Bitcoin Price Moves above $8,000 to All-time High

Currencies / Bitcoin Nov 25, 2017 - 06:24 PM GMTBy: Mike_McAra

The recent action in Bitcoin probably makes it relatively easy for the media to write stories about the currency. For some time now, we have consistently seen titles on Bitcoin’s sequence of all-time high and sometimes the move up is linked to the denial of a proposed change in the network, called SegWit2x. In an article on CNBC, we read:

The recent action in Bitcoin probably makes it relatively easy for the media to write stories about the currency. For some time now, we have consistently seen titles on Bitcoin’s sequence of all-time high and sometimes the move up is linked to the denial of a proposed change in the network, called SegWit2x. In an article on CNBC, we read:

Bitcoin hit a fresh all-time high Monday above the $8,000 mark after a wild week for the cryptocurrency.

On Monday around 12:25 p.m. London time, it hit a record high of $8,121.56, according to data from industry website CoinDesk. Bitcoin first broke the $8,000 handle on Sunday.

The rally comes on the back of a huge sell-off on Sunday, November 12, where the price of bitcoin fell to around $5,500. That low, to the record high on Sunday, marks a more than 47 percent increase in the cryptocurrency's price.

Bitcoin's price dip last weekend came after a proposed upgrade to the bitcoin network, SegWit2x, which was planned for November 16, was called off. The aim was to increase the transaction speeds of bitcoin, which has increasingly slowed down over the years. If the upgrade had taken place, it would have caused what is known as a "hard fork," causing a new bitcoin spin-off to be formed.

As usually, we are deeply skeptical of claims that “Bitcoin went up because of X” where X can be any one of the following: SegWit, fork, China, or any other piece of news for that matter. This is not to say that some moves in Bitcoin are caused, at least to some extent, by real-world developments. It is to say that more often than not it is very hard to pin down the links and at least sometimes the media seem to be clutching at straws. For instance, imagine that Bitcoin didn’t go up but rather went down heavily following the SegWit decision. A story along the lines of: “Bitcoin investors expected to get more coins in the process of forking but the split isn’t happening, the new coins are not created and people are getting out of longs.” Bitcoin, however, has gone up since the SegWit news came out. It might be the case that there was a bearish influence from the lack of split but it was absolutely overwhelmed by buying for different reasons. In this context, the lack of decline following the lack of split could have been viewed as a bullish hint. The point here is that the “reasons” you are likely to read about in the mainstream media are not necessarily the main drivers of a given move. Sometimes, they can be but that’s not a given. One indisputable fact is that Bitcoin is at a new all-time high once again.

For now, let’s focus on the charts.

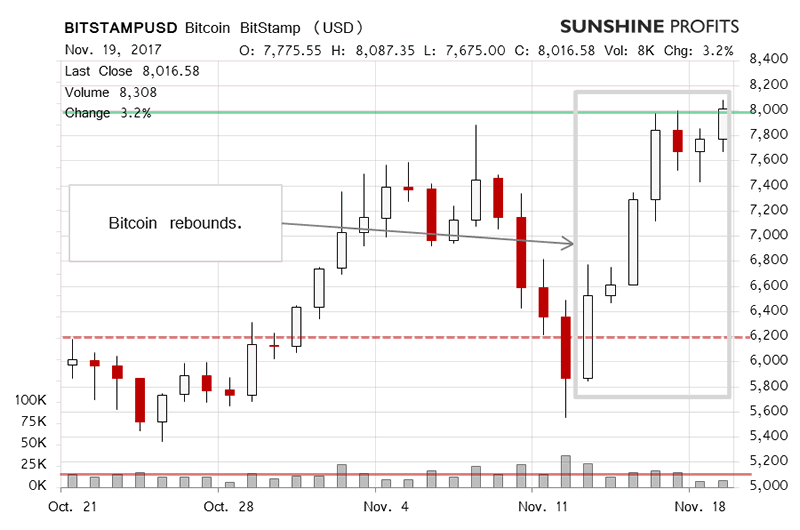

On BitStamp, we saw a move to the upside and yet another all-time high, this time in the proximity of $8,200 (a bit above this level, at the moment of writing these words, after 10:00a.m. ET). Recall our recent comments:

The move up was partially reversed with Bitcoin falling steeply to around $5,500 yesterday. Bitcoin went below the 23.6% Fibonacci retracement level ($6,206) before coming back above this level today. This might mean that all the bearish indications have been nullified, particularly since yesterday’s move was completed on significant volume, at least in comparison with what we have seen in the last couple of weeks.

