Stock Market Super Cycle Wave C May Have Started

Stock-Markets / Stock Market 2017 Oct 19, 2017 - 02:27 PM GMT Good Morning!

Good Morning!

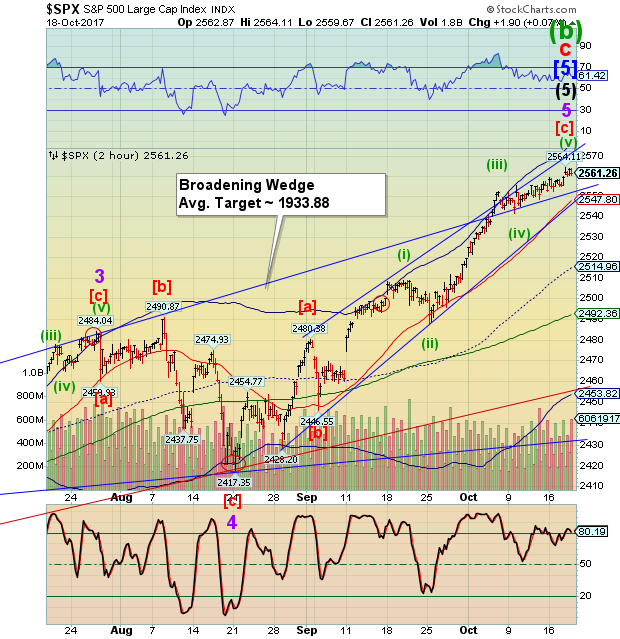

SPX futures are starting the morning off with a bang as they decline beneath the smaller Ending Diagonal trendline and Short-term support at 2547.80. There appears to be a bounce as the algos kick in to save the day. However, the damage in Asia and Europe has been done and it appears that there may not be a recovery. The DJIA has already dipped beneath 23000.00 this morning, but appears to have bounced back above that level.

ZeroHedge reports, “Has the market's "melt-up" levitation finally ended? Of course, it could be much worse: as Bloomberg's Paul Jarvis recalls, thirty years ago on this day traders around the globe were staring at their screens in disbelief as stock markets turned to a sea of red: the Dow, S&P 500, FTSE, DAX and CAC fell -23%, -20%, -10%, -9% and -10% respectively. “

NDX futures have tested Short-term support at 6058.99 this morning and have bounced in early morning trading. While the decline is impressive, the NDX still needs to decline beneath the trendline and Wave (iv) low near 6030.00 to have a decent sell signal.

Recently I have noticed that the lesser indexes, such as the NDX, the RUT and TRAN have all “taken turns” at their morning ramps. I believe that the reason for this is the thin liquidity at this level. Now that the entire market is selling off, the central banks may not be able to plug all the holes in the dike. Interesting thought…

VIX futures have surged past the 50-day Moving Average at 10.76 to put it on a buy signal (SPX sell). This morning’s high was 11.77, just beneath Cycle Top resistance. If it manages to blow through that level, it may be “blue sky” for the VIX. On the other hand, containment at the Cycle Top may mean a revisit to test the 50-day Moving Average.

I will be watching the open of the NYSE Hi-Lo Index to see if it confirms the VIX by declining beneath the lower trendline at 20.00. A decline beneath that level may indicate sell signal regardless if it levitates later in the day.

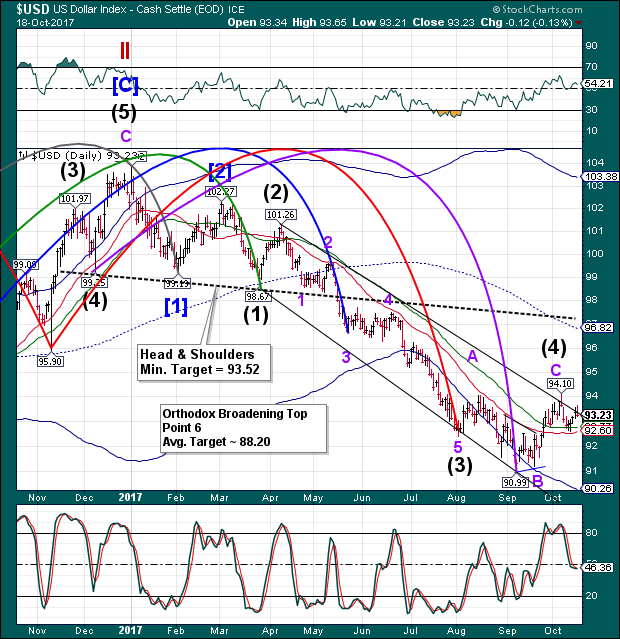

USD futures declined to 93.03 this morning as I had warned yesterday. The dollar has a date with destiny by the end of next week, since it has a double Primary Cycle and a Master Cycle low coming due at the same time.

