Stock Market Panics Into September, a Historically Bad Month

Stock-Markets / US Stock Markets Sep 05, 2008 - 12:29 PM GMT Many reports have been published over the past few days about stock market seasonality and, specifically, about September typically being the worst month of the year.

Many reports have been published over the past few days about stock market seasonality and, specifically, about September typically being the worst month of the year.

I included the following paragraph in a recent post : “Seasonality indicates that ‘September has firmly secured the rank as the worst month of the year' ( Stock Trader's Almanac ), but that a year-end rally typically starts in late September / early October.”

September has certainly got off to a rough start, with both the MSCI World Index and the MSCI Emerging Markets Index having declined every single trading day since September 1.

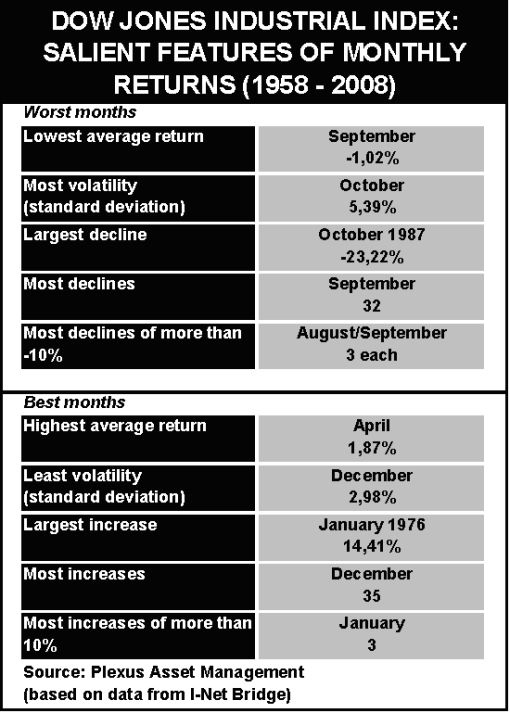

I realize numerous studies have been done on the historical pattern of monthly returns, but in order to gain a first-hand feel for the data, I have researched monthly returns of the Dow Jones Industrial Index from January 1958 to August 2008. Some interesting statistics are summarized in the table below.

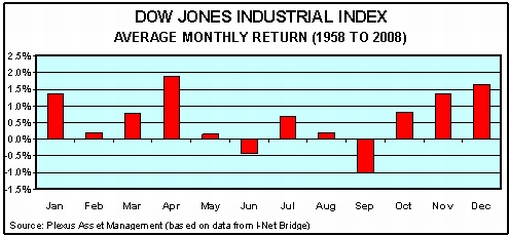

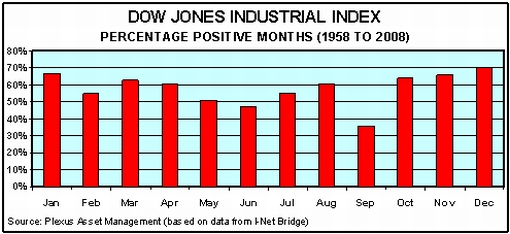

The following two tables show the percentage positive months (top graph) and the average monthly return (bottom graph) respectively.

It is clear from the above that September, on average, has historically been the worst month. But stock markets recovered after that and October, November, December and January have traditionally been good months.

Time will tell whether the current panic mode will make way for a better period in the weeks to come.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.