The ‘End of Dreams’, and the Saving of Appearances

Politics / Social Issues Nov 26, 2017 - 03:39 AM GMTBy: Raul_I_Meijer

Once again, to my delight, we’re back with former British diplomat and MI6 ‘ranking figure’ Alastair Crooke and his Conflicts Forum organization. We posted a few of his articles this year and last. This time, Alastair writes a reaction to one of his own articles posted at Consortium News, which I included in the November 18 Debt Rattle at the Automatic Earth. My short comment then: “Former (and current?!) TAE contributor Alastair Crooke draws his conclusions.” This morning, the Conflicts Forum reached out again:

Once again, to my delight, we’re back with former British diplomat and MI6 ‘ranking figure’ Alastair Crooke and his Conflicts Forum organization. We posted a few of his articles this year and last. This time, Alastair writes a reaction to one of his own articles posted at Consortium News, which I included in the November 18 Debt Rattle at the Automatic Earth. My short comment then: “Former (and current?!) TAE contributor Alastair Crooke draws his conclusions.” This morning, the Conflicts Forum reached out again:

Dear Raul, We took the hint on a recent posting your site that referred to one of Alastair’s articles! …. and below is a comment piece he has done. It is an attempt to be strategic at where we’re going.

Anytime, guys! My first reaction to that piece was that Alastair makes Donald Trump and Jared Kushner’s role in the Saudi crackdown seem very large, which makes the role played by deep state America look small in comparison. And I’m not so sure about that. The riddle of ‘who’s playing who?’ is not a straightforward one. But that’s by no means a criticism (I ain’t criticizing no MI6!). It’s a question.

First, here are two paragraphs of that article to ‘get in the mood’:

Aaron Miller and Richard Sokolsky, writing in Foreign Policy, suggest “that Mohammed bin Salman’s most notable success abroad may well be the wooing and capture of President Donald Trump, and his son-in-law, Jared Kushner.” Indeed, it is possible that this “success” may prove to be MbS’ only success. “It didn’t take much convincing”, Miller and Sokolski wrote: “Above all, the new bromance reflected a timely coincidence of strategic imperatives.” Trump, as ever, was eager to distance himself from President Obama and all his works; the Saudis, meanwhile, were determined to exploit Trump’s visceral antipathy for Iran – in order to reverse the string of recent defeats suffered by the kingdom.

So compelling seemed the prize (that MbS seemed to promise) of killing three birds with one stone (striking at Iran; “normalizing” Israel in the Arab world, and a Palestinian accord), that the U.S. President restricted the details to family channels alone. He thus was delivering a deliberate slight to the U.S. foreign policy and defense establishments by leaving official channels in the dark, and guessing. Trump bet heavily on MbS, and on Jared Kushner as his intermediary. But MbS’ grand plan fell apart at its first hurdle: the attempt to instigate a provocation against Hezbollah in Lebanon, to which the latter would overreact and give Israel and the “Sunni Alliance” the expected pretext to act forcefully against Hezbollah and Iran.

Since the crackdown seems to have had limited success so far on an international level, this is certainly an interesting issue to delve deeper into. MbS has reportedly, assisted by US mercenaries, hung members of his own family upside down from ceilings in posh hotels and palaces to break them into submission and steal their fortunes, but if the international part of his plan falls short, this becomes a very unpredictable story.

But this new article has a much broader scope. I’ve often said that the falling apart of the American, European and global political systems is caused one-on-one by deteriorating economies (even if 90% of media and politicians stick the recovery narrative). Alastair agrees, and even quotes me again.

Alastair Crooke: Robert Kagan first called attention to the fact that America would need to awake from its ‘dream’ a decade ago in End of Dreams: The Return of History, and would have to manage the rise of ‘other’ powers, (some greater than others), with adroitness, if it were to avoid a bad road-crash as emerging competitors clashed with the waning dominant power.

This meant that the US no longer would be able to assert its will everywhere, and on everything – and would have to give ground – especially to China and Russia. “There’s going to have to be some very painful horse trading”, historian Sir Max Hastings suggests, adding that its pain will be none the less traumatic, since – like Germany after WW1 – America, does not feel itself defeated: Quite the converse, it sees itself having emerged from the Cold War wholly vindicated: in terms of its societal, governmental and capitalist models.

