Bitcoin Trading Alert: Bitcoin Pauses – Will Appreciation Follow?

Currencies / Bitcoin Dec 16, 2017 - 05:01 AM GMTBy: Mike_McAra

Bitcoin was directly mentioned during Janet Yellen’s last scheduled conference as Fed chair. On CoinDesk, we read:

Bitcoin was directly mentioned during Janet Yellen’s last scheduled conference as Fed chair. On CoinDesk, we read:

Yellen, whose term in office expires in February, spoke to reporters today on a range of topics. About thirty minutes into the presser, Yellen was asked about bitcoin.

She noted that, in the Fed's view, bitcoin "plays a very small role" in the U.S. payment system, going on to explain:

"It is not a stable store of value and it doesn't constitute legal tender. It is a highly speculative asset and the Fed doesn't really play any role, any regulatory role with respect to bitcoin other than assuring that banking organizations that we do supervise are attentive that they're appropriately managing any interactions they have with participants in that market, and appropriately monitoring anti-money laundering [and] Bank Secrecy Act responsibilities that they have."

Yellen went on to answer a follow-up question on directives for banks regarding bitcoin. She answered by saying that, to date, the Fed has not issued any specific missives to banks on the subject.

The fact that Bitcoin is getting mentioned during a Fed press conference shows that the interest in the currency is now immense. Yellen’s answers were characteristic of how central bankers are approaching digital currencies. It seems that they don’t actively incorporate Bitcoin in their discussions, only considering it occasionally. And Yellen gave the reason why this is the case: central banks are not usually legally empowered to deal with Bitcoin, supervise entities dealing with Bitcoin and so on. There are exceptions, particularly where banks are involved but this is a rather marginal activity. Bitcoin is not the topics of intense interest for the Fed or other central banks as the Bitcoin market is actually not that huge, even in the wake of the recent appreciation. Total Bitcoin market cap is below $300 billion, which is cosmic for a digital currency, but at the same time not very impressive if one considers that gold’s market cap is upward of $8 trillion. So, Bitcoin is around 4% of gold’s market cap. Now you probably get why central banks and other government agencies are not too worried about Bitcoin.

For now, let’s focus on the charts.

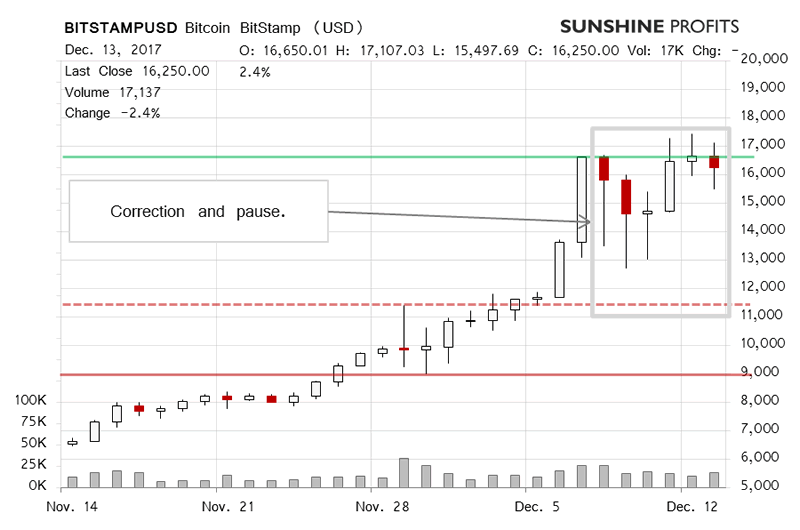

On BitStamp, we saw Bitcoin decline from the most recent all-time high. Does this mean that the rally is over or that we’re just seeing a pause? Recall our recent comments:

It turns out that Bitcoin was still able to go up despite the already very strong rally. The action, however, was followed by a relatively strong correction. At the moment of writing these words (...), the correction is almost denied and Bitcoin is actually at $16,000. This seems to set up a rather bullish picture for the currency, at least for the short term.

We haven’t seen too many developments in terms of price since our previous alert was published. At the moment of writing these words (around 8:00a.m. ET), Bitcoin is at the level of the previous local top (almost exactly at this level). So far, we’ve seen a move above this level, a very small correction below it and a pullback toward it. This looks more bullish than bearish but we haven’t seen a decisive confirmation just yet.

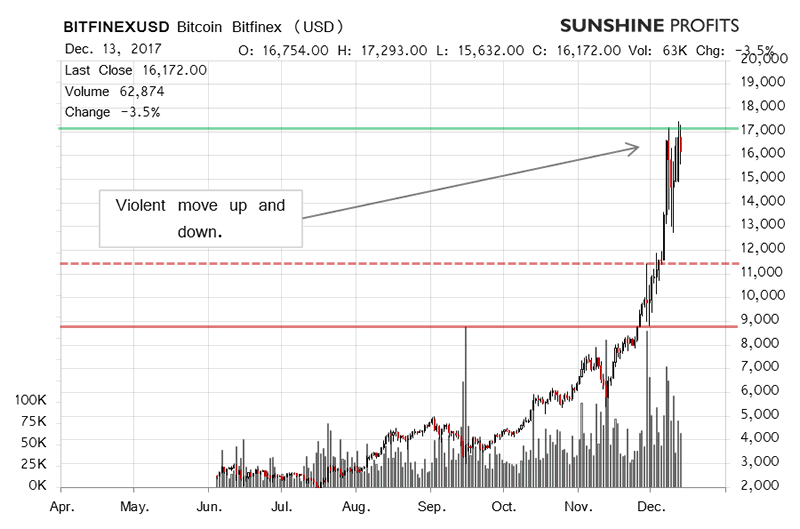

On the long-term Bitfinex chart, we see the very strong move up and the very violent action between $12,500 and $17,500. In our previous comments, we wrote:

A decisive move above $11,441 followed but Bitcoin left this level in the rearview mirror, perhaps a bit too quickly, at least for now. It is perhaps not so surprising to see Bitcoin appreciate around 50%, but once we combine this with the fact that this occurred already pretty well into a sizable rally, and the fact that mainstream media are picking up on the move, we might have a bearish indication on our hands. In other words, we would want to see at least a pause and quite possibly a more sizable correction before considering hypothetical longs at the moment.

We have now possibly seen the mentioned correction. Bitcoin corrected almost exactly 38.2% of the preceding move ($12,676) and rebounded from this level. It might seem that the volume is relatively weak today but it was stronger yesterday when the rebound took place. All of the mentioned facts suggest that Bitcoin might be in for a move higher. If we see a confirmed move above the recent top ($17,171), we might consider hypothetical longs.

Like mentioned before, what we saw was a dance around this level and Bitcoin is currently below this level. This is not necessarily bearish as we are still very close but we haven’t seen enough of a confirmation to suggest that the situation is bullish for the very short term. It isn’t bearish either as the recent strong move down might just be a pause within a bigger move up. At the moment, it seems that another move up might be possible but we would prefer to see a confirmation.

If you have enjoyed the above analysis and would like to receive free follow-ups, we encourage you to sign up for our daily newsletter – it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts. Sign up now.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.