Commodities Correcting from Extreme Overbought State is Healthy

Commodities / Resources Investing Sep 05, 2008 - 01:32 PM GMTBy: Ty_Andros

It's an interesting time to be in the financial markets. The return of the “Crack up Boom” series is a result of the amazing amount of MONEY and CREDIT creation that is going to be required to RECAPITALIZE and re-inflate the G7 economies. Money and Credit creation are the fuel and lifeblood of the G7 economies. Misstated inflation is reported as GROWTH; as the OVER-the-COUNTER debacle unfolds and vaporizes the balance sheets of the G7 financial and banking systems rendering many of the biggest players INSOLVENT. Their business models and income flows in tatters as their obligations just keep on piling up. But the WOLF wave continues its march throughout the G7 as incomes collapse under higher costs and collapsing business conditions. Combine that with a US election and you get a recipe for paralysis on the part of irresponsible PUBLIC SERVANTS.

It's an interesting time to be in the financial markets. The return of the “Crack up Boom” series is a result of the amazing amount of MONEY and CREDIT creation that is going to be required to RECAPITALIZE and re-inflate the G7 economies. Money and Credit creation are the fuel and lifeblood of the G7 economies. Misstated inflation is reported as GROWTH; as the OVER-the-COUNTER debacle unfolds and vaporizes the balance sheets of the G7 financial and banking systems rendering many of the biggest players INSOLVENT. Their business models and income flows in tatters as their obligations just keep on piling up. But the WOLF wave continues its march throughout the G7 as incomes collapse under higher costs and collapsing business conditions. Combine that with a US election and you get a recipe for paralysis on the part of irresponsible PUBLIC SERVANTS.

VOLATILITY IS OPPORTUNITYAND: The Markets are racing all over the place, volatility is abundant and so are opportunities. Stocks, interest rates, commodities, currencies and natural resources are doing their best Kabuki dance to confound poorly prepared investors and reward those that are properly prepared. Many are predicting the dollar has TURNED, maybe so, but it is just a correction in its path to its demise. USE the rally to extricate yourself from this global TARBABY AND PAPER CURRENCIES OF ALL STRIPES on better terms of exchange.

UBS reports that in June GLOBAL foreign exchange reserves have grown from under $2 trillion in 2000 to over $7 Trillion in the Chinese, Russian, Japanese, Taiwan Indian and Korean central banks alone: 225 % growth in just 8 years! To put this in perspective it took a decade for reserves to go from $1 trillion to 2 trillion. Just think of the reserves in the central banks not included in the survey such as the ECB (European Central Bank), BOE (Bank of England), Canadian, Brazilian, OPEC, Swiss, UAE and Australian Central Banks, just to name a few that have grown enormously as well . And what about the growth of cash reserves in the hands of the private sector? Can you say “to the moon?!!”

In the US alone, money market deposits are up 40% from $2.5 trillion to over $3.5 trillion since last OCTOBER.

GLOBAL GDP is OVER $50 trillion. THERE IS NO SHORTAGE OF CASH AND MONEY IN THE WORLD. Average money and credit growth is OVER 20% globally. KEEP THIS IN MIND when they talk about projected 2 trillion dollars of losses in the G7 financial and banking systems. All of a sudden the problems are put in perspective, large for the banks, small in the BIG picture.

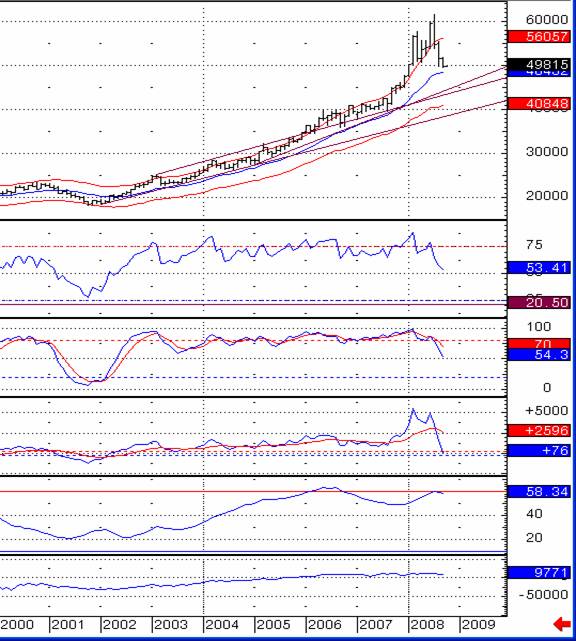

For those of you who fear that the LONG TERM themes are OVER I will give you three pieces of the puzzle to consider. Supposedly the commodities, oil and gold bubbles have burst? NO WAY , BECAUSE THEY ARE NOT A BUBBLE! They are just correcting after getting very ahead of themselves. I will show you the monthly charts, as they are retreating to NEUTRAL from extreme levels of being OVERBOUGHT . Let's take a look at the continuous commodity index which is a basket of the broad market of commodities such as the CRB index:

