SPX is higher. USD is Lower

Stock-Markets / Financial Markets 2018 Jan 02, 2018 - 03:54 PM GMT Happy New Year!

Happy New Year!

SPX futures are higher this morning, but have not breached Friday’s high at 2692.12. The top view is that it is back-testing the trendline at 2690.00 from a possible Leading Diagonal. Should it exceed it, there is a possibility of a new high. There is an alternate Wave structure that would accommodate it.

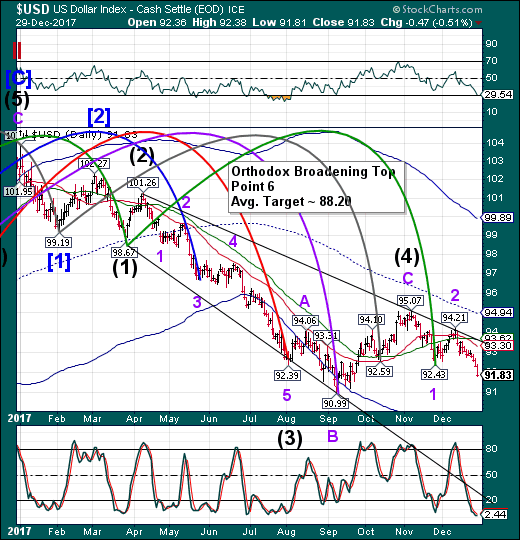

ZeroHedge reports, “U.S. equity futures are higher in the first trading session of 2018 offsetting Friday's last hour sharp drop, as Asian stocks roar to new all time highs, while a surging euro which has rallied near to a 3 year high thanks to the sliding dollar, which in turn dropped to a 3 month low, pressured European stocks across the board. WTI crude oil prices retreated from a 2-1/2 year high despite initial upside as a result of the Iran violence. Treasuries fell, while gold extended a three-week rally.”

NDX has completed a clear impulse from the top. The futures show a retracement to the Short-term resistance at 6443.87. The retrace may go as high as the Cycle Top at 6514.30. We just need to give it room to do what needs to be done.

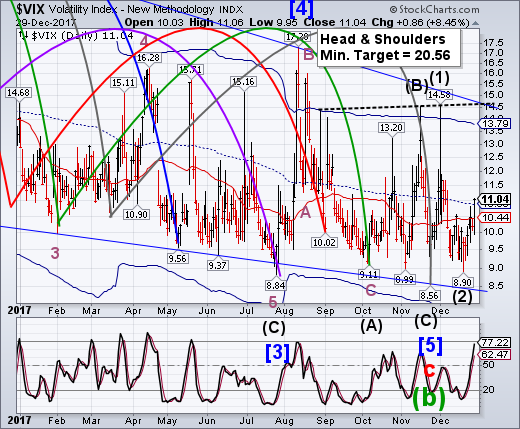

The VIX futures show a pullback that remains above the 50-day Moving Average. There appears to be a completed impulse from the bottom, so the retracement may go deeper.

ZeroHedge comments, “The opening gap higher overnight has extended its gains during European trading, sending US equity futures soaring above Friday's late-day plunge ledge...

The machines are in charge for now...”

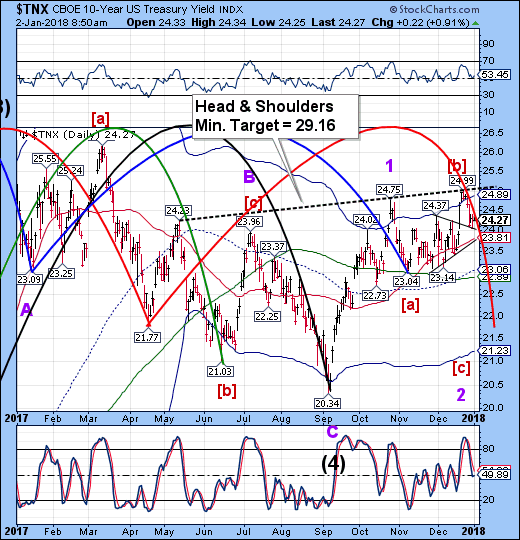

TNX futures show a possible completion of the correction that started last week. The Cycles Model suggests a possible Master Cycle Low in the next week or so…

USD futures are dropping. A possible Master Cycle low may be due near the end of the month.

More commentary later after the open.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.