Unemployment Rate Reaches Record Low, Positive for Stocks

Stock-Markets / Stock Market 2017 Nov 11, 2017 - 12:39 PM GMTBy: Donald_W_Dony

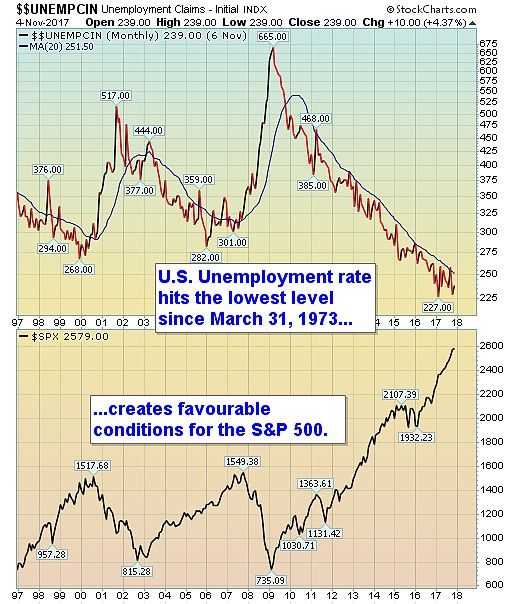

The U.S. Unemployment rate has just reached a level not seen in over forty years.

The U.S. Unemployment rate has just reached a level not seen in over forty years.

In early November, the seasonally adjusted claims was 239,000. The 4-week moving average sat at 231,250 which is the lowest level since March 31, 1973 when it was 227,750.

The main significance of a low number, apart from the positive outlook for the economy, is the stock market.

The U.S. Unemployment rate and the S&P 500 have a tight opposite correlation. A declining unemployment rate has a positive affect on the stock market.

The opposite is also true.

When the stock market (S&P 500) begins to rollover, the reverse action from the U.S. Unemployment rate is not far behind.

However, at present, both indexes show few signs of reversing their trends.

Historically, the Unemployment rate first has a bottoming period of approximately six to nine months before it starts to rise.

The stock market (S&P 500) also has a transition period of cresting, that is similar in duration to the U.S. Unemployment rate, before it starts to roll over.

Bottom line: There are few signs from the S&P 500 that this impressive run from early 2016 has come to an end. And as the stock market leads the U.S. Unemployment rate, the probability of a reversal coming to the U.S. Unemployment rate over the next few months is low.

The likelihood is that the Unemployment rate will find a floor at around 4.1% to 4.4% over the next few months.

And the probability of a multi-month base developing bodes well for the S&P 500 into 2018.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2017 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.