This BASKET of commodities is just BEGINNING to approach its 21-month moving average, relative strength index is still at 57 (look for it to test or slightly fall below the 50 area) before turning up again. Stochastics and MACD have RETURNED to neutral. ADX trend gauge signals the trend is STILL VIBRANT. And on balance volume is chugging along. This market was HUGELY ahead of itself, a prime buying opportunity lies directly ahead. I looked at the quarterly charts and ALL HIGHS were confirmed by the internals market indicators. DON”T be fooled by the FOOLS who tell you to bet on a recovery of PAPER versus STUFF. Next let's look briefly at crude oil:

SAME picture; REVERSION to the mean and correction from massive OVERSHOOT on the upside. EVERY technical indicator confirmed the highs. The 20-month moving average is at $98.53, expect a visit there very soon then BUY BUY BUY and convert your increasingly worthless paper dollars for something that is real. Now let's look in the mirror AGAIN in the gold market:

SAME picture; REVERSION to the mean and correction from massive OVERSHOOT on the upside. EVERY technical indicator confirmed the highs. The 20-month moving average is at 800, expect a visit there very soon then BUY BUY BUY and convert your increasingly worthless paper dollars for something that is real. A trip to the TRENDLINES is nothing to be afraid of. In fact, it is an opportunity for you to get MORE FOR YOUR MONEY. ANY market technician will tell you these are not pictures of anything but intermediate to long term CORRECTIONS! These markets are healthier now then they have been in a while, the excesses are being QUICKLY unwound and nothing more.

Do you think they are going to quit printing money and creating credit? NOPE, they are not suicidal and to do so would create a deflationary depression that would DWARF the 1930's. If the public in the G7 suffers from tighter credit availability you can rest assured that their governments don't have the same problem and I promise you they will pick up the slack and borrow what they can't. MAKE no mistake trillions of dollars, Euros, UK Pounds, Yuan, etc. are all still rolling off the printing presses like a freight train and PILING up in bank accounts. Soon greed will outweigh fear and the next leg higher will begin as to leave it in the bank is a recipe for losing purchasing power and confiscation by debasement. And to see what lies ahead…

Blow Out and Blow Ups

Broad fires are raging within the G7 financial and banking systems. It does not matter where you turn the CREDIT spreads between Sovereign treasuries: and Corporate (investment grade and junk), 2 year swaps, Fannie and Freddie issues, Mortgage loans, credit card and auto loans, bank offerings and preferred shares are wide and widening. FEAR is running like Niagara Falls over the edge. MONEY is available but only at high and rising prices.

Credit is being tightened AS IT SHOULD BE. But they are throwing the babies out with the bathwater. BANKS can't lend as they themselves don't know the value of their own holdings, and neither do their potential lenders. SO there is none. Take a look at this chart outlining the rates financial institutions would have to pay to borrow money from a recent John Mauldin missive (John can be reached at: johnmauldin@FrontLineThoughts.com ):

- Lehman Brothers--11-13%.

- Merrill Lynch--11-12%.

- Morgan Stanley--9-10%.

- Citigroup--9 ½ -10 ½%.

- CIT Group--12-15%.

- Fannie Mae/Freddie Mac---15%

- Keycorp--11-13%.

- National City --13-15%.

- Wachovia--10-12%.

- Zions Bancorp--13-15%.

- GM/GMAC--not possible.

- Washington Mutual--not possible.

- Ford--not possible."

With 10-year treasuries at 3.65% it becomes quickly apparent that these companies are in the JUNK category. It is impossible to raise money at these rates and stay in business and make a profit. Notice GM, Ford, and GMAC are unable to raise funds AT ANY price (functionally dead men walking) and we just await their BANKRUPTCY announcements or bailout's by the GANG of 535, also know as the US Congress. But the worst news is that these entities MUST ROLL over $1,000 billion ($1 trillion) of short term debt between now and next summer ($300 billion plus before December). Their tier 1 and 2 assets keep mushrooming, meaning that their balance sheets are CONTRACTING and lenders have NO ABILITY to determine their CREDIT WORTHINESS. Until they create an exchange for the over-the-counter derivatives known as (mortgage backed securities, CLO's, CDO's, etc.) these organizations are effectively UNABLE to find lenders at interest rates which will allow them SURVIVE, use the funds at a profit in excess of their costs and roll their current borrowings.

UNFORTUNATELY there is a nationwide election in progress and a solution WILL NOT be forthcoming until it has concluded. I believe there will be a violent storm in the next 60 days in BOTH the credit and stock markets because of this, as the credit calendar is RELENTLESS for the next year. If these short term notes can't roll, then bankruptcies will quickly follow.

The credit default swaps on these issues is UNCALCULABLE! They are at least many multiples of the face amounts of the borrowings that must roll out into the future. If Fannie and Freddie are nationalized and the shareholders are wiped out it will represent another $1 trillion of RESERVES in the form of PREFERRED shares that will be wiped off the balance sheets of the nation's banks rendering many of them insolvent. Do you know the amounts of these securities which reside in pension funds, institutions and insurance accounts? Huge amounts.

