EU Bailins Coming – 114 Italian Banks Have NP Loans Exceeding Tangible Assets

Stock-Markets / Financial Crisis 2017 Dec 06, 2017 - 07:31 AM GMTBy: GoldCore

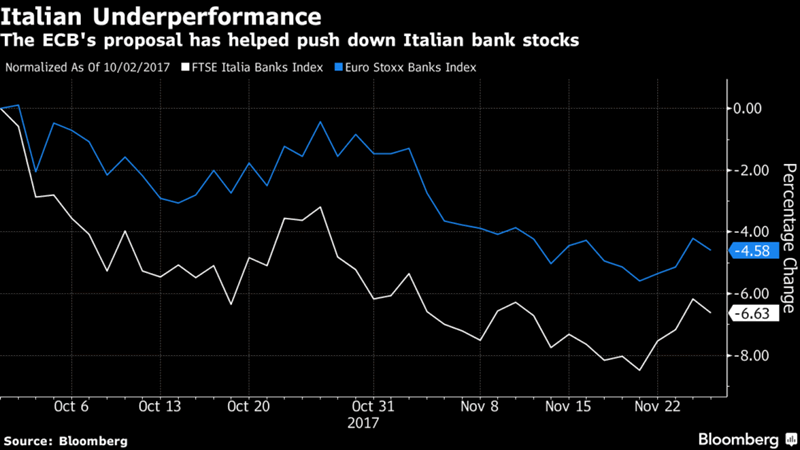

– Italy opposes ECB proposal that holds banks to firm deadlines for writing down bad loans

– Italy opposes ECB proposal that holds banks to firm deadlines for writing down bad loans

– Italy’s banks weighed down under €318bn of bad loans

– New ECB rules could ‘derail’ any recovery in Italy’s financial system

– Draft proposal requires banks to provision fully for loans that turn sour from 2018

– ECB insists banks have better access to collateral on delinquent debt to solve problem

– Investors should secure assets as proposal suggests more bailins on horizon and banks remain at risk

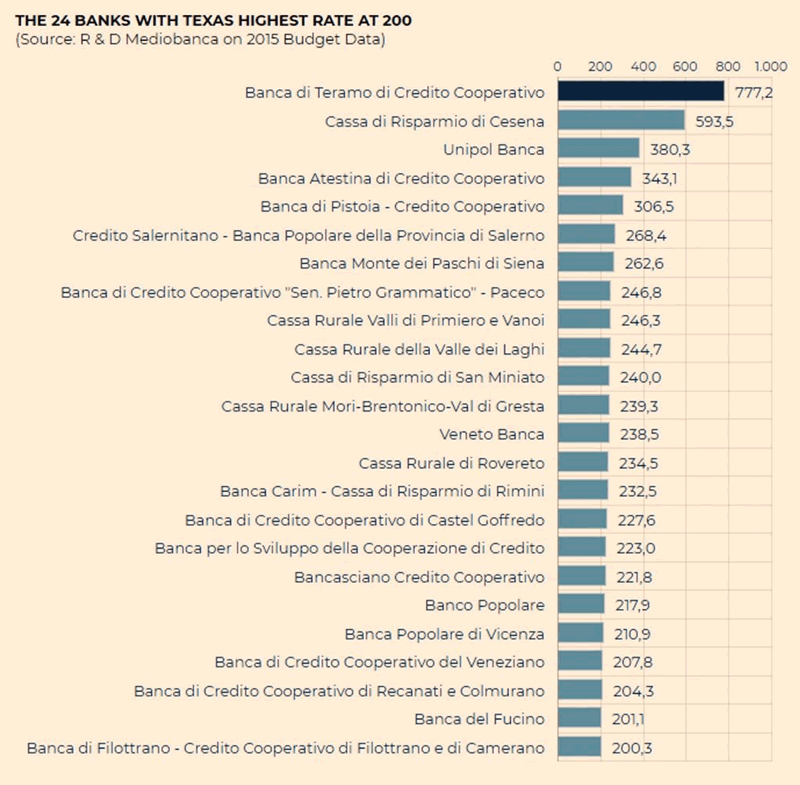

Source: ilsole24ore.com

Another week and another unjustifiable move by the ECB to ‘protect’ the EU’s banking system. This time it is the decision to toughen bad-loan rules for euro-area banks.

