Stock Market Crash Omens & Predictions: Another Day Another Lie

Stock-Markets / Stock Market 2017 Nov 16, 2017 - 05:58 PM GMTBy: Sol_Palha

Never argue with an idiot. They will drag you down to their level and beat you with experience. Mark Twain

Never argue with an idiot. They will drag you down to their level and beat you with experience. Mark Twain

Over the past several years the Naysayers have predicted the Market would crash and burn; we blatantly disagreed and opted instead to state that the market would continue to soar higher and higher. Despite the severe beating these naysayers have taken, they insist on regurgitating the same trash over and over again in the blind hope that by some miracle their insane ramblings come to pass. As soon as October was upon us, these experts started screaming at the top of their lungs. What was their latest prediction; a repeat of the 1987 Stock Market Crash. We immediately repudiated these predictions. Here is a brief excerpt from the article we posted in October.

They never seem to let up on pushing this sewage onto the unsuspecting masses. This is a clear example of insanity in action; mouthing the same thing over and over again with the desperate hope that this time the outcome will be different. The outcome will not be different this time, at least not yet. These guys should focus on writing fiction for reality seems to elude them completely. For years we have stated (and rightly so) that until the sentiment changes, this market will continue to soar higher and higher.

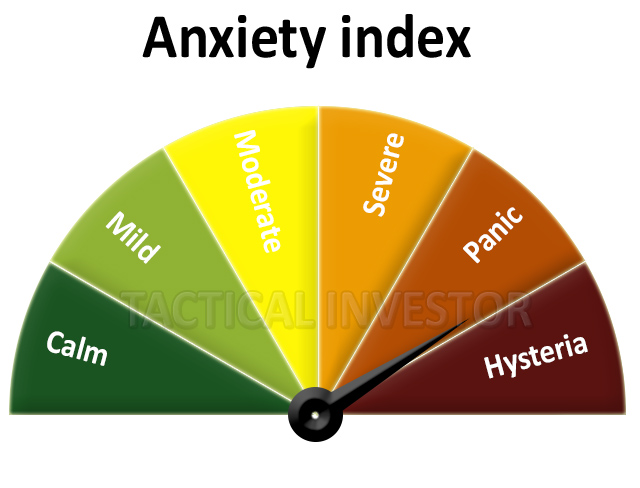

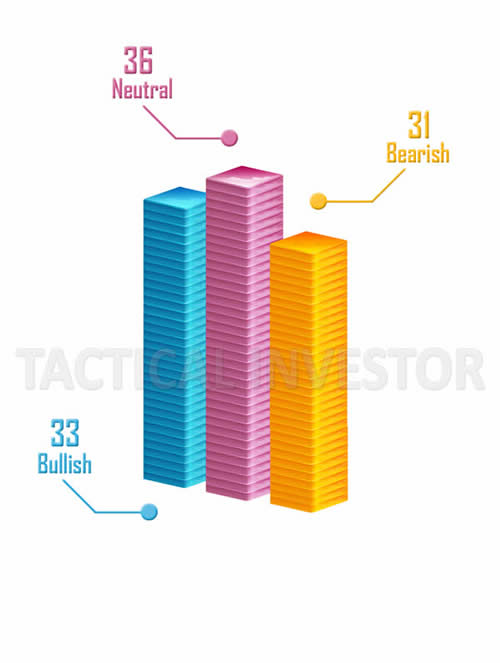

The latest nonsense is to state market omens that have a terrible record of coming to pass are about to trigger a crash; ones odds are better if one looks at tea leaves, plays with skull bones or hires some monkey to throw darts at a board with the words up or down plastered on it. One has to determine the trend first and look at several underlying forces before one can attempt to predict where the market is headed. However, these fools read a book or two, memorise someone else’s theories and assume all of a sudden they are experts. Fundamentals and technical’s are both useless when used in isolation. One has to look at the emotion driving the markets. In other words, what are the masses thinking or doing? When one looks at the sentiment data, the conclusion is inescapable. Stock markets always crash on a note of euphoria and the masses are far from being happy.

Masses are not embracing one of the Most Hated Bull Markets in History

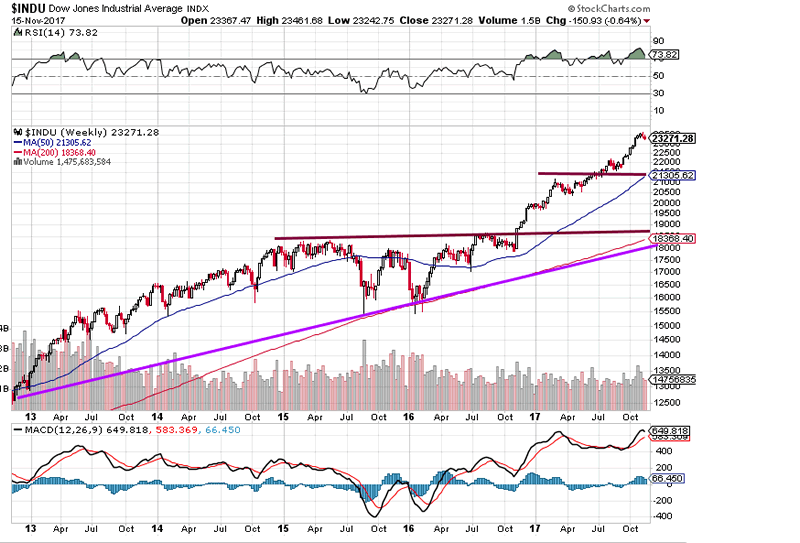

The images below speak a thousand words, so there is no need for us to add any commentary.

The Technical Outlook

While the Dow is trading in the extremely overbought ranges, any pullback will most likely end in the 21,000-21,500 ranges. For the correction to pick up steam, it would need to close below this level on a weekly basis. As the trend is still positive, the odds of the Dow crashing are very low. At the most, the Dow would test its breakout point which falls in the 18,900-19,200 ranges unless the trend were to turn negative suddenly or the masses suddenly embraced the market with gusto. At this point, the trend is strong and showing no signs of weakening. Remember that the markets can remain irrational for much longer than most traders can remain solvent by betting against it.

Inflation remains a non-issue on a worldwide basis

Central banks worldwide are either standing down or opting for rate cuts. This indicates that while the economy is improving somewhat, the global economy is far from healthy and low rates will continue to dominate the scene. In a lower rate environment corporations borrow more money and the new game is to use this money to buy back shares and in doing so magically improve the EPS.

Conclusion

When the Dow was trading below 20K, we stated that the next target was 21K; this target was struck in a few short months. After that, we raised the target to 22 and 23K. Now we will go on record and state that the Dow is likely to test 28,000-28,500 with a possible overshoot to 30K before it crashes. We will be providing our subscribers with an in-depth analysis of the path the Dow will traverse to achieve this target. We don’t expect the Dow to just shoot to these targets, certain requirements have to be fulfilled, but so far the Dow is following the path we expected it to take.

Before you listen to these so-called experts who seem quite happy to dish out faulty information, take a look at their track record. A simple search will reveal that over 90% of them are full of hot air and had any of these Dr’s of Doom followed even a sliver of their advice, they would have been blown out of the game long ago. The fact that they are still here tells you that they are trying to pan their sage advice to you in return for a certain fee; advice they would never follow.

A simple game plan

View strong corrections through a bullish lens. This game plan will remain valid until the masses turn bullish or the trend turns negative. The stronger the deviation, the better the opportunity.

You can't make anything idiot proof because idiots are so ingenious.

Ron Burns

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2017 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.