Stock Market Bears Ready to Strike During September

Stock-Markets / Stocks Bear Market Sep 03, 2008 - 05:06 PM GMTBy: Michael_Swanson

We just had the summer rally. You may have missed it, but the S&P 500 managed to finish the month of August up a whopping 1.1% while the Nasdaq ended with a gain of 1.8%. You might detect some sarcasm here and there is a bit. You see despite the lack of conviction in the market action many people are calling for a new bull market in the financial media and on TV.

We just had the summer rally. You may have missed it, but the S&P 500 managed to finish the month of August up a whopping 1.1% while the Nasdaq ended with a gain of 1.8%. You might detect some sarcasm here and there is a bit. You see despite the lack of conviction in the market action many people are calling for a new bull market in the financial media and on TV.

This week's Barrons has a story titled The Reluctant Bulls. It quotes Francois Trahan as saying that the "the US is the best stock market to be in." He claims that oil is going into a bear market, wage growth is shrinking and therefore inflation should fade. Combine that with interest rate cuts made by the Fed earlier this year that should begin to kick in to the economy and you have a recipe for "reviving domestic economic prospects," he says.

Trahan ignores that fact that we are not in a normal economic contraction, but a full blown credit crisis and a confirmed bear market. But he's not alone.

Others expect to see a stock market explosion upwards after the election on the assumption that the election will excite people and cause them to throw money at the stock market no matter who wins.

I see clear signs though that the bear market rally that began in July is reaching its end and that means the next downturn in the market is ahead of us.

Despite yesterday's drop in oil and commodities I also am one of the few people who still like the action in gold. Gold didn't make a new low yesterday when oil did and gold stocks are still nicely above their August lows too. Leadership in commodities seems to be shifting into gold.

Before I continue I want to give you this disclaimer - I am short the market since the S&P 500 was around 1300 on Thursday and am long gold stocks from August 11th, positions I alerted my WSW Power Investors subscribers to as I took them. I did the same thing when I shorted the market in May a few days before it topped and then covered the morning it made its bottom in July.

Now lets look at the charts.

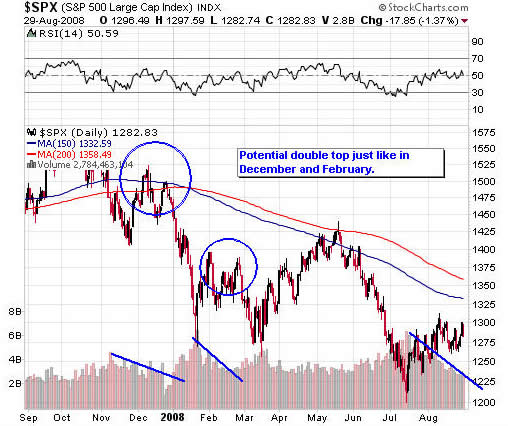

In reality it is the rally that is getting these people excited about the market and when I look at the rally I see reasons to believe that it is failing. Volume on the rally has steadily contracted throughout the month of August while the VIX, which measures the premium investors are paying for puts and acts as a "fear index" has dropped, warning that complacency has once again returned to the market - the type of complacency seen in December and in May when the market made its last two peaks. Volume finally did pick up Tuesday, but that was on a day that the market was down so is a sign of distribution.

The market has been in bear market since October and in bear markets you want to use rallies like these to get out and if you are aggressive to short.

But almost no one has admitted to themselves that this is a bear market or taken action accordingly to protect themselves. The hope is still alive and you can see that in the way so many of the so called experts grasped on to this rally and became believers again - despite the fact that it has been the weakest rally of the whole bear market.

Bear markets end when everyone faces reality and in the United States most investment advisors and so called professionals are in steep denial. It is very difficult for a Wall Street broker or an investment advisor to tell their clients to sell. You see Wall Street makes money by being in control of your money. If you sell you may move your money somewhere else and that is the last thing they want you to do. It is not so much that these people are consciously lying to you it is that they have rationalized all of their thoughts and thinking processes to align them with what is in their best interest. Most brokers and investment advisors believe the Wall Street propaganda themselves and really have no clue about how the stock market really works.

Of course you also have to understand that if you have a broker or investment advisor they are actually under a lot of pressure by you to stay bullish all of the time.

Here is the deal- if your broker thought the market was topping out and called you up and convinced you to sell your positions you would most likely get extremely angry at him if the market then went higher. You would think he is crazy and probably move your money elsewhere. But if the market drops you may get upset about the market, but you won't blame him for that. He'll tell you to stay disciplined and most people will do it - because when you get down to it most people would rather lose money by holding then face the possibility of making a decision and being wrong especially when everyone is telling them to keep holding on TV.

So the broker stands to lose everything by being negative on the market and being wrong and very little by being positive on the market when it is even in a bear market.

Wall Street has defined being "disciplined" as allowing them to control your money forever.

Prudent investing is aligning your investment positions with reality. That means being bullish in bull markets and bearish in bear markets and correctly identifying the trend any stocks you may own are currently in and be willing to accept the fact that one day their trend will likely change and that is when you will want to take your profits - or cut your losses if you don't have any.

That is what success in the stock market is really about.

When a market is in decline most people don't take action. They fail to recognize that the trend has changed on them or stubbornly think they are going to fight the market and just hold on in the face of losses, because they believe their positions will go up - because they have to.

