal.

We will not know the status of the NYSE Hi-Lo Index until after the open.

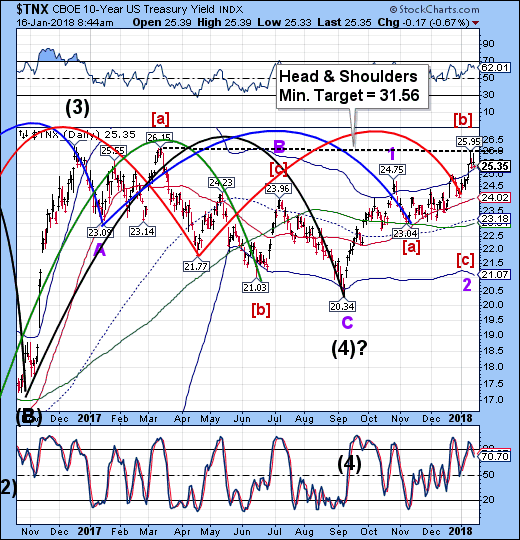

TNX futures are declining to challenge the Cycle Top support at 25.28. We may consider it on a sell signal once beneath that support.

ZeroHedge observes, “In its latest reminder that China is a (for now) happy holder of some $1.2 trillion in US Treasurys, Chinese credit rating agency Dagong downgraded US sovereign ratings from A- to BBB+ overnight, citing "deficiencies in US political ecology" and tax cuts that "directly reduce the federal government's sources of debt repayment" weakening the base of the government's debt repayment.”

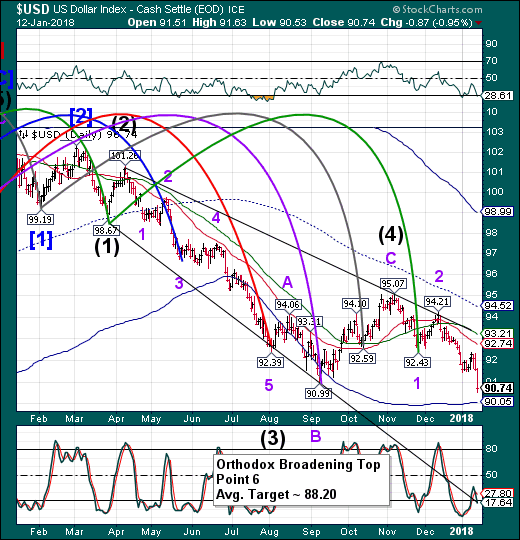

USD futures appears to have reached the Cycle Bottom at 90.05 yesterday and is currently on a bounce. This bounce may last until the weekend, but may only rise to Intermediate-term resistance at 92.74. The Wave structure is as yet unfinished and may extend to or beyond its target at 88.20.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.