The American-shaped globalist order, in which three American generations have been steeped, had seemed so naturally to flow out from the Cold War, that the onset of world ‘order’ dissolution seems – shockingly, for many – to have struck out of the blue – as it were – with Brexit, and the election of Mr Trump.

Commentators speak of America needing to be wary of the Thucydides’ Trap (when the then aspiring power, Athens, threatened the primacy of the established hegemon, Sparta, leading to war). But ‘the trap’ today is not simply just about who’s rising ‘up’, and who’s heading ‘down’, in the great-power stakes – for, as Josh Feinman, chief economist for Deutsche Bank, last year warned, the problem is not just great power competition. But rather: “We’ve seen this movie before. The first great globalization wave, in the half-century or so before World War I, sparked a populist backlash too, and ultimately came crashing down in the cataclysms of 1914 to 1945.” In short, the two world wars were not just about Germany challenging British hegemony, but were also about globalization ‘backlash’ too – something that is often overlooked.

In other words, in the wake of WW2, America has been backing itself into the corner of an ‘American-shaped’ (imposed), second wave ‘globalisation’, and that is the major risk posed today (as much as rising China), with ‘populism’ again markedly on the up. And ‘second wave globalisation’ is again yielding predictable political volatility (i.e. in ‘unexpected’ election results). However, as Max Hastings suggests, (quoting former UK politician Michael Howard), “we must recognize that the élites, of which he [Howard] himself freely admits to having been a part, have failed to sustain the consent of electorates for this [Euro-centralisation and for globalisation]. This ignoring the need to sustain the consent of the electorate, bears a considerable responsibility for getting us into this mess”.

Further, as Andrew Bracevich underlines globalism has its distinct social ‘flipside’: “[A] war [has been waged] on (genuine) culture: Under whatever guise, liberal-market globalism is hostile to tradition, community, established norms, and the very idea of a common culture – all of which impinge [adversely] upon the operation of the market, or claims of radical individual autonomy”.

The Thucydides’ Trap for America, rather, as Professor Lears of Rutgers writes, then, is not just the rising of Russia and China, but that of Americans being backed into the corner of not recognizing “that ‘they’ [the liberal globalists] are no longer defending either liberalism or democracy; [these] forms of élite rule – that provoke [such] popular anger – are merely the husk of liberal democracy: The once-vital discourse of liberal democracy has been hollowed out, and transformed into a language of managerial technique … Within this discourse, freedom has been reduced to market behaviour; citizenship to voting; and, efficiency for the public good to efficiency for profit. The rich civic culture that gave rise to popular American politics in the past—unions, churches, local party organizations—has been largely replaced, in both parties, by élites who have benefited from the ‘technocratic turn’”.

“As long as prosperity continued to increase as it has since 1945, western electorates were willing to give élites a very considerable measure of discretion about what they did, [whether in creating the EU], or whatever it might be. They were willing to acquiesce. Now, prosperity is being squeezed, wages are stagnant, and for many people unlikely to rise much in real terms. It is going to be much more difficult to sustain the consent of Western electorates for purposes which the élites might consider as [somehow] ‘enlightened and unselfish’”. (Hastings again – with emphasis added).

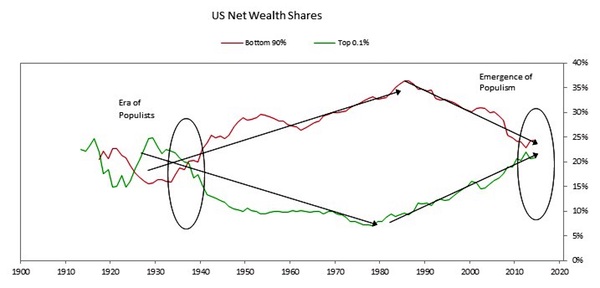

And here lies the real ‘trap’: it is not that “prosperity is being squeezed” as per Hastings, but that the economy has rather, been divaricated into the ‘squeezed 60%’ and the asset-holding, and enriched 40% (as Ray Dalio describes it). Last month Dalio, the billionaire founder of top hedge fund, Bridgewater Associates, posted a new article, “The Two Economies: The Top 40% and the Bottom 60%”. He believes it is a serious mistake to think you can analyze or understand “the” economy because we now have two of them. The wealth and income levels are so skewed between top and bottom that “average” indicators no longer reflect the average person’s experience or living conditions. Dalio explains with this chart:

