Donald Trump tells me our best days are ahead. Once his tax cut plan is passed...

Politics / US Politics Nov 06, 2017 - 02:43 PM GMTBy: James_Quinn

Donald Trump tells me our best days are ahead. Once his tax cut plan is passed, the future will be so bright I’ll have to wear shades.

Donald Trump tells me our best days are ahead. Once his tax cut plan is passed, the future will be so bright I’ll have to wear shades.

Sometimes a single chart reveals the truth being obscured by the Deep State propaganda machine, working overtime selling their economic recovery narrative. The economy most certainly is booming for Wall Streeters and D.C. parasites sucking on the teet of Federal government largess. But for the average working deplorable, this supposed recovery has passed them by.

The cognitive dissonance is strong, as average Americans want to believe what their “leaders” are telling them to believe, but their personal financial situation contradicts the narrative. Even using the highly manipulated data peddled by the BLS, any critical thinking individual can see through the lies, misinformation and bullshit.

Let’s examine what has happened since 2015 and assess the truthfulness of the purveyors of propaganda running the Deep State looting and pillaging operation.

- There are 5.7 million more Americans employed since the beginning of 2015, a pitiful 3.9% increase. Meanwhile, 2.7 million left the workforce because they supposedly don’t need a job to make a living.

- The amount of Federal individual income tax collected by the government only rose by 3% between 2015 and 2017. If the number of employed was up 3.9% and wages supposedly grew by 5%, how could the government’s take only go up 3%? Maybe it’s because the jobs “created” were low paying shit service jobs and part-time jobs.

- The average workweek is lower today than it was in 2015. Does this jive with 3% GDP growth? If the unemployment rate is really 4.1%, shouldn’t workers be putting in overtime and driving the weekly hours upward?

- Now for the best data point of them all – real wages. According to the captured government drones at the BLS, real wages are up a cumulative 1.5% over the last two years. The supposed non-existent inflation has reduced your real wage increases by 70%. And let’s remember the inflation numbers put out by the BLS have been massaged so hard to achieve a happy ending, the BLS drones could work here:

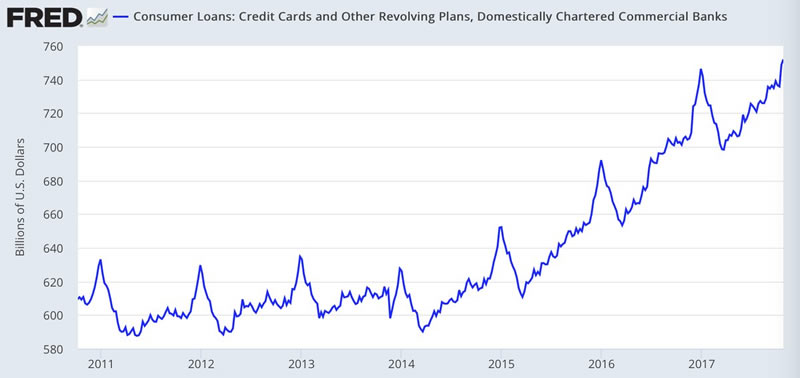

In reality, recognizing a true inflation rate of at least 5%, the average worker has seen their real wages decline by 5% over the last two years. This brings us back to the chart above. Credit card and other revolving debt has increased by 20% since the beginning of 2015. The Deep State narrative would describe this phenomena as a huge positive (more interest and fees for the criminal Wall Street cabal) because it proves average Americans are optimistic about the future. Consumer confidence has never been higher. Right?

When the huge acceleration in credit card debt is analyzed in conjunction with the stagnation of wages and household income since 2015, a truthful picture emerges. Average Americans are not leveraging themselves up to their eyeballs because they are ecstatic about their future prospects. They are charging basic living expenses, like real estate taxes, rent, tuition, medical costs, insurance premiums, food, utilities, and gasoline. They are attempting to maintain the lifestyles they’ve been told they should have by the Deep State propagandists and their Madison Avenue Bernaysians by going deeper into debt at the low low rate of 15% or more.

If the narrative of economic health was true Americans would be ramping up their discretionary spending at department stores, restaurants and retail outlets across our suburban sprawl countryside. Nothing could be further from the truth. Retail sales, other than the debt financed auto “rentals”, have been sucking wind for the last two years. Restaurant traffic has been negative for over a year. A record number of retail bankruptcies and store closures will occur in 2017, far more than during the depression year of 2009. Buzzards are circling above JC Penny and Sears as their carcasses will shortly inhabit the desert graveyard of failed retailers.

Things are not well in flyover America. They are not well in suburban America. They are not well in small town America. They are not well in most urban areas. The economic decline of the middle class is why Donald Trump got elected. The elite who inhabit NYC, D.C., Silicon Valley and Hollywood have been doing great, as the debt creation benefited them and their hangers-on. The greatest debt induced bubble in world history is now at its apex. The hubris of central bankers, corporate chieftains, corrupt politicians, and feckless media oligarchs has reached epic proportions. They do not believe there will be negative consequences from their reckless actions since 2008. They will be wrong.

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2017 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.