Gold and CPI and Retail Sales in November 2017

Commodities / Gold and Silver 2017 Dec 18, 2017 - 06:05 PM GMTBy: Arkadiusz_Sieron

Last week, the reports on U.S. consumer inflation and retail sales were released. What do they imply for the gold market?

Last week, the reports on U.S. consumer inflation and retail sales were released. What do they imply for the gold market?

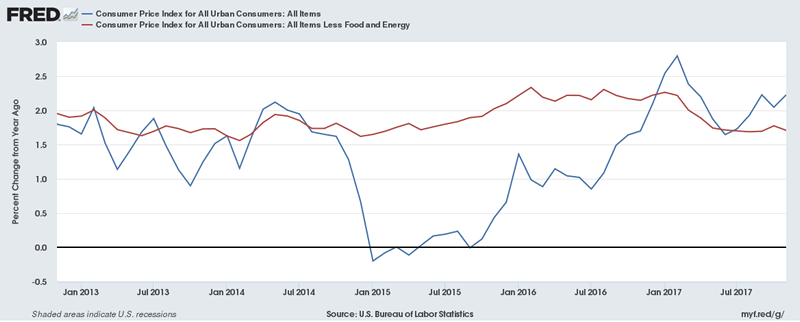

Consumer prices jumped 0.4 percent in November, following a 0.1 percent rise in October. However, the move was driven mainly by higher costs of gasoline and fuel oil. The energy index increased 3.9 percent last month. Hence, the core CPI, which excludes food and energy, increased merely 0.1 percent. On an annual basis, the core CPI was 1.7 percent, which means a drop from 1.8 percent in October. The overall index soared 2.2 percent, rising from 2.0 percent in October and exceeding the Fed’s target again. Therefore, there was a slight shift up in the overall index, but a minimal slowdown in core inflation, as one can see in the chart below.

Chart 1: CPI (blue line) and core CPI (red line) year-over-year from November 2012 to November 2017.

What does it mean for the Fed’s policy and the gold market? Well, inflation continues to rise slowly, very slowly. It is bad news for the gold market. Higher inflation could spur stronger demand for gold as an inflation hedge and would translate into even lower real interest rates. And the subdued inflation justifies the continuation of the gradual tightening of monetary policy.

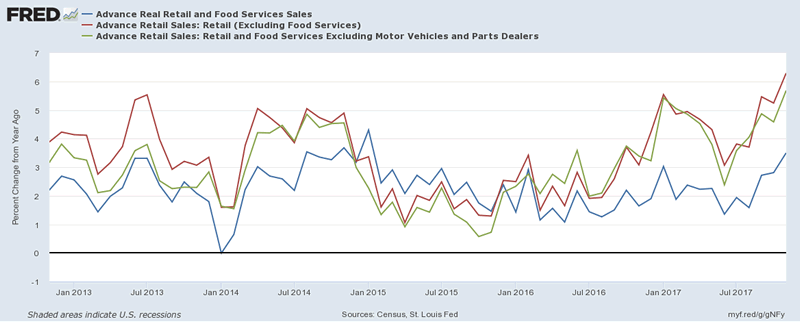

U.S. retail sales jumped 0.8 percent in November following a 0.5 percent rise in October (after an upward revision from 0.2 percent). The number was strong and significantly above expectations. Importantly, the overall index soared even despite a 0.2 percent decline in auto sales. When we exclude vehicles, retail sales rose 1 percent in November due to the unusual strength in e-commerce. And the annual growth also accelerated, as one can see in the chart below.

Chart 2: Real retail sales and food services sales (blue line), retail sales excluding food services (red line), and retail sales and food services sales excluding motor vehicles and parts dealers (green line) year-over-year from November 2012 to November 2017.

The report was strong as Black Friday and Cyber Monday generated extra demand. But it signals that the U.S. economy remains in good shape – the solid retail sales in November will add to the estimate of GDP growth in the last quarter of 2017. Indeed, the forecast of the Atlanta Fed of fourth-quarter real GDP growth increased from 2.9 percent to 3.2 percent after the release of the reports on the CPI and retail sales. It is bad news for the gold market.

Summing up, retail sales surged in November. Consumer prices also noted a nice increase, but the core index remained subdued. Hence, the macroeconomic environment – i.e., solid economic growth with low inflation – looks unpleasant for gold. However, weak inflation translates into dovish expectations of the pace of the Fed tightening, which, in turn, translated into a weak greenback. As the yellow metal is negatively correlated with the U.S. dollar, the lack of inflationary pressure is not necessarily negative for the gold market. Stay tuned!

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.