The rules state that banks must be held to firm deadlines for writing down loans that turn sour. Banks will be required to provision fully for loans that turn sour from the start 2018.

This is particularly bad news for Italy. The country has over €318 billion of bad loans. Should the banks be forced to dispose of these non-performing loans too quickly then a financial disaster could be triggered, derailing any form of recovery

This is a step too far for Italy’s bankers who argued the ECB had overstepped its supervisory role, instead enforcing measures that should only be enforced by lawmakers.

Should they be enforced these new measures will not only put extra pressure on smaller banks but result in yet more savers and businesses losing money. The idea that these new policies will be beneficial for all is arguably laughable. Especially when one looks at the overall state of the Italian banking system.

The Texan warning signal

The health of a bank’s non-performing loans (NPLs) can be measured using the Texas ratio. This is a measure of bad loans as a proportion of capital reserves. When the reading is over 100 it is a warning signal the banks need a solution quickly.

Data cited in a March 2017 article shows that 23% of Italy’s near 500 banks are showing signs of severe stress. 24 of the banks that have a Texas ratio reading of over 200.

The bureaucrats in the likes of the ECB aren’t worried about the majority of the Italian banks with a Texas ratio of over 100 as they are small local or regional savings banks with tens or hundreds of millions of euros in assets. But when a reading of over 100 basically means they don’t have enough money to pay for the bad loans, what happens to the people who have their money with these small banks?

This isn’t just about those with money in small banks. The larger banks that often prop up the system are also in bad shape:

- Banco Popolare (the result of a merger between Banco Popolare di Verona e Novara and Banca Popolare Italiana in 2017 and then a subsequent merger with Banca Popolare di Milano on 1 January 2017): €120 billion in assets; TR: 217%.

- UBI Banca: €117 billion in assets; TR: 117%

- Banca Nazionale del Lavoro: €77 billion in assets; TR: 113%

- Banco Popolare Dell’ Emilia Romagna: €61 billion in assets; TR: 140%

- Banca Carige: €30 billion in assets; TR: 165%

- Unipol Banca: €11 billion in assets; TR: 380%

i.e. with the exception of Unicredit (TR of 90%), Intesa Sao Paolo (TR of 90%) and Mediobanca all of Italy’s major banks have TR ratios of over 100.

As long as these banks continue to have worsening TR ratios then Italy’s banking system has little hope of finding its feet again. In turn, this means more of Italy’s savers, pensioners and businesses will suffer.

If you want help, ransack savings first

We all remember Cyprus in 2013. When savers went to their bank accounts to find their money gone thanks to ECB policy. Uproar was short-lived as the rest of Europe believed this wasn’t something that could happen to them. They remained arrogant when the ECB brought in official bail-in policies, which would see savers impacted even more should a bank begin to fail.

Sadly this is not something Italy can ignore.

If anywhere has felt the brunt of the ECB’s bank ‘rescue’ proposals then it is Italy that has been hit the hardest. Sadly it is set to happen time and time again.

Already this year the EU has seen four bank ‘rescues’, three in Italy thanks to the NPL market: Monte dei Paschi, Banca Veneto and Vicenza Banca in Italy and Banco Popular in Spain.

Each of them were crushed by the weight of NPLs on their balance sheets and insufficient capital to offset higher losses. Who suffered? Bank creditors, i.e. savers.

Andrew Fraser, Head of Financial Research (Credit) at Standard Life Investments, explained:

In each case, the outcome for subordinated bondholders was very negative, with falling prices reflecting the likelihood of zero recovery on an investment.

“The failures have also raised questions as to whether there is sufficient clarity in the application of the regulatory rulebook.

“The risk of owning bank debt has increased materially. Investors more than ever need to fully understand the risks embedded in a bank’s balance sheet but also the thickness of each layer of a bank’s capital structure which could absorb losses in the event of distress.”

In order to ‘help’ the Italian banking system the ECB will no doubt end up doling out charitable lending (formally known as TLTRO II). But, banks don’t qualify so easily for public financing, without the help of their generous customer first.