The red line is the share of US wealth owned by the bottom 90% of the population, and the green line is the share held by the top 0.1%. Right now they are about the same, but notice the trend. The wealthiest 0.1% has been increasing its share of wealth since the 1980s, while the bottom 90% has been losing ground. But it would be a mistake to understand this phenomenon – ‘populism’ as it is labelled in Dalio’s chart – or, the push to recover national culture and sovereignty – as simply a gripe about inequity. It has become since 2009 much more than that: it has become a matter of survival for a major segment of the American and European population (especially, as it coincides with a pensions crisis, which will leave many impoverished in their old age):

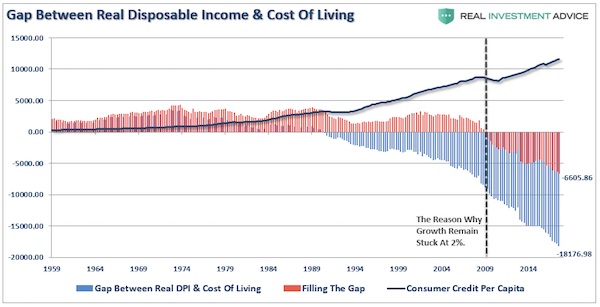

“Prior to 2009, debt was able to support a rising standard of living…”, Raúl Ilargi Meijer says, “but less than a decade later, [personal debt], can’t even maintain the status quo. That’s what you call a breaking point.” (Alastair: Or, even, a precursor to civil violence?)

“To put that in numbers, there’s a current shortfall of $18,176 between the standard of living and real disposable incomes. In other words, no matter how much people are borrowing, their standard of living is in decline.

“Something else we can glean from the graphs is that after the Great Financial Crisis of 2008-9, the economy never recovered. The S&P may have, and the banks are back to profitable ways and big bonuses, but that has nothing to do with real Americans in their own real economy. 2009 was a turning point, and the crisis never looked back”.

And Max Hastings’ point is that with austerity gone, early popular acquiescence has turned to anger against the élites – for having so taken them for granted in their utopian globalist projects.

Now the wider point: what we have here is the intersection of geo-politics with geo-finance. Both are now wholly contingent on the ‘saving of appearances’. One co-constitutes the other. One is the saving of appearance that America is not losing ‘respect’, or being disdained in the international arena, as it attenuates its global commitments (that is the Thucydides ‘syndrome’), and two, saving the appearance that ‘recovery’ and ‘prosperity for all’, are continuing to unfold nicely in the economy (the world converging globally to western values ‘syndrome’).

Both these aspects to the dissolution of today’s western ‘modernity’ are intertwined, and co-constituting, and therefore likely to march in tandem – at least for now: western ‘prosperity’ underwrites the global order, and the global order underwrites American ‘prosperity’. The American and European élites therefore find themselves painted into a globalised ‘rules-based order’ corner, geo-politically, just as the Central Bankers have been backed into their QE, low or negative interest rate corner – from which there is no easy escape, either.

The term ‘globalisation’ has been used to paint a landscape that is both inevitable, and beneficent: “free trade floats all boats; everywhere” is the meme. Devotees of globalisation however, never examine rigorously whether David Ricardo’s comparative advantage theory still holds good in the contemporary world (Nobel prize winner Joseph Stiglitz, however, being a notable exception). There just has been no point in asking the fundamentally political (as opposed to technical) question: Has the resulting off-shoring of supply lines, truly been in our interest – politically, as well as financially? And has the concomitant – globalist disembedding of humans from national culture, community and sovereignty, and the rise of the apolitical, neo-liberal, chameleon-identity ‘Self’, been in the general political and societal interest, too?

It may be objected that Trump is not a globalist. Whilst it is true that he does not favour America shouldering the claims of a world order; he – himself – protests loudly that he is a globalist – but it is just that he is a hard-nosed, New York businessman, type of globalist: that’s all. Globalisation (in the neo-liberal mode), remains as a western totem, rightly, or not, according to political taste.