The next thing you know their positions fall more and more and eventually they simply cannot take the losses anymore and sellout. They then admit the reality of the downtrend their stocks have been in and start to say that it is a bear market. The masses tend to do this together and that is why at real market bottoms almost everyone is bearish - but on the way down as they try to stay tough they convince themselves that the market is still bullish.

We saw this pattern play out to a tee back in May as the market topped out and fell for two months while the put/call ratios and VIX stayed subdued until the very end. People kept calling bottoms and holding on until Fannie Mae and Freddie Mac started to unwind. It was only then and over 200 points lower on the S&P 500 that fear came into the market - the type of fear that can put in a low and cause a rally.

And that market has rallied since that July low. But I am now worried now that the rally is near its end - if it has not ended already. And I know that hardly anyone is on guard for this. Few have taken profits on this rally. Few have said this is a bear market and I should use the rally to get out. Almost everyone is ignoring the reality of the bear market and the historical fact that the market's worst two months tend to be in September and October.

The market situation right now is very similar to what it was like in December and February. In both of those times the market put on a very short-lived bear market rally. During these rallies volume steadily declined just like it has right now. In fact last week was the lightest volume week of the year for the stock market. Both rallies ended with a lower high put in place. Last week the market rallied in the beginning of the week, but failed to break through it earlier August highs and turned down hard on Friday and Tuesday on higher volume.

If it breaks its August lows then a confirmed double top will be put in place and you can expect to see substantially lower prices to follow. Right now you want to watch the 1260 level on the S&P 500. If the S&P 500 closes below this level then I'll take it as confirmation that the rally is over.

One thing worth noting is that the average bear market rally lasts 6-8 weeks. Last week marked week seven of the rally that began in July.

There are a lot of things to worry about now. For starters Fannie and Freddie Mac are on the verge of going to zero. According to Barclays Capital the two companies will have to raise $225 billion of short-term to debt over the next six weeks. Of course they won't be able to do that in the private markets with crashing stock prices.

That means that the first government $100 billion plus bailout of Freddie and Fannie is right around the corner. I don't think the stock market or the bond market will take that too kindly, because it will mean the government raising the white flag and announcing to the entire world that it will print any amount of money to bail out these two companies and with estimates for their losses to reach $500 billion to even a trillion that is a lot of money we are talking about. Economists are also estimating another $500 billion to trillion dollars will be spent by the FDIC to cover bank failures. Put the two figures together and you are talking about the government having to add over one trillion dollars to the deficit in the next year as a result of the credit crisis.

That's serious money printing. It means serious trouble for the economy and the stock market and most likely a huge explosion in gold prices once gold gets it footing.

By Michael Swanson

WallStreetWindow.com

Mike Swanson is the founder and chief editor of WallStreetWindow. He began investing and trading in 1997 and achieved a return in excess of 800% from 1997 to 2001. In 2002 he won second place in the 2002 Robbins Trading Contest and ran a hedge fund from 2003 to 2006 that generated a return of over 78% for its investors during that time frame. In 2005 out of 3,621 hedge funds tracked by HedgeFund.Net only 35 other funds had a better return that year. Mike holds a Masters Degree in history from the University of Virginia and has a knowledge of the history and political economy of the United States and the world financial markets. Besides writing about financial matters he is also working on a history of the state of Virginia. To subscribe to his free stock market newsletter click here .

Copyright © 2008 Michael Swanson - All Rights Reserved.

Disclaimer -

WallStreetWindow.com is owned by Timingwallstreet, Inc of which Michael Swanson is President and sole shareholder. Both Swanson and employees and associates of Timingwallstreet, Inc. may have a position in securities which are mentioned on any of the websites or commentaries published by TimingWallStreet or any of its services and may sell or close such positions at any moment and without warning. Under no circumstances should the information received from TimingWallStreet represent a recommendation to buy, sell, or hold any security. TimingWallStreet contains the opinions of Swanson and and other financial writers and commentators. Neither Swanson, nor TimingWallstreet, Inc. provide individual investment advice and will not advise you personally concerning the nature, potential, value, or of any particular stock or investment strategy. To the extent that any of the information contained on any TimingWallStreet publications may be deemed investment advice, such information is impersonal and not tailored to the investment needs of any specific person. Past results of TimingWallStreet, Michael Swanson or other financial authors are not necessarily indicative of future performance.

TimingWallStreet does not represent the accuracy nor does it warranty the accuracy, completeness or timeliness of the statements published on its web sites, its email alerts, podcats, or other media. The information provided should therefore be used as a basis for continued, independent research into a security referenced on TimingWallStreet so that the reader forms his or her own opinion regarding any investment in a security published on any TimingWallStreet of media outlets or services. The reader therefore agrees that he or she alone bears complete responsibility for their own investment research and decisions. We are not and do not represent ourselves to be a registered investment adviser or advisory firm or company. You should consult a qualified financial advisor or stock broker before making any investment decision and to help you evaluate any information you may receive from TimingWallstreet.

Consequently, the reader understands and agrees that by using any of TimingWallStreet services, either directly or indirectly, TimingWallStreet, Inc. shall not be liable to anyone for any loss, injury or damage resulting from the use of or information attained from TimingWallStreet.

Michael Swanson Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.