Merry Christmas to You - Gold Bullion Premiums at Multi-Year Lows

Commodities / Gold and Silver 2017 Dec 08, 2017 - 04:27 PM GMTBy: GoldSilver

There’s nothing like a bargain during the holidays. And here’s an unexpected one even I was surprised to see…

There’s nothing like a bargain during the holidays. And here’s an unexpected one even I was surprised to see…

It’s not easy to dig up industry-wide data on coin and bar premiums. To do it manually is incredibly time-consuming and then would be out of date as soon as you published it, since premiums always fluctuate.

But we’ve snagged both wholesale and retail data from a couple sources. And there’s a very clear message from these statistics: gold bullion is on the SALE rack…

Wholesale Prices: Plunging

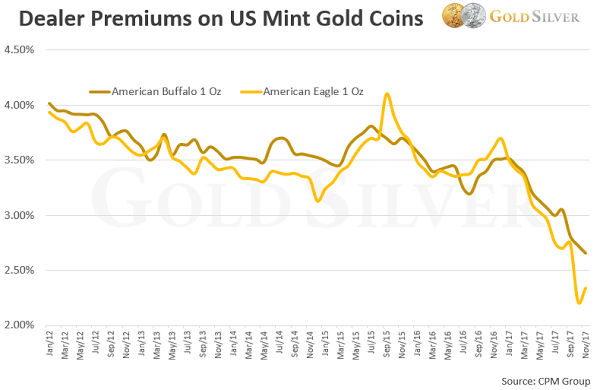

CPM Group tracks premiums paid by dealers from the US Mint, and here’s what they reported at the Silver & Gold Summit. Check out how premiums have recently plunged.

Wholesale prices on gold Eagles are lower by a third or more than what they were five years ago. In fact, there have been very few times since the Eagle was first produced in 1986 when you could buy them at this steep of a discount.

Retail Premiums: Near 10-Year Lows

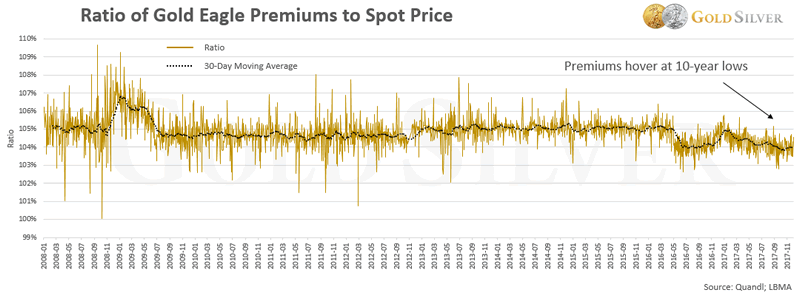

The website Quandl has tracked retail premiums of some of the more popular bullion products (the data is not exhaustive though should be fairly representative across the industry). Here’s the ratio of gold Eagles to spot prices over the past 10 years.

You can see that beginning the summer of 2016, the ratio of Eagle premiums to the spot price dropped to a new low—and has stayed there. Compare the current level to the end of 2008 and early 2009.

But it’s more than just low premiums that allow you to save money right now…

Double Discount Days

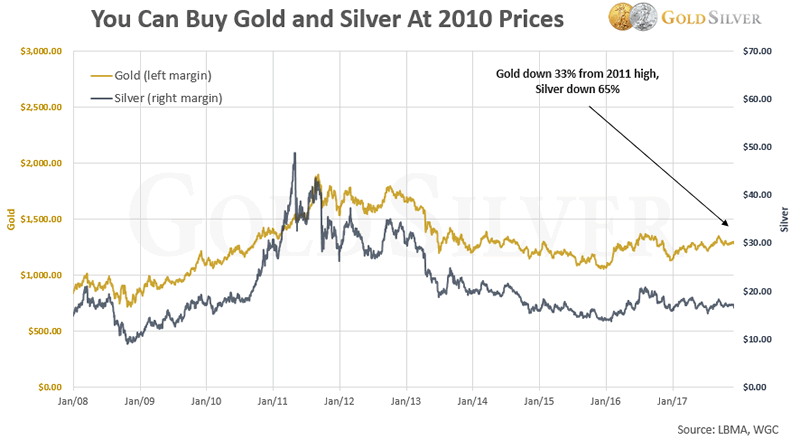

Not only are premiums at multi-year lows, so are spot prices.

You can buy gold and silver at the same price as seven years ago!

- It’s one of the best scenarios you could hope for: low spot prices and below average premiums. All on an asset that has historically served as a safe haven when other assets have been under stress, as well as one poised to soar in the next crisis.

And if you haven’t noticed, GoldSilver’s premiums are much lower than what you see in that retail chart above. And you can now order the latest coins the industry has to offer—the 2018 gold Eagle, Maple Leaf, Philharmonic, and Britannia.

I encourage you to take advantage of the current gold environment. Low prices, low premiums, with an asset that will protect you in the inevitable crisis like no other.

Source: https://goldsilver.com/blog/merry-christmas-to-youbullion-premiums-at-multi-year-lows/

By Jeff Clark

© 2017 Copyright GoldSilver - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.