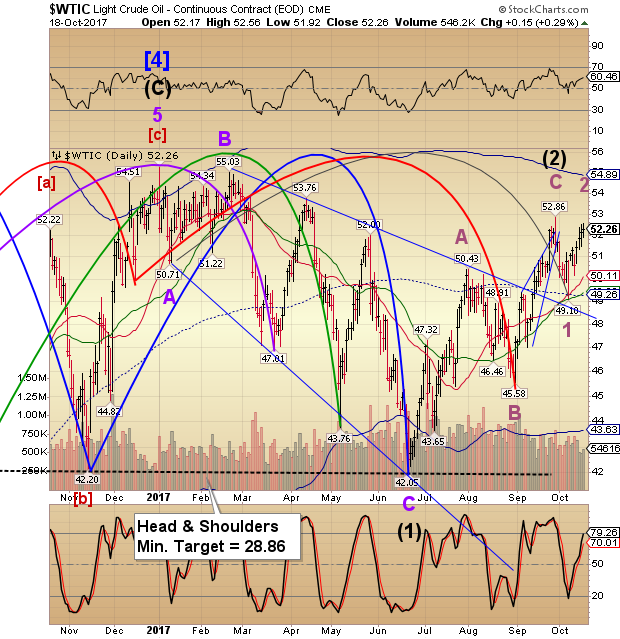

Crude Oil futures may have begun their decline as they hit a morning low of 51.17. The Elliott Wave structure supports an aggressive short entry, though confirmation won’t come until supports at 50.11 and 49.26 are crossed.

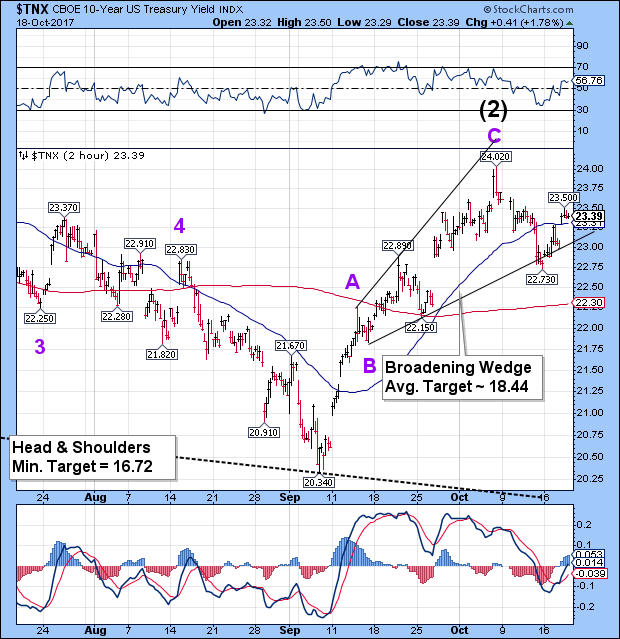

TNX futures appear to have bounced off the lower trendline of the Broadening Wedge at 23.12 this morning. The trendline is your confirmed sell signal for TNX and a buy signal for USB (TLT).

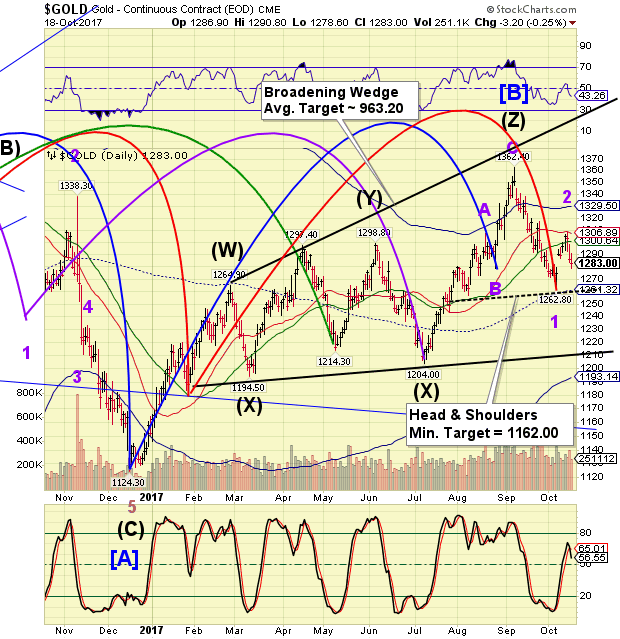

Gold futures have bounced as indicated. However, I warned last night that the is no indication of strength in the Cycles Model. Thus far it has advanced to 1290.20, which is a 44% retracement. A sell-off beneath 1278.60 would offer an aggressive sell signal that would be confirmed beneath the neckline at 1261.32.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.