First Solar FSLR Recovery in Progress

Companies / Solar Energy Nov 10, 2017 - 04:58 PM GMT First Solar (NASDAQ: FSLR) designs and manufactures solar modules using a proprietary thin film semiconductor technology. The company has developed, financed, engineered, constructed and currently operates many of the world’s largest grid-connected PV power plants.

First Solar (NASDAQ: FSLR) designs and manufactures solar modules using a proprietary thin film semiconductor technology. The company has developed, financed, engineered, constructed and currently operates many of the world’s largest grid-connected PV power plants.

First Solar relies almost entirely on utility-scale projects which accounts for over half of the U.S. solar market and can be affected by the potential solar import tariffs by the Trump administration. However, preparation were already made to avoid such a step-back and the company booked 4.5 GW of panel and system sales in the previous quarter, more than it makes in a year.

After last month’s better than expected earnings report and the fact that utilities and project developers are booking tariff-free panels to lock up supply in 2018 helped First Solar shares to jump over 20% and the technical picture for its stock is looking for more gains in the coming months.

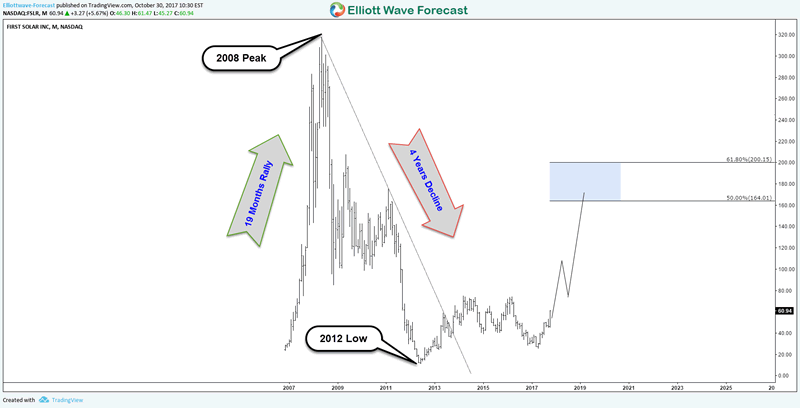

FSLR Monthly Chart

First Solar saw an impressive 1100% rally in the first 19 months after its IPO ($20) before it started declining from 2008 peak ($317) like the rest of the stock market around that period. The 3 swings decline lasted 4 years and erased all the gains saw previously until the stock found a bottom in May 2012 at $11.43. Up from there, FSLR bounced higher either to start new bullish cycle to the upside or at least to correct the decline toward the 50% – 61.8% Fibonnacie retracement area $164 – $200.

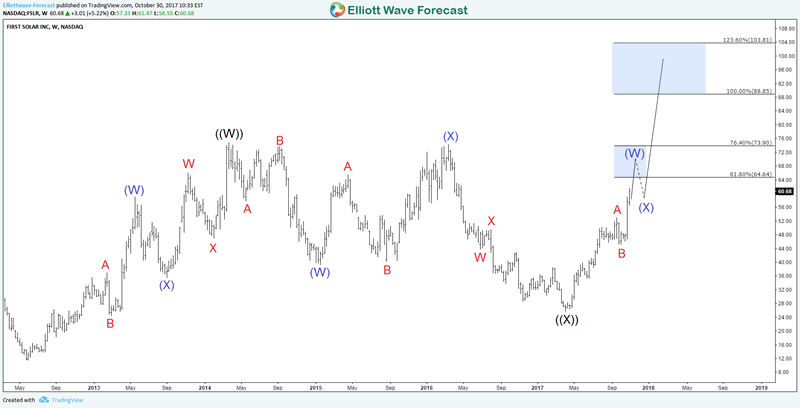

FSLR Elliot Wave Weekly Chart

Up from May 2012 low, FSLR rallied in a corrective 7 swing sequence which indicates the stock is still in a correction stage then it did another double three to the downside which ended on April of this year. Afterward, the stock started another rally which still needs to break above 2014 peak to target equal legs area $88 – $103 as a first step of a larger move.

In the short term, FSLR is looking to reach $69.1 – 72.5 area where a 3 waves pullback can take place before it can resume the move higher, consequently the stock should remain supported while holding above 45.26 low.

Recap

First Solar booked most of its production for the next two years, which gives it a tremendous amount of certainty and could present a good investment. Technically the stock is still recovering from the fall since 2008 peak but will it be a fast recovery or a slow sideways bounce? Only time will tell but the overall picture remain in favor of the Solor Energy sector and companies like First Solar or SunPower (NASDAQ:SPWR) are have more potential in the future.

If you’re interested in getting more insights about the Energy Sector then take this opportunity and try our services 14 days for Free to learn how to trade Stocks and ETFs using our blue boxes and the 3, 7 or 11 swings sequence. You will get access to our 26 instruments updated in 4 different time frames, Live Trading & Analysis Session done by our Expert Analysts every day, 24-hour chat room support and much more.

By Ayoub Ben Rejeb

https://elliottwave-forecast.com

ElliottWave-Forecast has built its reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 52 instruments including Forex majors & crosses, Commodities and a number of Equity Indices from around the World. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Elliott Wave Setup .

Copyright © 2017 ElliottWave-Forecast - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.