Stock Investors Ignore What May Be The Biggest Policy Error In History

Stock-Markets / Stock Market 2017 Oct 20, 2017 - 04:57 PM GMTBy: John_Mauldin

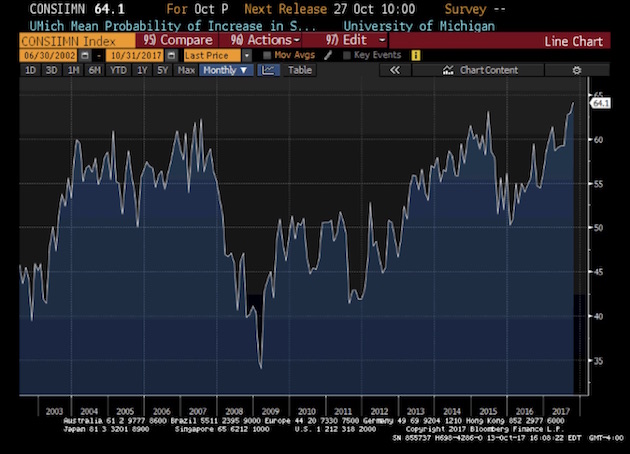

My good friend Peter Boockvar recently shared a chart with me.

My good friend Peter Boockvar recently shared a chart with me.

The University of Michigan’s Surveys of Consumers have been tracking consumers and their expectations about the direction of the stock market over the next year.

We are now at an all-time high in the expectation that the stock market will go up.

The Market Ignores Monetary Uncertainty

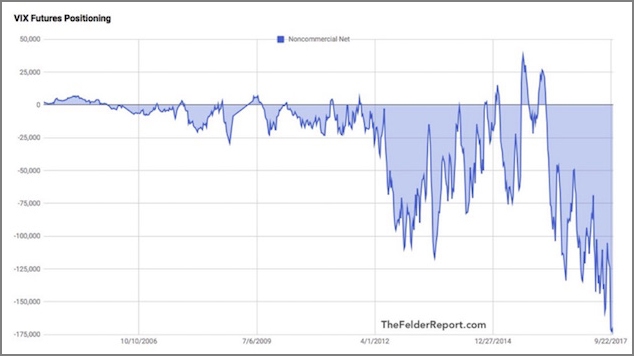

It is simply mind-boggling to couple that chart with the chart of the VIX shorts (I wrote about the VIX craze in this this issue of Thoughts from the Frontline).

Peter writes:

Bullish stock market sentiment has gotten extreme again, according to Investors Intelligence. Bulls rose 2.9 pts to 60.4 after being below 50 one month ago. Bears sunk to just 15.1 from 17 last week. That’s the least amount since May 2015. The spread between the two is the most since March, and II said, “The bull count reenters the ‘danger zone’ at 60% and higher. That calls for defensive measures.” What we’ve seen this year the last few times bulls got to 60+ was a period of stall and consolidation. When the bull/bear spread last peaked in March, stocks chopped around for 2 months. Stocks then resumed its rally when bulls got back around 50. Expect another repeat.

Only a few weeks ago the CNN Fear & Greed Index topped out at 98. It has since retreated from such extreme greed levels to merely high measures of greed. Understand, the CNN index is not a sentiment index; it uses seven market indicators that show how investors are actually investing. I actually find it quite useful to look at every now and then.

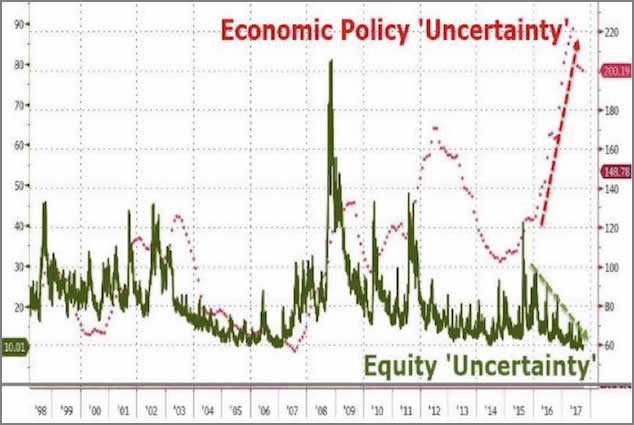

The chart below, which Doug Kass found on Zero Hedge, pretty much says it all. Economic policy uncertainty is at an all-time high, yet uncertainty about the future of the markets is at an all-time low.

Why This Is Happening Now

At the end of his email blitz, which had loaded me up on data, Dougie sent me this summary:

At the root of my concern is that the Bull Market in Complacency has been stimulated by:

* the excess liquidity provided by the world’s central bankers,

* serving up a virtuous cycle of fund inflows into ever more popular ETFs (passive investors) that buy not when stocks are cheap but when inflows are readily flowing,

* the dominance of risk parity and volatility trending, who worship at the altar of price momentum brought on by those ETFs (and are also agnostic to “value,” balance sheets,” income statements),

* the reduced role of active investors like hedge funds – the slack is picked up by ETFs and Quant strategies,

* creating an almost systemic "buy the dip" mentality and conditioning.

when coupled with precarious positioning by speculators and market participants:

* who have profited from shorting volatility and have gotten so one-sided (by shorting VIX and VXX futures) that any quick market sell off will likely be exacerbated, much like portfolio insurance’s role in a previous large drawdown,

* which in turn will force leveraged risk parity portfolios to de-risk (and reducing the chance of fast turn back up in the markets),

* and could lead to an end of the virtuous cycle – if ETFs start to sell, who is left to buy?

On the Brink of the Largest Policy Error

The chart above, which shows the growing uncertainty over the future direction of monetary policy, is both terrifying and enlightening. The Federal Reserve, and indeed the ECB and the Bank of Japan, went to great lengths to assure us that the massive amounts of QE that they pushed into the market would help turn the markets and the economy around.

Now they are telling us that as they take that money back off the table, they will have no effect on the markets. And all the data that I just presented above tells us that investors are simply shrugging their shoulders at what is roughly called “quantitative tightening,” or QT.

I simply don't buy the notion that QE could have had such an effect on the markets and housing prices while QT will have no impact at all.

In the 1930s, the Federal Reserve grew its balance sheet significantly. Then they simply left it alone, the economy grew, and the balance sheet became a nonfactor in the following decades.

I don’t know why today’s Fed couldn’t do the same thing.

There really is no inflation to speak of, except asset price inflation, and nobody really worries about that. We all want our stocks and home prices to go up, so there’s no real reason for the central bank to lean against inflationary fears; and raising rates and doing QT at the same time seems to me to be taking a little more risk than necessary.

And they’re doing it in the midst of the greatest bull market in complacency to emerge in my lifetime.

Do they think that taking literally trillions of dollars off their balance sheet over the next few years is not going to have a reverse effect on asset prices? Or at least some effect? Is it really worth the risk?

Remember the TV show Hill Street Blues? Sergeant Phil Esterhaus would end his daily briefing, as he sent the policemen out on their patrols, with the words, “Let’s be careful out there.”

Get one of the world’s most widely read investment newsletters… free

Sharp macroeconomic analysis, big market calls, and shrewd predictions are all in a week’s work for visionary thinker and acclaimed financial expert John Mauldin. Since 2001, investors have turned to his Thoughts from the Frontline to be informed about what’s really going on in the economy. Join hundreds of thousands of readers, and get it free in your inbox every week.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.