Masters of Economic and Political Illusion – in Taxes, Debt, Government, and Markets

Politics / US Politics Dec 12, 2017 - 12:22 PM GMTBy: Raymond_Matison

We are a gullible people, and have become more so with the evolution and development of ever more persuasive propaganda. We accept many commonly popular economic or political “established facts” as truth almost without question. We forget or are ignorant of the fact that there are large well financed organizations in whose interest it is to provide us with information and views that will polarize our own thinking and values to parallel those of these powerful influences. In effect we are provided with the scaffolding for an illusion which we fill in according to our own personal, but mainstream media propaganda and other organization-channeled input. In creating such illusions it seems appropriate to paraphrase President Reagan’s comment: it’s not that we are ignorant, but that we know so much that simply isn’t so.

We are a gullible people, and have become more so with the evolution and development of ever more persuasive propaganda. We accept many commonly popular economic or political “established facts” as truth almost without question. We forget or are ignorant of the fact that there are large well financed organizations in whose interest it is to provide us with information and views that will polarize our own thinking and values to parallel those of these powerful influences. In effect we are provided with the scaffolding for an illusion which we fill in according to our own personal, but mainstream media propaganda and other organization-channeled input. In creating such illusions it seems appropriate to paraphrase President Reagan’s comment: it’s not that we are ignorant, but that we know so much that simply isn’t so.

Corporate taxes

Corporate revenues and after-tax profits have grown unevenly, but at the admirable rate of 7.1% for at least five decades, which also provided impetus for high rates of investment return in the stock market over that period. If America’s corporate tax rate was effectively the highest in the developed world, and was such a disadvantage, how were these corporations able to generate this decades-long record-breaking growth? If our corporate tax rate was and still is such a disadvantage, how is it that American corporations have grown to become global powerhouses which today often have more influence than many sovereign nations, and essentially “dominate the world”. Could it be that the alleged disadvantage to American corporations is an illusion?

Corporations today are more powerful and influential than ever before. Corporate profit allows them to spend on research, product development, and increasingly efficient production facilities around the globe, and to purchase significant political influence in most foreign countries - where bribery is not considered as offensive or criminal as it appears to be in the US. Of course it is not that we do not have corruption or bribery in the U.S., it is just that its greater criminalization in the states simply requires more adept facades at concealing its occurrence. Their economic power allows corporations to finance elections both domestically and internationally of chosen representatives who in turn can provide certain desired legislation for exclusions or reductions from restrictive regulations, which favorably affects profits or their taxation. The accepted fact that corporations are at a huge disadvantage relative to foreign countries is a well-crafted illusion.

According to the St. Louis FED data, growth of total U.S. corporate earnings over the 1965-2016 period grew from $55.2 billion in 1965 to $1,787 billion by 2016, compounding at a rate of 7.1%. By comparison, growth of America’s GDP over 1948-2017 period was at 3.2%. These statistics confirm that global expansion and productivity efficiencies allowed corporate earnings to grow rapidly relative to overall GDP growth.

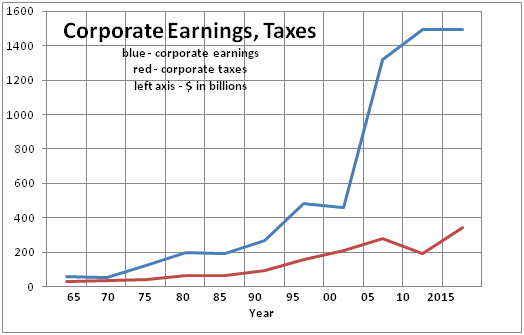

The following graph details this corporate earnings growth and compares it to the taxes corporations actually paid. It is interesting to note that from the 1975-1995 period the actual effective tax rate appeared to come in at about a 33% rate; but this rate after turn of the century dropped dramatically to a rate ranging from the high teens to the low twenties per cent.

Highlighting corporate earnings, taxes paid, and the effective calculated tax rate we show this data for specific years in the following table:

The dramatic observation here is that while the stated corporate tax rate was 35%, the actual tax rate allowing various exclusions and deductions turns out to be far lower. The actual effective tax rate appears as having been close to the rate which the new tax code is likely to establish as the new legal burden. Accordingly, under the new reduced rate, effective tax rates are likely to migrate to the low teens over the next few years.

In these graphs we used only eleven data points, quinquennially from 1965; this means that we do not show a dramatic spike or decline in earnings that may have taken place in the interim years. However, these data points show the level and trend of earnings and taxes well enough to demonstrate its true characteristics.

