Own Gold Bullion To “Support National Security” – Russian Central Bank

Commodities / Gold and Silver 2017 Nov 29, 2017 - 09:30 PM GMTBy: GoldCore

– We own gold bullion to “support national security” – Russian Central Bank

– We own gold bullion to “support national security” – Russian Central Bank

– Russia warns Washington: Confiscating fx reserves would be “declaration of financial war”

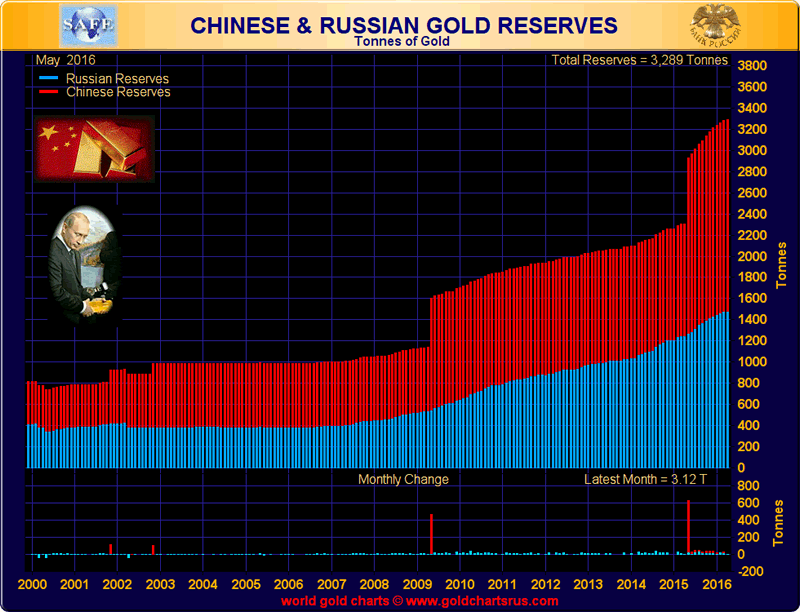

– Russia has quadrupled its gold bullion reserves in decade

– BRICs discussing ‘the possibility of establishing a single (system of) gold trade’

– Russia, China & maybe Saudi Arabia form alliances to unseat petrodollar

– Putin warns state-owned and private companies: be ready for rapid transition to war-time operations

– Russia, China gold-buying, Saudi strategic shift signal petrodollar era ending

Last week Russia’s Central Bank First Deputy Governor Sergei Shvetsov said Russians own gold bullion and their central bank is adding to its gold reserves in order to “beef up national security.”

Yesterday, the Russian Finance Minister Anton Siluanov warned Washington yesterday: “If our gold and currency reserves can be arrested, even if such a thought exists, it would be financial terrorism.”

Russia is prepared for the possible toughening of US sanctions. However, if they include the seizure of Russia’s foreign exchange reserves, it would be regarded as a “declaration of a financial war,” the Russian finance minister warned as reported by RT.

This is not the first time, senior Russian officials has declared the importance of Russia’s gold and fx reserves and indeed the economic and political strategy behind the country’s fx diversification and gold buying activities. Putin has frequently signaled his belief in gold including in symbolic photos, as has the head of the Central Bank.

Russian gold bullion reserves have increased in value to $73.7 billion as of Nov. 1 from $60.2 billion at the beginning of the year. In September 34 tons of gold was added to the country’s reserves, pushing the country to sixth place in the global rankings of gold holdings. It now sits one place behind China.

Russia and China have taken a similar approach to reserve management. Both have been working hard to reduce their dependence on (and exposure to) the petrodollar system. Bilateral trade agreements between themselves and others have allowed participants to trade in gold and their own currencies rather than solely the US dollar.

When Shvetsov referred to gold as a strengthener to ‘national security’ he is not directly referring to the obvious – weapons and physical means of defence. He is referring to economic war and the currency wars that the U.S. has played for so long.

The time has come when major oil producing nations and global powerhouses have had enough of the ace card the United States has dangled above them for so long. Russia, China, Turkey, Iran and possibly Saudi Arabia are stepping out of the US dollar’s shadow with little shame.

As unease grows across the Middle East, East Asia as well as between Russia and bordering EU nations, national security is of utmost importance to individual nations, as are economic alliances. When Putin and his banks’ Deputy Governor refer to preparations of national security and war-time operations they mean financial as well as physical.

Russia, China and others are well aware of this and happy to diversify out of the US dollar and into more secure and trustworthy assets, reducing their exposure to greenback-supporting cronies at the same time.

