Invest In Gold To Defend Against Bail-ins

Commodities / Gold and Silver 2017 Nov 02, 2017 - 05:37 AM GMTBy: GoldCore

– Italy’s Veneto banking meltdown destroyed 200,000 savers and 40,000 businesses

– Italy’s Veneto banking meltdown destroyed 200,000 savers and 40,000 businesses

– EU bail-in rules have wiped out billions for savers and and businesses, with more at risk

– Bail-ins are not unique to Italy, all Western savers are at risk of seeing savings disappear

– Counterparty-free, physical gold bullion is best defence against bail-ins

One of Italy’s twenty regions is calling for more autonomy from the state following a nonbonding referendum. Why? Because a government supported ‘rescue package’ caused the lifesavings of 200,000 savers to be wiped out during the implosions of Popolare di Vicenza and Veneto Banca.

Since then the banks have been rescued in one way or another yet the impact of the collapse on individuals and small businesses is only just becoming clear.

As in Spain’s Catalonia the region of Veneto is wealthier than the average Italian region, with its own industries and language yet it has been left with a pile of ash when it comes to its banking sector.

The region is proud to be the home of successful brands such as Benetton, De’Longhi, Geox and Luxottica. But it is the 40,000 small businesses that are in a state of limbo unable to pay workers, find credit or operate on a day-to-day basis.

Sadly the case of Veneto is one of a growing list of regions of banking customers that have been destroyed due to the incompetence of national authorities and the overbearing powers of the EU.

Profitable businesses take the hit

What is seen is as surprising to many reading about the story of Veneto is that profitable, stable businesses are also suffering as a result of a banking collapse.

When someone’s savings are wiped out, that isn’t the end of the nightmare. Many businesses were exposed to those banks both through credit and shares.

Many businesses operate on credit. This happens in companies of all scales and levels of success. The businesses that borrowed from the two Veneto banks are now in a state of limbo. They have no line of credit due to their exposure to the collapsed banks.

This is despite a government-led body stepping into help manage the fallout and finances of the ruined institutions. Bloomberg explains:

Even a perfect credit score is useless in Veneto now if your only collateral is stock in either bank, which were coveted investments for generations of locals.

Bail-in of the first resort

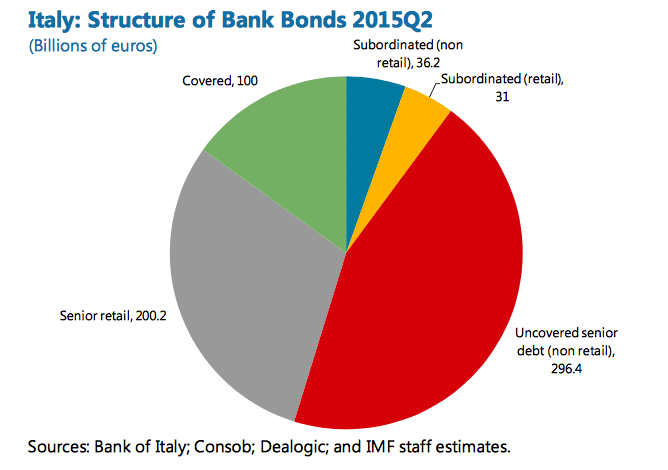

Italians are in very deep financially when it comes to their banking system. The 2015 IMF report states:

Retail holdings in Italy are relatively large compared to other countries, comprising about one- third of about €600 billion worth of bank bonds and half of about €60 billion worth of subordinated bonds.

That is all money that will just disappear overnight in the case of bank failure. In some cases, it already has.

In Italy a common problem has been that savers and businesses were persuaded to invest in subordinated (junior) bonds by their bank managers.

By 2015 over €31 billion of retail sub bonds had been sold to retail investors. Retail investors are ordinary savers and small businesses.

‘Households hold about one-third of senior bank debt and almost half of total subordinated bank debt.’ – IMF

These bondholders are seen as creditors. The same type of creditor that EU rules state must take responsibility for a bank’s financial failure, rather than the taxpayer. This is a bail-in scenario.

