Inflation is Spiking Globally… Bond Bubble Bursts in 3… 2…

Economics / Inflation Dec 15, 2017 - 03:03 PM GMTBy: Graham_Summers

I believe 2018 will be the year inflation arrives.

I believe 2018 will be the year inflation arrives.

The reason, as I’ve noted throughout mid-2017, is that multiple Central Banks, particularly the European Central Bank (ECB), Bank of Japan (BoJ) and Swiss National Bank (SNB) have maintained emergency levels of QE and money printing, despite the fact that globally the economy is performing relatively well.

All told, in 2017 alone, these Central Banks will printed over a $1.5 trillion in new money and funneled it into the financial system. This is an all-time record, representing even more money printing than what took place in 2008 when the whole world was in the grips of the worst crisis in 80 years!

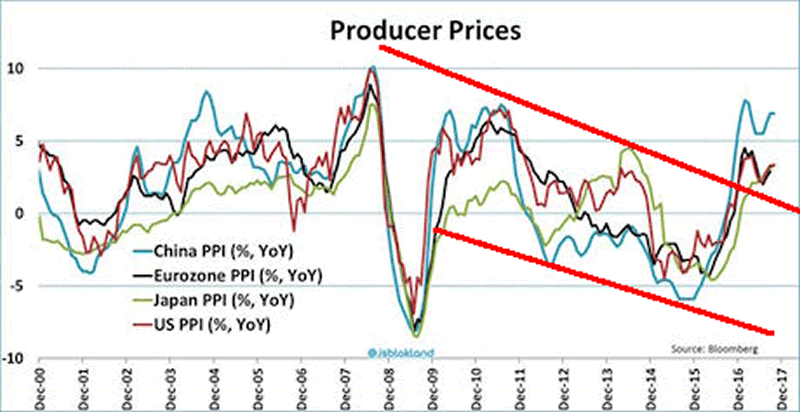

And it has finally unleashed the much sought after inflation. Around the world, inflationary data are breaking out to the upside. Producer prices are soaring in the EU, Japan, China and the US.

H/T Jeroen Blokland

Why does this matter?

Because the $199 TRILLION Bond Bubble trades based on inflation.

When inflation rises, so do bond yields to compensate.

When bond yields rise, bond prices FALL..

And when bond prices fall, this massive bubble, which I call The Everything Bubble bursts.

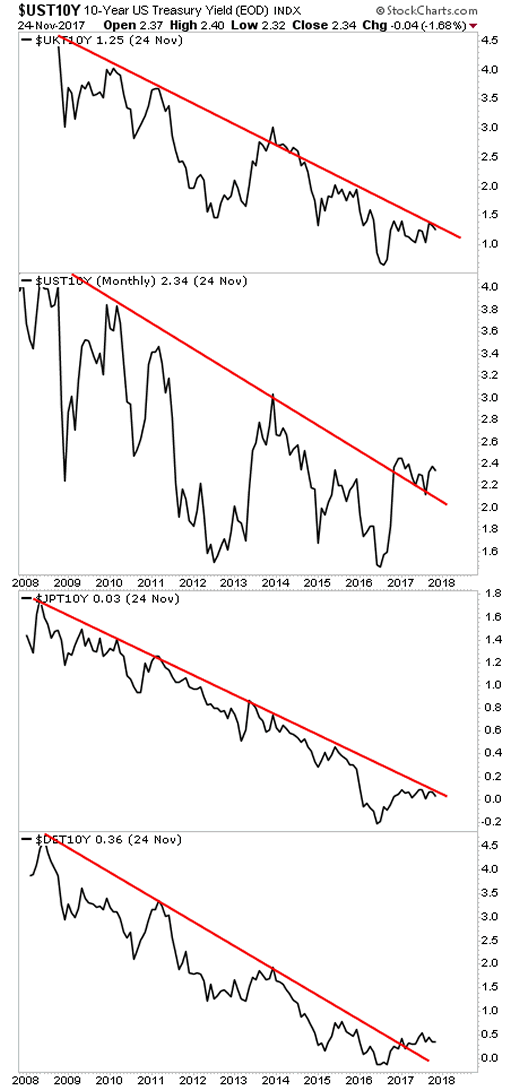

This process has already begun. Around the world, bond yields are spiking to the upside as the bond market adjusts to the threat of future inflation.

The time to prepare for this is NOW before the carnage hits.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s to come when The Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here:

https://phoenixcapitalmarketing.com/TEB.html

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2017 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.