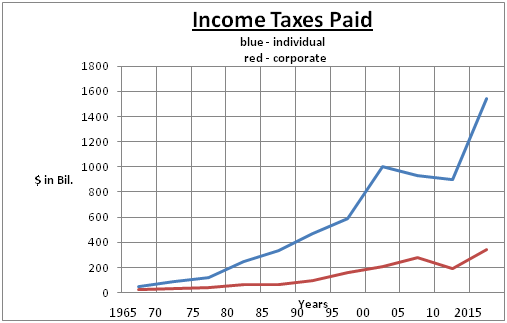

We also take a long-term look at the share of income taxes paid by corporations relative to that of individuals.

Please note that these two graphs show similarities, because both graphs show corporate taxes, but the second graph is quite different. The rapid rise in the blue line of second graph represents the rapidly increasing taxes that individuals have to pay relative to corporations. This graph clearly shows that the tax burden over decades has shifted from corporations to the individual taxpayer, such that the burden corporate of taxes is visibly an illusion. With this information available from both charts and the data table, we can surmise that in regards to corporate taxation “the corporation doth protest too much”.

The consumer driven economy and taxes

The American economy is universally acknowledged to be driven by the spending activity of its citizen consumers – that is, we have a consumer-driven economy. How is it then that politicians, in a nearly unanimous voice, are clamoring more to reduce the tax rate for corporations as opposed to individuals? Reducing the rate of tax for corporations does not add income to the consumer; therefore, it does little or nothing to stimulate the consumer-driven economy. Corporations with more after-tax money will not create more jobs or produce more products, if consumers do not have considerably more disposable income. Corporate management is too sophisticated to be drawn into spending to create more production facilities or domestic jobs without the very real prospect of having its products sold at a profit.

It is arguable that if a reduction in the individual tax rate would stimulate the economy, then by extension, an individual tax reduction to zero would have the greatest effect in stimulating that economy. By this logic, dramatic increases in consumer spending would drive increased revenues of corporations and their profit. That kind of dramatic growth would nudge corporations to expand their operations and create more jobs. In the meantime, of course, any meaningful reduction in an income tax rate for individuals is welcome, and the ability to file one’s taxes on a single page – a godsend.

Since economic benefits related to congressional regulation over many decades have largely accrued to corporations rather than individuals, it is appropriate to withhold applause until the present expectation for favorable tax revision benefiting individuals is actually experienced. As a reminder, ten years ago banks were convicted of fraud and paid billions of dollars to the federal government in fines for their criminal behavior, yet these same institutions were bailed out by our politicians, while the less influential individual mortgage borrower was abandoned.

Could America achieve a tax plan that requires no taxes from individuals at all? It is heartening to reflect that prior to the establishment of that private banker owned organization called the Federal Reserve in 1913, America prospered for more than a century without an individual income tax.

Eliminating tax on individuals would require that our national budget is drastically reduced, and corporations provide most of the tax dollars our government’s needs. By drastically reducing military spending for offensive operations while maintaining necessary military spending for defensive operations government would significantly reduce the need for individual taxation. Reduced expenditures of foreign wars would reign in the growth in our national debt, and reduce the attendant $458 billion per year that taxpayers now contribute to interest on that national debt. There is also no logical reason why in a constitutional republic the government should be the largest employer in the nation. Simply reducing the size of government, and bringing productivity efficiencies would reduce its drastic inefficiency, growth and expense – reducing individual taxes.

An additional approach for raising needed tax revenues would be to implement a small annual tax on assets of the wealthy. No, this is not a call to socialism or communism. If this suggestion seems too radical, please note that the middle and lower income class has been paying an annual wealth tax for over a century. It is called a real estate tax. Don’t pay your annual asset tax, and your house is taken from you. However, if you own hundreds of buildings or factories held in a corporation stock totaling tens, hundreds or thousands of millions of dollars, there is no annual tax on this stock and the owner gets to choose when he pays any tax at all at the propitious time of his choice in the sale of some shares. Real estate tax paid by corporations on their physical holdings such as office buildings and production plants is simply a cost of doing business, is included in the price of product, and therefore is of little consequence to the ultimate asset owner.

For the middle and lower income homeowner, his home, even when mortgaged usually represents his largest asset. But that asset is taxed annually. For higher income families, even as they live in larger and lavish homes or estates, their homes always represent a smaller percent of their total assets, and there are other assets that produce the income to pay that annual tax on the dwelling. These other wealth-producing assets are not taxed annually, and are passed from one generation to the next through special law provisions and exemptions. One can never be called rich by owning only a very large home or estate – it takes much more. Indeed, if one only owns a large home or estate, it actually becomes a huge liability – on which the owner has to pay the annual asset tax. A small annual tax on assets of the wealthy would be fair, especially considering that middle and lower income people pay an annual tax on most of their assets.