In a bail-in scenario the type of junior bonds held by the retail investors in the street is the first to take the hit. When the world’s oldest bank Monte dei Paschi di Siena collapsed ordinary people (who also happen to be taxpayers) owned €5 billion ($5.5 billion) of subordinated debt. It vanished.

A 2015 IMF study found that the majority of Italy’s 15 largest banks a bank rescue would ‘imply bail-in of retail investors of subordinated debt’. Only two-thirds of potential bail-ins would affect senior bond-holders.

Nothing will respect you like gold does

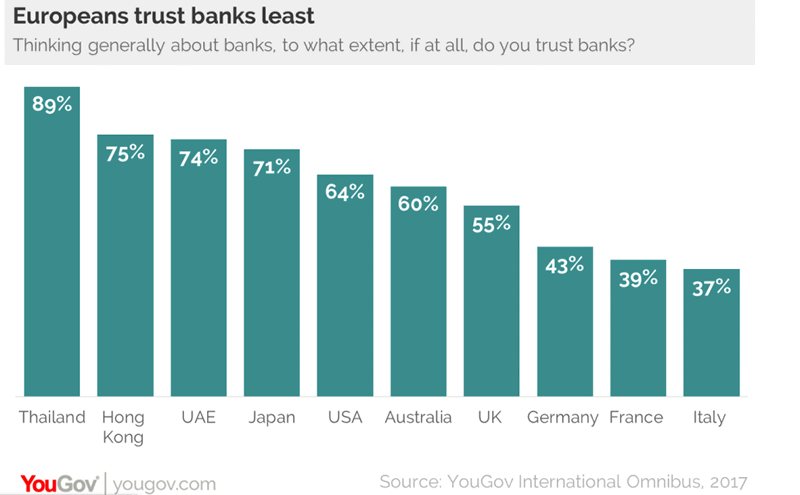

Why put so much faith in the bank? Because, despite many financial crises in the last 100 years, savers and businesses still believe their money will be safe.

The graph above shows just how much we still trust our banks. The least trusting country is Italy yet their exposure has been so great, imagine what damage will be done when the likes of the UK, US or Germany face a bail-in situation.

In Italy where banks have been around for literally hundreds of years, many family business owners are still dealing with bank accounts, investments and loans their ancestors organised a century ago.

This kind of relationship can lead to an almost Stockholm Syndrome situation. Despite receiving consistency bad treatment from your bank you want to support it and help it out. You still trust it. So when the bank suggests you hold shares then you take their advice.

“We jealously guarded those shares like you would gold bars,” A 60 year old baker told Bloomberg, “Buying your bank’s stock was the traditional thing to do. We got it badly wrong.”

Of course what everyone forgets is that banks are not there to look after you. They are there to make money. They do this almost instantly the second you deposit funds, it’s their money. The second you take out a loan, they own you. The second you buy shares, they have a license to be reckless.

Naively treating anything other than gold like gold is the first step in financial mismanagement. Nothing is like physical, allocated and segregated gold. For a start it is all yours.

Is your government or the EU there for you? Don’t bet on it

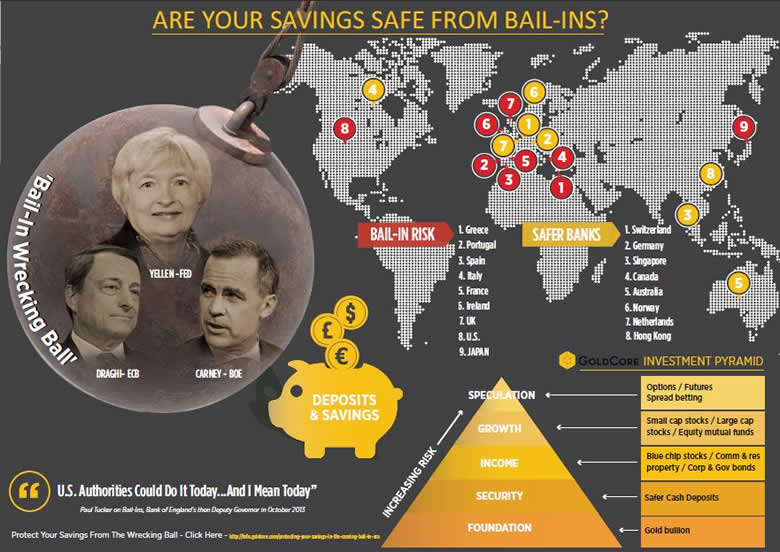

A bail-in forces creditors of a bank to shoulder losses when the firm fails. The term covers cover every case of creditor loss-sharing when a bank goes belly-up.

