Will Germany’s Crisis Affect Euro Dollar?

Currencies / Euro Nov 23, 2017 - 12:50 PM GMT Germany suddenly found itself in a political turmoil on Monday after the month-long talk to form a three-coalition party between Angela Merkel’s conservative bloc (CDU/CSU), the pro-business Free Democractic Party (FDP) and environmentalists Greens has failed. The crisis definitely challenges the idea that Germany is the anchor of democratic stability in Europe. FDP walked out of the negotiations on Sunday, saying they could not find a common ground on migration and environment.

Germany suddenly found itself in a political turmoil on Monday after the month-long talk to form a three-coalition party between Angela Merkel’s conservative bloc (CDU/CSU), the pro-business Free Democractic Party (FDP) and environmentalists Greens has failed. The crisis definitely challenges the idea that Germany is the anchor of democratic stability in Europe. FDP walked out of the negotiations on Sunday, saying they could not find a common ground on migration and environment.

From the image of the eternal chancellor and leader of the free world, Merkel now is battling to keep her power as the fourth term is not guaranteed. This could leave Germany stuck for months with lameduck government and spell bad news for the stability of European Union. The parties would now have three weeks to attempt the negotiation again. But unless the deadlock ended, Germany has three options:

1) Merkel’s CDU could form a coalition with the opposition Social Democrats (SPD). After all, they have the experience of working together from 2013-2017. However, SPD has clearly ruled out working together again with CDU. In the last election, SPD received a historic low 20.5% in the poll, suggesting that the coalition with Merkel’s party didn’t provide any political benefit.

2) CDU could try to govern in a minority government. In this case, CDU would need to seek majority support for each bill it presents to parliament. However, Germany has never had a minority government since the end of second world war. This is an option with inherent instability and Angela Merkel herself has indicated that she would rather have fresh election.

3) Fresh election in Spring 2018. This option however is difficult to execute as Germany’s Basic Law requires the German President to first nominate Merkel as chancellor. Then she would need to earn a majority of votes in the German parliament / Bundestag. After she fails to gain majority 3 times, then the President will dissolve the Bundestag and calls for new elections within 60 days. And even if this step is successful, a new election does not guarantee a different outcome as German voters may not make different choices.

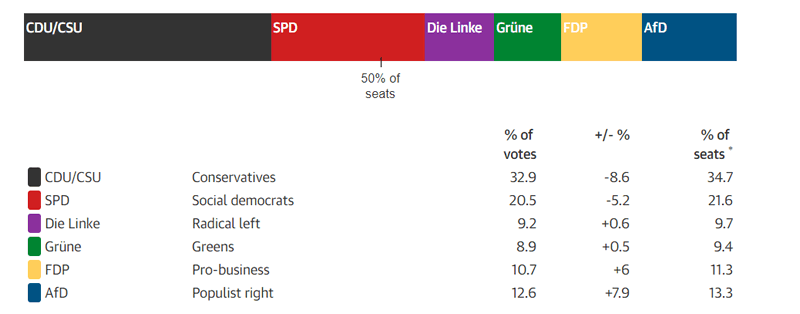

Recall that in September 2017 election, Ms. Merkel and her conservative party CDU won, but it was weakened. The surprise is the strong result from nationalist and populist right-wing AfD (Alternative for Germany) party, and also the return of pro-business FDP to the Bundestag. Below is the result of the September election and a new election doesn’t necessarily boost Merkel’s party vote share.

If the uncertainty persists and the parties couldn’t come into agreement, then most likely fresh election will be the outcome. This could potentially affect the stability of Germany and the European Union. It may also provide a cap to potential Euro dollar strength.

EURUSD Euro Dollar Daily Elliottwave Chart

The entire rally from 1.3.2017 low to 9.8.2017 peak can be labelled as a 5 waves with momentum divergence clearly observed. In this view, pair could see further downside to correct the rally from 1.3.2017 low. 50% – 61.8% retracement can bring the pair down to 1.1215. Alternatively, pair could see another leg higher in wave ((5)) before ending the 5 waves up from 1.3.2017 low. Pair is at the crossroad now with SMA (Simple Moving Average) 50 about to cross below SMA 100. If the political uncertainty persist and there’s no immediate solution, then we may see pair correcting further.

If you enjoy this article, check our work and join Free 14 days Trial to see Elliott Wave Forecast in 78 instrument, as well as getting access to Live Trading Room, Live Session, and more

By Ayoub Ben Rejeb

https://elliottwave-forecast.com

ElliottWave-Forecast has built its reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 52 instruments including Forex majors & crosses, Commodities and a number of Equity Indices from around the World. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Elliott Wave Setup .

Copyright © 2017 ElliottWave-Forecast - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.