Russia – leading the hunting pack

“I would like to note that the ability of any economy to rapidly increase the output of defense products and services when it is needed is one of the most important conditions of the nation’s military security. All strategic and… large enterprises must be ready for this.”

Putin, November 22, 2017.

It has been no secret over the last few years that Putin is pushing Russia’s agenda on the international stage. He is demonstrating the country’s lack of passion when it comes to towing the line of the Western agenda, keen to show that the players of the East are worthy competitors.

He is doing this in a multitude of ways whether through forming alliances, the supposed hacking of the US election, posturing during military exercises and particularly Russia’s stocking up of gold reserves alongside allies.

According to the World Gold Council, since 2000, the combined national gold reserves of Turkey, Russia and China have more than quadrupled to more than 4,000 tonnes in 2017.

Whilst the gold bullion reserves of the US, the UK and the Eurozone member states are alleged to be 5 times as large, they have also shrunk in size by 10% since the start of 2000. We say alleged as the U.S. gold reserves have not been audited since the 1950s. So arrogant in the knowledge are the Western allies, that the US dollar and fiat reserves will stand them strong in the years to come.

With a desire to step away from U.S. dollar hegemony and Western kowtowing comes the need to set up new trading agreements and mechanisms.

Deputy Governor Shvestov did not only say that gold was a weapon of war but that the current gold trading system was archaic and irrelevant:

“The traditional system based in London and partially in Swiss cities is becoming less relevant as new trade hubs are emerging, first of all in India, China and South Africa.”

The Deputy explained how Moscow and Beijing have signed a memorandum of intent regarding bilateral gold trading, no doubt this will lead to the launch of new pricing benchmarks.

“We are discussing the possibility to establish a single gold trade [system] both within the BRICS, and at the level of bilateral contacts.”

The news of cooperation between Russia and China is not big news. The Central Bank of Russia now has plans to form a single bilateral gold trade system with the People’s Republic of China in 2018.

What would strengthen this move away from US dollar hegemony? The cooperation of one of the main parties participating in the petrodollar agreement – Saudi Arabia.

Saudi is no longer playing the American tune

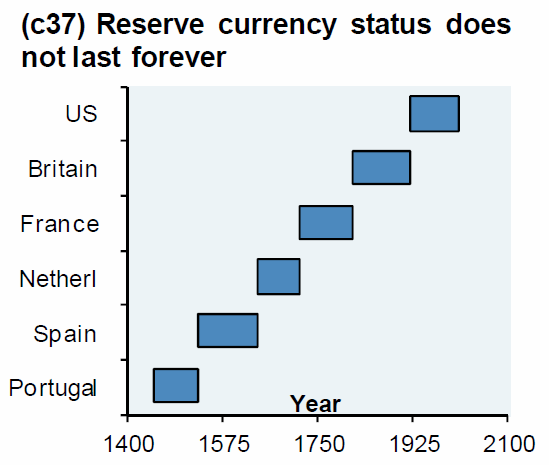

One of the overriding reasons for the petrodollar’s longevity is due to an agreement in 1974 between US President Nixon and Saudi King Faisal.

The two leaders agreed that the Arabian Kingdom would accept dollars as payment for its oil exports. At this point the petrodollar-era began.

Now we are on the cusp of something new. In the last six months the world has watched as Crown Prince Mohammed Bin Salman (MBS) has brought in a raft of new changes. Much of these have been introduced under his Vision for 2030 plan, a plan designed to reduce the country’s reliance on oil revenues.

According to economist Brandon Smith, there is an underlying motive here – reduce steps away from the petrodollar.

“… I believe this plan is NOT about ending reliance on oil, but ending reliance on the US dollar. In fact, the plan indicates a move away from the dollar as the world’s petrocurrency and a de-pegging of the riyal from the dollar.”

This plan has already involved strengthening ties to Russia and China, the two countries at the forefront of ending US dollar dominance.

Putin and King Salman – the petrodollar’s worst enemies?

In October Saudi Arabia’s King Salman visited Moscow, something which would have been unimaginable two years ago when Russia intervened in the Syrian conflict.

Today the two countries have a pressing issue that brings them both together – the falling oil price and the need to reduce global dependance on the US dollar.

The upheaval in the US administration has opened a window for Russia to show itself as a global power in the Middle East. Meanwhile Saudi is disappointed with Trump’s progress since his spring visit. There is little reason for the two to work separately towards the same goal.

Since 1960 Saudi Arabia has been able to move markets with a few select words. Not anymore, since last year Putin is now the world’s ‘energy czar’. Putin’s influence has been no more apparent than in recent weeks when Bloomberg declared he had crowned himself ‘OPEC King’.