This is different to events we saw during the 2008 financial crisis when taxpayers tended to bail-out banks. Since 2016 European Union rules have stated there must be a bail-in before a government bailout is allowed.

Governments would clearly like to prevent savings of hardworking individuals and businesses from being wiped out. However they are fearful of the EU, trying to skirt their bail-in rules would no doubt sour relations with a body that is keen to stick to rules it only recently passed.

There is a conflict of interest it seems between pleasing the EU and doing the right thing by voters.

Given Brexit and now Catalonia the EU is unlikely to be in the mood to bend its rules for another troublesome country. This is despite it costing the EU’s own citizens billions of euros in lost savings and investments.

This is a risk for the EU, especially in Italy where there is already strong anti-EU sentiment. The case of Veneto, where 75% require more power and 15% would like to see total autonomous rule is another Catalonia again. A further sign of increased populism thanks to an overbearing and indifferent EU.

Invest in gold, or prepare to fail

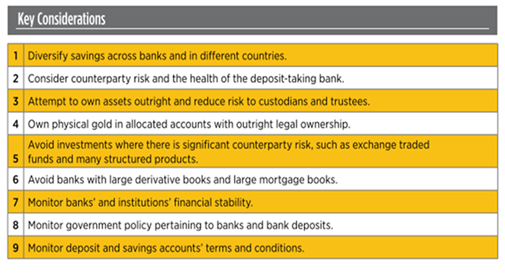

Depositors and investors should be aware of their country’s requirements when it comes to keeping their money safe in the banks. Whilst bail-ins will at present only hurt those who hold deposits above EUR 100,000, there is little stopping the protected amount being decreased, or ignored altogether.

For those living in the EU, the European Commission has forced all 28 countries to implement bail-in legislation. This means depositors must be more vigilant than ever about the health of a particular bank, and the risk exposure of their portfolio. This means diversifying your invesments and decreasing the level of counterparty exposure.

One area of portfolio diversification that is growing due to concerns over the safety of bank accounts, is gold investment which saw a 15% climb in Q2 of 2016. Europe, in 2015, showed the largest regional demand for gold bars and coins (an increase of 12% year on year).

Unallocated gold is as much at risk as any other asset exposed to counterparties. Savers and businesses can protect their wealth by investing in allocated gold, in segregated accounts. This gives your outright legal ownership. There are no counterparties who can pop along after going bust and take what is legally theirs. It cannot be made to disappear overnight.

Gold is the financial insurance against bail-ins, political mismanagement and overreaching government bodies.

Gold Prices (LBMA AM)

01 Nov: USD 1,279.25, GBP 961.48 & EUR 1,099.52 per ounce

31 Oct: USD 1,274.40, GBP 964.21 & EUR 1,095.60 per ounce

30 Oct: USD 1,272.75, GBP 966.91 & EUR 1,093.80 per ounce

27 Oct: USD 1,267.80, GBP 968.35 & EUR 1,090.18 per ounce

26 Oct: USD 1,278.00, GBP 968.34 & EUR 1,082.34 per ounce

25 Oct: USD 1,273.00, GBP 964.81 & EUR 1,081.67 per ounce

Silver Prices (LBMA)

01 Nov: USD 16.94, GBP 12.74 & EUR 14.55 per ounce

31 Oct: USD 16.82, GBP 12.72 & EUR 14.45 per ounce

30 Oct: USD 16.74, GBP 12.69 & EUR 14.39 per ounce

27 Oct: USD 16.72, GBP 12.76 & EUR 14.38 per ounce

26 Oct: USD 16.97, GBP 12.84 & EUR 14.37 per ounce

25 Oct: USD 16.89, GBP 12.75 & EUR 14.34 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.