To provide the rest of needed tax revenue to establish a zero tax for all individual returns, one option would be for government to borrow the funds and add it to our national debt. Of course it makes little economic or financial sense to do so! We all know this. However, President Trump’s current tax plan will also increase our national debt. In addition, it does not make sense either to expand our national debt for the purpose of manufacturing bombs and armaments, and increasing military spending to create destruction around the globe. If funds spent on excess military spending and interest costs on existing debt were better managed or eliminated, and some productivity improvement could be brought to government, it appears that the individual income tax could essentially disappear. Is this likely to ever happen in our current political and corporate environment? Not really. It will first require that the carefully constructed economic and tax illusions are exposed to transparency and wide public understanding. Perhaps then people will be able to throw off their elitist government and Federal Reserve constructed yoke, destroy the harmful illusions – reduce the present tyranny and gain more liberty.

Politicians also have strenuously been promoting the idea that individual citizens must provide a better tax break to the wealthy because they will invest the additional funds to provide jobs. Bunk! It is another false illusion. When it is convenient to politicians, they know to claim that new jobs are created by the middle class individuals forming new businesses. Large corporations are the ones who in the interest of growing corporate earnings go overseas to utilize low wage rates of other countries, thereby depressing domestic wages and exporting jobs away from the United States.

So congratulations to America’s corporate leaders – you won again. With President Trump’s new tax legislation, you have achieved almost a 50% reduction in your corporate tax rate. It just shows that businessmen are consistently more effective, than the political scientists and lawyers who inhabit our congressional halls. Unfortunately, this means that ultimately it is individual taxpayers who will have to pick up this loss in overall tax receipts.

Productivity

Corporations greatly value and focus on increases in productivity; while politicians, when convenient to them, simply parrot the issues in public forums. Increase in productivity simply means producing more with the same or reduced amount of labor or investment. Our techno-industrial society has already achieved enough productivity in both agriculture and manufacturing such that people simply do not need to work five days per week to produce all we need.

Politicians also talk about increasing jobs and incomes when their focus on productivity has to result in fewer jobs and lower wages! There are elephants in the halls of congress and in the FED building that are not seen or are ignored by these politicians - masters of illusion. For decades, politicians have been able to ignore the need for productivity as it relates to its own government. How can it be that in every industry worldwide, except government, innovation and productivity increases allow companies to achieve ever more with less labor - and fewer people?

But government, which creates no wealth by its activities, continues to grow. Government has become the largest employer in this country, and also in most countries of the world. Government growth results from gross inefficiencies, misguided goals, abominable and deficient business management. Corporate managers are driven and financially rewarded by achieving and doing more with less at lower expenses. By contrast, it is well known that a manager in a government position who cannot find a means of increasing his budget for the next year is viewed as a failure. This measure of success in government is diametrically opposite to that of an effective manager in private business. No wonder government activities and their programs are wasteful, inefficient, and growing to the detriment of every country. Any characterization that government is efficient, or works in the interest of the average citizen – is just a baleful illusion.

Markets

Over the last two year period there has been a virtual flood of comments from the well-informed and industry-leading professional money managers stating that our markets are either in bubble territory or at least exceedingly fully priced. Yet the markets do not correct. How can this be? Manipulation! It is manipulation on a grand scale. Remember that the FED’s balance sheet has increased by $4 trillion over the last decade. Well, those dollars didn’t just get stored in a warehouse. They were used. They caused our bond, equity, and precious metals markets to be manipulated. The FED had also created trillions of dollars to bail out the European banking system. Indeed so much money was created that our defense department under Donald Rumsfeld’s leadership was able to “misplace” two trillion dollars which could not be found or accounted for. For a government which will spend millions of dollars to find who may have misappropriated a fifty-cent stamp in a Post Office, this loss of trillions is criminal. The gargantuan printing of dollars since 1971 has allowed manipulation not only of our markets, but also of foreign currencies, economies, and its markets.

In a previous report (see: Prognosis of Financial Markets For 2017 and Beyond http://www.marketoracle.co.uk/Article58065.html) we anticipated that the markets would be correcting in the second half of 2017, although we also did point out that combined government and FED forces with their incredible power could postpone this reckoning to a later time. Fortunately, admitting our prognostication on timing to having been wrong has no real consequences, for we have also stated that one should not be in these markets at all. Yes, one then foregoes the illusory profits of a FED stimulated market – but nonparticipation comes with the satisfaction from not needing to worry about the coming market collapse.

If one wanted to stimulate our economy such that it would also give rise to justifiably ebullient markets, then our national leaders could print the money to pay off every individual mortgage loan in the country. Enough money was printed, but it went to the banks instead of the country’s citizens. So is the printing of money for paying off mortgage loans ridiculous? Of course it is ridiculous, but no more ridiculous than printing trillions of dollars for military hardware and munitions – and then making it all go poof!