They bought the FALLACY that the mortgage giants were TOO BIG TO FAIL and implicitly insured. POLITICAL correctness is practically incorrect as I have said MANY times. The problem with assumptions is they are derived from the word ASSUME which actually an acronym is for: make an ASS of U and ME. In this case both parties are ASSES, the buyers and sellers! They made POLITICALLY CORRECT assumptions and they are finding out that unless they are in WRITING they are worth NOTHING and practically incorrect. Sounds ominously like public servants' promises; ever seen one that was kept? SMART GUYS…

The reason the dollar is rising is that BORROWERS are HOARDING funds in anticipation of being UNABLE to roll and lenders are fleeing because there is NO WAY to know if the borrower can repay or is among the DEAD men walking groups.

Thus, there is a buyers strike on all the securities mentioned above. You can expect the spreads to blow out further in the next 30 days. THERE ARE NO BUYERS OF DEBT (LENDERS) FOR BORROWERS OF DUBIOUS QUALITY. Fannie and Freddie face 300 billion dollars themselves between now and year end. I hope hammering Hank Paulson is running FIRE DRILLS, as the markets ARE NOT going to wait for him. Solutions must be presented immediately or the dominoes of disaster will begin to fall.

The money printing MUST go into high gear NOW! Look for the Feds term auction facilities to be expanded BIG TIME to create liquidity for the financial and banking systems which increasingly will not be able to access the private debt markets due to the unknowable balance sheets. Fannie and Freddie at some point will belly up to the Fed and US treasury, as sooner or later they will not be able to raise funds unless Paulson and the Treasury pulls the trigger on the bailout. I predict preferred shareholders, regular shareholder and subordinated debt will be allowed to have stakes in the future as the implications to the FDIC and the credit default swap markets are unknowable and they don't want to find out the answers. LOOK FOR FIREWORKS!! Look for Bill Gr*ss at PIMCO to work for the bailout. Rest assured Bill, it will happen.

In conclusion, i t's almost inconceivable in a world AWASH in dollars but the fact is: There is a shortage of dollars available to the G7 financial and banking systems. Those credit spreads will only widen to force the issue on the government bailouts. A resolution trust MUST be created to deal with the toxic securities and discover what the true worth of them is, today it is UNKNOWABLE. As outlined in the Tedbits piece “Roach Motels” over a year ago, they can't print money fast enough to fill the holes these products are blowing in to the balance sheets of the banks and investment houses of the G7. Their worth becomes more obscure every day.

As predicted, those term auction facilities are about to expand in multiples of today's size. The trade in commodities and stuff is only correcting, destroying the public who always gets in last. Allowing the MAINSTREAM financial media to FOOL you with their WISHFUL thinking, HOPE (which is not an investment strategy) and the belief rallies can happen as earnings COLLAPSE. Anyone who believes a bull market in paper can happen at this point is smoking something. Can the dollar rally in a countertrend manner? Yes. Use it to position yourself for the next leg of fiat currency creation. It is only a matter of time and perception.

This is one of the greatest opportunities in history, as the biggest money in the world is investing with their eyes in the rearview mirror. They DON'T understand the functions of money, don't understand that safety CANNOT be found in paper, and are INVESTED in getting you to believe NOMINAL gains are REAL gains, so THEY CAN FLEECE YOU. The shrill voices of those financial analysts who have been wrong for YEARS and claim the return to the happy days of bull markets in PAPER are fools and you will be too. NO markets tip their hands over the course of a few weeks or months as to the long term REALITIES. To believe you can call tops in markets in 6 weeks is problematic at best, foolhardy at the worst. The world still produces 85 million barrels of crude a day and consumes 87 million barrels, and next year use will rise to 88 million barrels, yet many are calling a top. Inflation is in the pipeline, a short pullback will not change this.

Volatility is opportunity and it is high and RISING! Stocks, bonds, currencies, commodities, precious metals and natural resources will ALL move dramatically to price in new realities and these are OPPORTUNITIES FOR YOU. The credit crunch means the trades in STUFF has much more to run as development and investment are inhibited by the CREDIT crunch. The transfer of wealth from those who hold their wealth in paper to those who don't is still in its infancy. Paper is poison; use this pullback in stuff to exchange your paper for something more TANGIBLE.

Don't miss the next edition of Tedbits and the “Crack up Boom” series. Hi ho, Hi ho its off to the printing press we go.

Please remember that subscribers receive Tedbits two to three days before it is posted on the web. Subscribers will also start receiving guest essays from leading economic pundits, and a blog looms soon. So if you want it early and the added features SUBSCRIBE NOW it's FREE!

Thank you for reading Tedbits if you enjoyed it send it to a friend and subscribe its free at www.TraderView.com don't miss the next edition of Tedbits.

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

By Ty Andros

TraderView

Copyright © 2008 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.