Can Stocks and Bonds go Down at the Same Time?

Stock-Markets / Stock Market 2017 Nov 10, 2017 - 06:27 PM GMT TNX gapped up this morning in a possible Wave [iii] of 3 of (5). I spent a considerable amount of time evaluating the Waves and Cycles to arrive at this construction of the Wave pattern. The fact that the Wave had become very oversold alerted me to the possibility of stocks and bonds both in decline. An index may often rally an average of 3 weeks after a Master Cycle low.

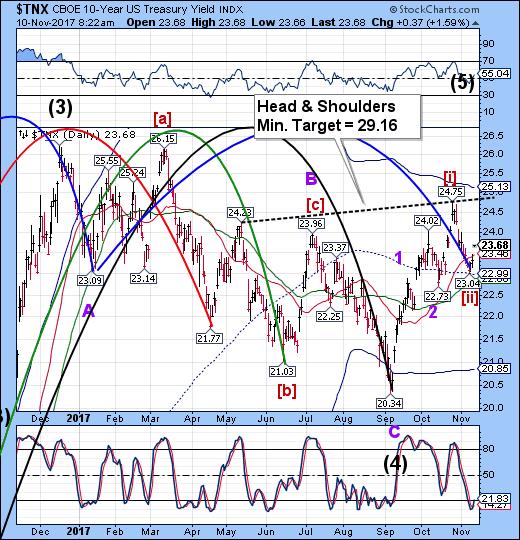

TNX gapped up this morning in a possible Wave [iii] of 3 of (5). I spent a considerable amount of time evaluating the Waves and Cycles to arrive at this construction of the Wave pattern. The fact that the Wave had become very oversold alerted me to the possibility of stocks and bonds both in decline. An index may often rally an average of 3 weeks after a Master Cycle low.

The view that bonds go higher as stocks go down is only a recent phenomenon. What if both go down in a liquidity crisis? For example, Japan or China may sell their treasuries to forestall their stock market declines.

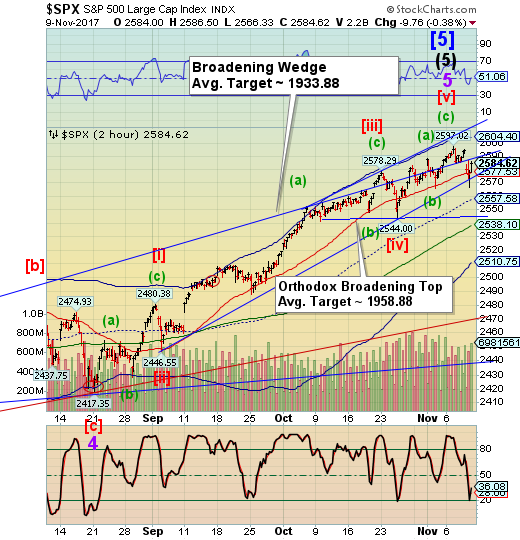

SPX futures have been challenging the Diagonal trendline near 2575.00 this morning. It appears that SPX may gap open beneath

Short-term support at 2577.53. Note that yesterday’s gap has not been filled. This is a feature of Waves C and 3. Should the SPX continue its decline, we may see one or more panic down days next week. You may not have heard the expression “10% down days.” These ten percenters occur in clusters, so we may see something equivalent to that by Wednesday. The total decline may not end until November 20 and may extend until November 27.

ZeroHedge reports, “Yesterday's Japan flash-crash inspired selling continues for a second day, with global equities - and bonds - sliding early Friday on concerns U.S. tax reform - and corporate tax cuts - will be delayed after Senate Republicans unveiled a plan that differed significantly from the House of Representatives’ version. After suffering their biggest plunge in 4 months on Thursday, European stocks failed to find a bid along with Asian stocks, while U.S. index futures pointed to a lower open (ES -0.5%, or -10), the Nikkei 225 ended 0.8% lower, Treasuries yields are up 1-4bps across the curve in steepening fashion, with the 10y at 2.370%, while the Bloomberg Dollar Spot Index declined for a third day. The VIX has jumped 6% this morning trading through 11 while WTI crude oil is little changed trading north of $57/bbl.”

VIX futures were trading above 11.00 earlier this morning, but it appears that the VIX futures feed has been shut down, leaving only yesterday’s closing price. However, the VIX ETFs are trading higher. It appears that there may be a concerted effort to jam the VIX prior to the open, or at least leave us in the dark about the rally.

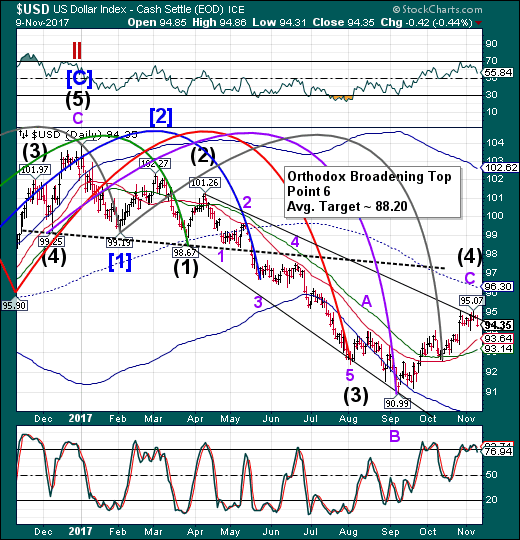

USD futures are drifting lower this morning. The Orthodox Broadening Top is now approaching its 3-year mark. There are many who believe that this formation has lost its integrity due to the passage of time. The Wave pattern suggests otherwise. The next possible Master Cycle low due date may occur on November 27.

USD/JPY is also drifting lower and share the Master Cycle with the USD.

By the way, USB has its next Master Cycle low due at the end of November, as well.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.