Depending on what move you precisely look at, we can draw several 23.6% Fibonacci retracements. Bitcoin, however, went back above the level we mentioned previously and also above all the 23.6% retracement levels we have considered writing this article. And it did so in a quite visible manner. This means that the situation is now decidedly more bullish than it was only a couple days ago.

Now, we can add a move above the previous all-time high around $7,900 to the picture. This means that Bitcon is again in uncharted territory in terms of the price level. We have so far only seen one daily close above this level and the volume hasn’t really been pronounced, which doesn’t necessarily confirm the move up just yet (it might in the next couple of days).

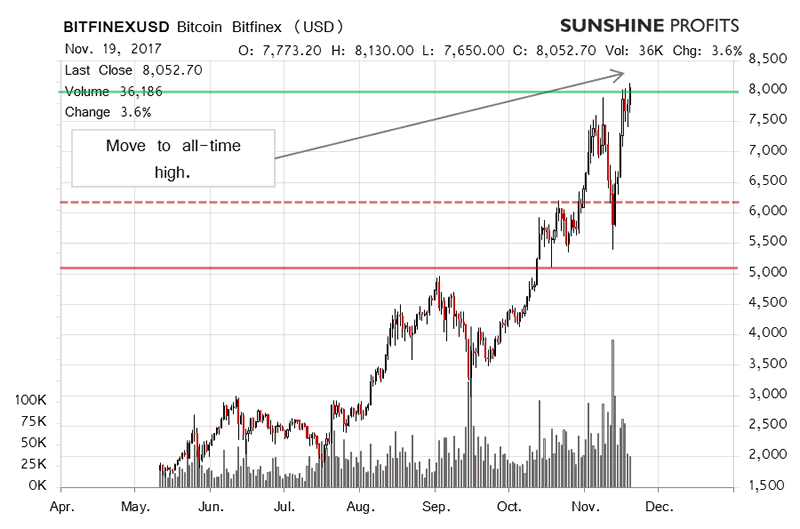

On the long-term Bitfinex chart we see a move to the all-time high above $8,000. At the same time, the volume isn’t spectacular. What might this mean for the Bitcoin market? In our previous alert, we wrote:

It turns out that a move up was in the cards and that the recent invalidation of the breakdown below the 23.6% retracement (it almost doesn’t depend on which precise retracement we use). Also, depending on the time horizon, we saw a breakdown below the 38.2% retracement and a rebound. All this is quite important in and of itself. There are at least two additional factors to consider now, both of the bullish. Firstly, Bitcoin is not overbought in terms of the RSI. This might mean that there is still ample room for the currency to go up. Secondly, the recent local bottom was formed on very significant volume, which can be clearly seen on the chart. Combining these facts leaves us with a potentially bullish picture for the short (...).

If anything has changed, it was Bitcoin going higher. Not spectacularly higher, and not in a very confirmed way, but higher nonetheless. There’s not that much to call home about just now, however, the bullish picture remains firmly in place for the very short term, in our opinion. Bitcoin is not yet overbought in terms of the RSI and at present, we would expect the currency to go deeper into the overbought territory before possibly reversing. Right now, it definitely pays to be cautious but, at least for the next couple of days, the outlook for the currency remains bullish and might get more bullish if the move above the all-time high is confirmed, in our opinion.

If you have enjoyed the above analysis and would like to receive free follow-ups, we encourage you to sign up for our daily newsletter – it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts. Sign up now.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.