Zerohedge explains:

In order to qualify for public assistance, banks must be solvent. Presumably, that would automatically disqualify any bank with a Texas Ratio of over 150%, which includes MPS, Banco Popolare, Popolare di Vicenza, Veneto Banca, Banca Carige and Unipol Banca. The bailout must also comply with current EU regulations including the Bank Recovery and Resolution Directive of Jan 1, 2016, which specifically mandates that before public funds are injected into a bank, shareholders and creditors must be bailed in for a minimum amount of 8% of total liabilities, as famously happened in the rescue of Cyprus’ banking system in 2013.

Savers suffer as banks fail

As we have written about previously EU banking regulations do not protect those who need protection – savers, pensioners and businesses.

It seems every few months there are new measures announced to further prop up the banking system. With each one is further punishment and risk for those with cash or investments in the banks.

At the beginning of November we broke the news that new ECB proposals outlined plans to remove the deposit protection scheme. The news was little reported in the mainstream media, demonstrating the lack of concern readers currently have for the safety of their money.

Italy has a lesson to teach us all, not about how to support a banking system but how to protect your savings from EU bureaucrats.

Policies from the EU’s legislators and bankers are created with one purpose in mind: keep the Eurozone afloat. To do this, they believe, individuals must make sacrifices through their savings, their pensions and even their homes.

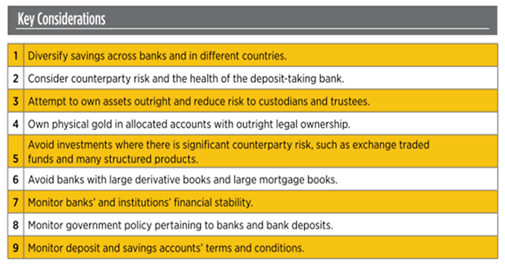

This does not mean that those with money and investments in the bank must take the same approach. For some ignorance is bliss, for others the deposit protection insurance is enough of a safety net. However depositors and investors should be aware of the policies when it comes to keeping their money safe in the banking system. Whilst bail-ins will at present only hurt those who hold deposits above EUR 100,000, there is little stopping the protected amount being decreased, or ignored altogether.

The European Commission has forced all 28 countries to implement bail-in legislation, something anyone with exposure to an EU bank must be aware of. Consider the health of a particular bank and the risk exposure of their portfolio. This means diversifying your invesments and decreasing your own level of counterparty exposure.

Protect your savings, not your bank

Gold investment is seeing an uptick as a result of concerns surrounding counterparty risk. Gold investment saw a 15% climb in Q2 of 2016. Europe, in 2015, showed the largest regional demand for gold bars and coins (an increase of 12% year on year).

Do not believe that any gold investment will protect you. Unallocated gold is as much exposed to counterparties as any other bank-based asset. Wealth of individuals and businesses can by protected by investing in allocated gold, held in segregated accounts. The buyer has legal ownership, with no counterparties to pop along after going bust and take what is legally theirs. Allocated gold held in segregated accounts cannot disappear overnight.

Gold is the financial insurance against bail-ins, political mismanagement and overreaching government bodies.

Gold Prices (LBMA AM)

04 Dec: USD 1,279.10, GBP 952.67 & EUR 1,079.43 per ounce

01 Dec: USD 1,277.25, GBP 946.57 & EUR 1,072.51 per ounce

30 Nov: USD 1,282.15, GBP 952.64 & EUR 1,084.06 per ounce

29 Nov: USD 1,294.85, GBP 965.70 & EUR 1,092.46 per ounce

28 Nov: USD 1,293.90, GBP 972.75 & EUR 1,088.95 per ounce

27 Nov: USD 1,294.70, GBP 969.73 & EUR 1,084.83 per ounce

24 Nov: USD 1,289.15, GBP 967.89 & EUR 1,086.37 per ounce

Silver Prices (LBMA)

04 Dec: USD 16.33, GBP 12.09 & EUR 13.77 per ounce

01 Dec: USD 16.42, GBP 12.16 & EUR 13.80 per ounce

30 Nov: USD 16.57, GBP 12.32 & EUR 14.00 per ounce

29 Nov: USD 16.90, GBP 12.60 & EUR 14.26 per ounce

28 Nov: USD 17.07, GBP 12.84 & EUR 14.36 per ounce

27 Nov: USD 17.10, GBP 12.81 & EUR 14.32 per ounce

24 Nov: USD 17.05, GBP 12.80 & EUR 14.38 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.