Cryptocurrencies Break Through $800 Billion, Led By Bankster Coin Ripple

Currencies / BlockChain Jan 07, 2018 - 06:45 PM GMTBy: Jeff_Berwick

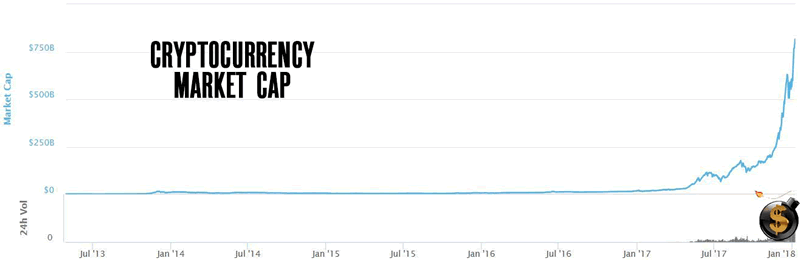

Once again, the cryptocurrency markets have surged to a new all-time high above $800 billion US, gaining over $200 billion in just four days time!

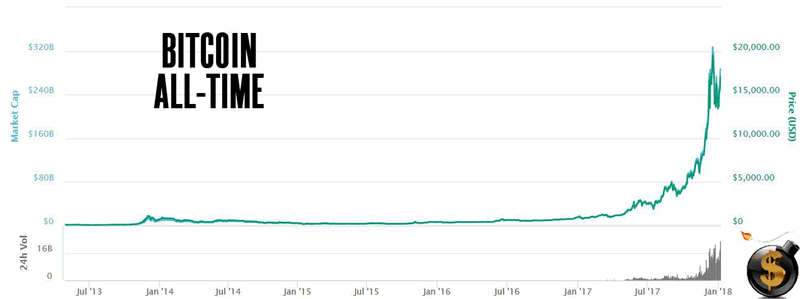

Bitcoin is again trading above $17,300 despite being the slow, congested, dysfunctional slow lane of cryptocurrencies on the digital highway as portrayed very well and in real time at txhighway.com

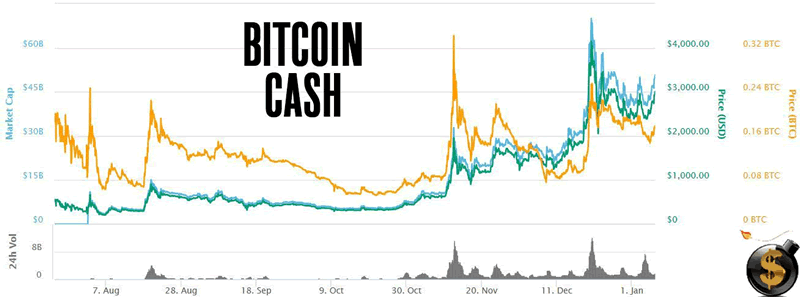

Bitcoin Cash, with its wide open spaces and uncongested lanes, also rose nearly 10% in the last 24 hours to $2,750.

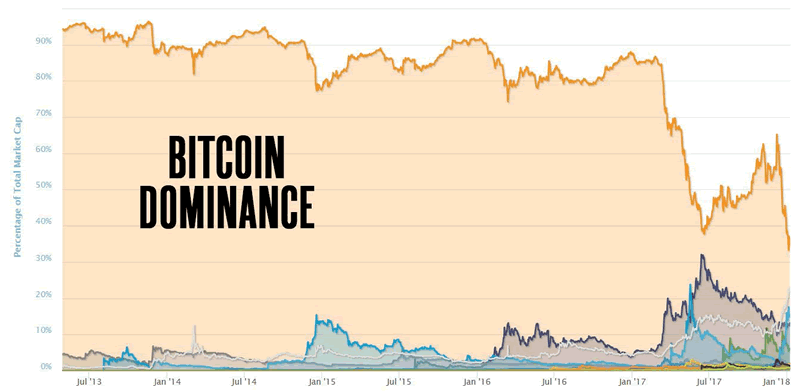

However, even with the crypto market capitalization higher than ever, bitcoin is no longer nearly as dominant as it once was. Its dominance has fallen to 36% of the entire market.

This is one of the many consequences bitcoin has suffered as a result of its slow transaction times and high network fee.

But, the biggest contributor to the quickly rising cryptocurrency space has been Ripple which has soared from $0.22 a month ago to over $3 today.

But, is Ripple even a cryptocurrency? Should it even be included as part of the cryptocurrency market cap?

Central bankers and mainstream media cronies have been quick to promote Ripple as the cryptocurrency which is going to eventually “supplant” bitcoin.

For instance, there was recently an article published on MarketWatch that stated, “Ripple is considered the outfit with the most legitimate business model from a Wall Street perspective.”

And of course in their eyes it is. It’s the least decentralized major cryptocurrency out there right now.

The coin was massively premined… a no-no in cryptocurrency world. And still to this day, the majority of Ripple is still held by the company that created Ripple. And, with the price skyrocketing, Ripple founder Chris Larsen just surpassed Mark Zuckerberg to become the fifth wealthiest person in the world!

And all this for a coin that isn’t really decentralized, doesn’t really have a blockchain and that banks may intend to use for something as mundane as international transactions.

In other words, its the opposite of nearly everything we value in cryptocurrencies… and its why we have stayed away from it and continue to do so despite the massive gains.

And besides, in the end, the entire central banking and financial system will disappear entirely as cryptocurrencies make them obsolete. So, actually owning Ripple long term is incredibly risky as it depends on the banking system continuing to exist in the future… something that is highly unlikely.

We’ll happily stick to the cryptos that will take down the banks and governments. Even if it means slightly smaller gains for the time being. We’ve made fortunes on real cryptocurrencies in the last few years and expect to continue to do so.

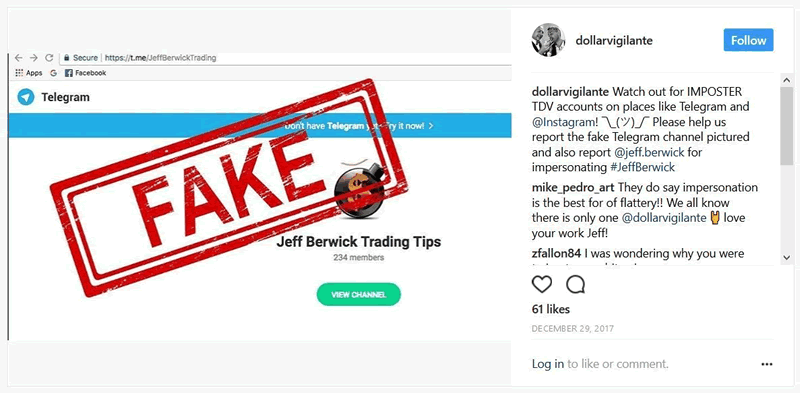

Because of this, I should warn, that a number of fake “Jeff Berwick” and “TDV” Instagram, Facebook and Telegram accounts have been launched to take advantage of our notoriety.

Please stick to our official Facebook, Instagram and Twitter accounts and my personal Facebook account. And, we don’t have a Telegram account, so if you see TDV or “Jeff Berwick” there, it is fake.

You can get all our real recommendations, trades and analysis HERE.

Cryptos are absolutely the future of money, finance and banking. But, stay away from the phony bankster copycoins like Ripple and stick to the best decentralized blockchains that will engender a revolution in individual freedom & financial sovereignty leading to a restructuring of global economics and power, and a shift in favor of the people, rights, peace and liberty the likes of which the world has never imagined.

This is why we are in crypto!

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2018 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.