Since engineering Russia’s pact with the Organization for Petroleum Exporting Countries to curb supplies a year ago, Putin has emerged as the group’s most influential player. As one senior OPEC official put it on condition of anonymity, the Russian leader is now “calling all the shots.”

The Kremlin’s growing sway within the cartel reflects a foreign policy that’s designed to counter U.S. influence across the globe through a wide mix of economic, diplomatic, military and intelligence measures. That strategy, which is undergirded by Russia’s vast natural-resource wealth, appears to be working.

China ‘compels’ Saudi Arabia to trade oil in yuan

China meanwhile is an economic and industrial powerhouse, with arguably as much power over the US dollar as those oil-producing nations. It recently usurped the US as the most oil-hungry nation on earth.

This gives it major bargaining power when it comes to paying for oil. Something with Saudi Arabia must be aware of. China has made its alliance with Russia, another major oil producer, on various fronts. It is now reportedly making its move with Saudi Arabia.

The economist Carl Weinberg says, Saudi Arabia has “to pay attention to this because even as much as one or two years from now, Chinese demand will dwarf U.S. demand…I believe that yuan pricing of oil is coming and as soon as the Saudis move to accept it — as the Chinese will compel them to do — then the rest of the oil market will move along with them.”

In recent years China has bought less and less oil from Saudi Arabia, which sells a dollar-denominated product, so keen is the PRC to step away from the greenback. This will begin the hurt the nation that is already suffering at the hands of the oil price.

Should Saudi bow to pressure from the Chinese then this will have a major impact on the US dollar:

“Moving oil trade out of dollars into yuan will take right now between $600 billion and $800 billion worth of transactions out of the dollar… (That) means a stronger demand for things in China, whether it’s securities or whether it’s goods and services. It is a growth plus for China and that’s why they want this to happen.” Weinberg.

As already mentioned, China has multiple trade agreements with Russia especially for oil. It has also ensured oil-for-gold is a trade that can take place without the involvement of the greenback. To support this, both countries have been ramping up efforts to acquire and mine physical gold. An asset the Saudis certainly understand.

Prepare for a major change in the global order

Whether you’re looking at North Korea’s latest missile launch, NATO and some of the Baltics preparing for war with Russia or Saudi stirring up tension in the Middle East things are changing and power is shifting.

With this comes a shift in economic and financial power. Whether or not the Russians and Chinese are successful in their usurping of the US dollar one can be sure that there will be disharmony and uncertainty.

All that Putin and Xi are doing is seeking to diversify and reduce their exposure to the most devalued and manipulated fiat currency on the planet. This is no different to the behaviour one should expect from the sensible investor and saver seeking to protect their own assets.

Gold cannot be devalued as fiat currencies can. It cannot be used by governments as a weight on the shoulders of others as we see with the US dollar. Allocated and segregated gold bullion coins and bars cannot be confiscated thanks to the irresponsible actions of a counterparty. It is borderless money that acts as the ultimate reserve and safe haven in a diversified portfolio.

Russia and China have a plan to take charge of their national security and financial future. Diversification and gold are at the centre of these plans, as it should be for anyone seeking personal financial security and seeking to protect themselves from the coming global monetary crisis.

Gold Prices (LBMA AM)

29 Nov: USD 1,294.85, GBP 965.70 & EUR 1,092.46 per ounce

28 Nov: USD 1,293.90, GBP 972.75 & EUR 1,088.95 per ounce

27 Nov: USD 1,294.70, GBP 969.73 & EUR 1,084.83 per ounce

24 Nov: USD 1,289.15, GBP 967.89 & EUR 1,086.37 per ounce

23 Nov: USD 1,290.15, GBP 969.93 & EUR 1,089.40 per ounce

22 Nov: USD 1,283.95, GBP 969.25 & EUR 1,092.51 per ounce

21 Nov: USD 1,280.00, GBP 967.04 & EUR 1,090.69 per ounce

Silver Prices (LBMA)

29 Nov: USD 16.90, GBP 12.60 & EUR 14.26 per ounce

28 Nov: USD 17.07, GBP 12.84 & EUR 14.36 per ounce

27 Nov: USD 17.10, GBP 12.81 & EUR 14.32 per ounce

24 Nov: USD 17.05, GBP 12.80 & EUR 14.38 per ounce

23 Nov: USD 17.10, GBP 12.84 & EUR 14.43 per ounce

22 Nov: USD 16.97, GBP 12.81 & EUR 14.44 per ounce

21 Nov: USD 17.00, GBP 12.85 & EUR 14.50 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.