According to the FED, our national mortgage debt for homeowners (one-four family residences) excluding commercial real estate is $10.3 trillion. If instead of printing trillions of dollars and spending them on war materiel and physical conflict – which is wasted on destruction – why not print the money and pay off all mortgage loans of consumers? Since our national debt did rise by $10 trillion over the last decade, instead of the money being spent on war activities, it could have paid off the totality of individual mortgage loans. Such stimulus would have started a subsequent consumer spending spree that we simply cannot imagine in its force, length and breadth.

Our most recent special sales days such as those of “Black Friday” the day following Thanksgiving are disappointing, while the number of stores closed across the country this year have risen to nearly six thousand. The number of people fed by charitable institutions has apparently risen to record levels. Homelessness has risen to levels not seen since the last Great Depression on the 1930s. Such statistics do not support the illusion of a rising or healthy economy.

This is a time to be out of the markets and to preserve capital – which requires discipline and the ability to overcome greed. It is time to wait for the “blood in the streets” investment opportunity coming to those who have the discipline to stand on the sidelines and not allow greed to overtake reason. Despite almost daily stock market gains to record levels, we maintain that this is not the right time for predictable or profitable investing.

The current reduction in the corporate tax rate will increase corporate profits, and so it is likely to fuel a continued advance in market averages near term. Our response is to sit comfortably on the sidelines, without fear of losing out or fear of being able to get out of the market when finally everyone is heading for the narrow exits. The true investment opportunity lies in the not too distant future. Do not get trapped in the illusion that the markets are sound and not manipulated. It is a costly illusion.

The future

Today with Republicans controlling the Senate, House of Representatives and the oval office, it seems amazing that relatively little helpful legislation has been delivered by politicians over the last year. There is the distinct appearance that the president is trying to move the country in a direction that the country’s representatives choose not to go. Foreign policy, however, seems to be unchanged regardless of which party controls Congress. We can surmise that this is so because the people or corporations who fund congressional races want the policies we now see practiced by our government. Government is not influenced by its citizens but by its elites and corporations who influence and pay for political elections.

For the near term we see that President Trump is successfully increasing jobs for America’s citizens. That is good. However, this goal presently is being achieved by selling military hardware to other countries. Thus, it is mostly our military manufacturing jobs which will grow. On the premise that “when you have is a hammer, every problem encountered is a nail” we can reasonably anticipate that continued promotion of weapons sales will result in future armed conflict with attendant destruction of cities, manufacturing plants and infrastructure, and loss of life around the globe.

If president Trump gets near to reducing the swamp to the point that its leading denizens actually feel threatened, then he is likely to experience the same fate that befell presidents Lincoln and Kennedy. This is because taking control of our economy, our society and our nation will require retaking control of our money. Money creation must not remain in control of central bankers, who through its printing control governments and events around the globe, and destroy savings of its citizens. In fact it does not suffice that our government retake control of existing money creation – as unfortunately the present fiat dollars are totally inappropriate to a sound money economy, and unfortunately has to be destroyed and fundamentally replaced. Our politicians lack the courage to challenge the status quo or to rise up against their elite overlords - and to improve conditions for its citizens. But the rest of the world’s nations have evolved to a point where they are aligned and united against our fiat currency and might – as a means to protect themselves against our financial warfare – initiate this structural change against us.

Most things that we see, read or hear are carefully managed economic and political illusions created to benefit elite bankers and government cronies. We are given faulty rates of unemployment, inflation, wages, earnings on savings, solidity of our corporate pensions and government retirement systems. Yet people experience the real world, where savings for retirement are acknowledged as insufficient, the return on our savings near zero, the prospects for well-paid jobs for everyone unpromising, and the economic system around us convulsing. Expanding government debt, to which the common citizen has been against for more than a decade is enslaving, even as our base currency itself is continuing an unrelenting decline in purchasing power with further prospects of major reductions relative to some foreign currencies and gold.

With so many economic and political problems supported by persistent illusions, what prospects are there for our future generations? The ultimate and most important determinant for improvement of the human race is the increased availability of unfiltered truthful information among people. It requires the destruction of faulty economic and political illusions. This reduces the effectiveness of elitist, corporate, and government propaganda – allowing people to make their own informed decisions for their benefit. Light disinfects, information liberates! But just as with the advent of the printing press, it unfortunately may take decades or more before the universal access to information will destroy the illusions completely and result in a fairer and a more liberated society. This is a worthy vision to replace the faulty illusions.

Raymond Matison

Mr. Matison was an Institutional Investor magazine top ten financial analyst of the insurance industry, founded Kidder Peabody’s investment banking activities in the insurance industry, and was a Director in Merrill Lynch Capital Markets. He can be e-mailed at rmatison@msn.com

Copyright © 2017 Raymond Matison - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.