Where now? In the domestic field, the Central Banks’ easy ‘group think’ on QE, low or negative interest-rates, and ballooning public and private debt, has been pursued now for so long and so extensively, that it has both given us Dalio’s Two Economies, and no way back. It has become a vicious circle: as high debt, to GDP ratios, low-interest zombification of entities and shrinking personal disposable income in the 60%, have depressed growth. Yet, paradoxically, never has the need for more of the same – QE, low or negative interest rates, or even ‘helicopter’ income – been so widely extolled — and, at the very moment when their drawbacks have become so widely identified, even by central bankers, themselves.

So here we are: there is a messy, and bitter, divorce taking place in our societies between the 60% and the 40% ‘tribes’. Asset valuations indeed have never been higher. Yet growth by contrast, has, on average, been ratcheting down, decade by decade – and for some, the situation has become truly existential (those for whom even additional debt cannot sustain their non-discretionary outgoings).

Where do we go from here? A continuation of the existing financial paradigm is what everyone believes; what everyone expects (wants) – and is what we likely will get. It might even be deepened a little, in the wake of a market hiccough (S&P down by more than 2%). And in the case of a financial black swan, we may witness the system literally ‘hosed down’ with newly created ‘money’. But essentially, the business and trade cycle will continue to be heavily repressed – volatility slammed down – and the S&P be the metric of national well-being.

Not only do the markets ‘believe it’, President Trump needs it: geo-politically he likes to do his style of negotiating from a position of strength (and not from one of economic crisis); and internally, he is at ‘war’ with the Establishment. With the S&P touching records daily, he is immune from taunts of incompetence (regardless of whether not the highs have anything to do with the President). His base likes it too: their meagre retirement portfolios at least are rising in value. And in any event, it is not surprising if Trump is a low interest, plentiful liquidity, expanding balance sheet, man globally: It is how he made his billions, personally.

Of course, the flip side to continuing the ‘easing’ paradigm is the ongoing hidden transfer of wealth from general taxpayers (the 60%) to the 40%: more populism; more unexpected election outcomes in Europe; more fake-ness; quicker dissolution of the glue holding society together; more political process, less outcome; less ability to address the needs of collective purpose, etcetera — rising rancour and push-back, in a word. This is the implication.

In parallel, the saving of appearance in geo-politics seems to require its slamming down of volatility too (and in the EU, not least – i.e. Catalonia). People want to believe it (in American power); important sectors of the economy want it, (need it): the appearance of America’s global standing must be preserved. Repressing North Korea, ‘slamming down’ Iran can save appearances (America is strong), but the flip-side is the increased danger of war – whether inadvertently triggered, or by the US cornering itself into it. Actually, ebbing power is something that you smell: false bravura only heightens the odour of weakness.

So, continuance of the paradigms (financial and geopolitical), and the continuance of ‘populist push-back’ (i.e. volatility) seem set. Is Josh Feinman of Deutsche Bank then right when he says: “We’ve seen this movie before. The first great globalization wave, in the half-century or so before World War I, [it] sparked a populist backlash too, and ultimately came crashing down in the cataclysms of 1914 to 1945.” Is a financial crisis inevitable – ultimately? Is war – a confrontation with either Russia, China or N. Korea – unavoidable?

Who can say, for sure? But the repeating of history is not inevitable. Financial re-set at some point, has become inevitable, it would appear. It has taken time for the old meme to fade, and weaken its hold sufficiently. Hemingway famously said about bankruptcy (his), that it starts only very slowly, but ends lightningly fast. The political impulse for a change in the social and cultural paradigm however does seem to be unfolding at an accelerating pace. ‘Populism’ and ‘unexpected’ election results are acting as its accelerant. And the intellectual context for a seismic economic policy shift, is in place too: monetary policy is seen to be bust, and the economic ‘models’ have been seen to be plain wrong. TINA (there is no alternative) is wobbling on her pedestal, and seems poised to topple over.

Of course there are alternatives. But will they arrive in time? Perhaps the existing paradigms are destined to endure a while yet … ’til Hemingway’s observation about bankruptcy sliding unstoppably fast towards the end is further proven as a truism? In the meantime: we wait; shackled by inertia, and backed into a corner.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2017 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.