Getting Your Feet Wet In Crypto Currencies

InvestorEducation / BlockChain Oct 19, 2017 - 11:38 AM GMTBy: Avi_Gilburt

By Avi Gilburt with Ryan Wilday

By Avi Gilburt with Ryan Wilday

Introduction

I want to begin this new series on crypto-currency by introducing my co-author, Ryan Wilday.

In 2012, with twelve years of trading behind him, Ryan had no interest in, or knowledge of, crypto currency. However, a chat with a programmer friend about Bitcoin peaked his curiosity. He then dug up a chart and, despite all his years of experience trading, he couldn’t make sense of its sudden spikes and deep drops.

Since his initial introduction into crypto-currencies, much has changed in Ryan’s life. Today, he is currently leading the newly created Crypto Currency Service at Elliott Wave Trader (EWT). And, every week, he is meeting new people online and in person, introducing them to the concepts surrounding cryptos, and how to trade them.

So, Ryan and I are going to collaborate on a series of articles to guide you on how you can get involved in this market for the first time. We will outline how to trade this asset class, and we will also provide our opinion as to whether we have a bubble ready to pop. In later articles, we will focus on a few of the large cap coins and where we see them going, through the Elliott Wave lens.

But, first, how does one start?

Not all about Bitcoin

By now, many people know Bitcoin is not the only cryptocurrency. Ethereum, Litecoin, Ripple are a few of the other large ones. In fact, the site coinmarketcap.com tracks over 1100 crypto coins. Yet, few know that bitcoin or any crypto currency is not the real innovation. It is Blockchain technology which is the true breakthrough. Although Blockchain is a challenging concept to understand, it is probably the biggest innovation in the internet since the URL.

Here’s an analogy. Imagine you are collaborating on a Google Spreadsheet with a large team. Imagine, as many have experienced, one of your teammates is making errors that you need to fix constantly. You might even have a stubborn team member changing things against the team's will. Unless you cut that member off from editing the document, errors will continue to be made. Or, perhaps something happens to the document and a copy disappears from the cloud.

Blockchain, also called distributed ledger, is much like a spreadsheet in the cloud, with a few differences that prevent these sorts of problems.

First, inputs are the only options. Deletions are not possible. In the case of Bitcoin, the input happens via sending bitcoin. An address where the bitcoin is sent from, the receiving address, plus the amount of the transaction is what is registered within the single transaction. Once placed on the ledger, it cannot be removed and is protected by cryptography. Cryptography also prevents anyone but the holder of the sending address to input the transaction. And, only the receiver can now reverse the transaction via sending them back with a new transaction.

Furthermore, if any copy of the ledger, which is not centralized across the web, is corrupted, the other copies fix the errors. This creates a very secure basis for transactions in a currency. The transactions are secure and immutable. Further, they are decentralized. And, bringing it back to our original analogy, Google Docs is not decentralized, as it resides on Google's server.

Decentralization means that someone doesn't need to hold an account anywhere. One only needs a copy of the private keys for their address to open up a bitcoin file (called a wallet) on any machine anywhere in the world. Their balance is then available to them. This also means that one's balance is not controlled by a company or bank, unless, of course, you hold your bitcoin at a business or exchange, which is what most do when trading.

Crypto currency is the first use case for Blockchain, but these secure, decentralized, and incorruptible ledgers are being explored for many more use cases in the future, both in open source blockchains on the web, and inside companies across the globe.

But how does one get started trading this new asset class?

Getting Started

The first step in getting started is signing up on an exchange which will transfer your fiat currency for crypto-currency. Not all exchanges interact with the banking system, but we use three in the US that do: Kraken.com, Gemini.com, and Coinbase.com. Coinbase and Gemini will make EFT transfers, Kraken and Gemini take wires, and Coinbase will also take a credit card.

Once you have signed up on an exchange, and purchased your coins, you can manipulate them in many different ways. You can move them to different addresses on another exchange, you can move them to an address that resides on a ‘wallet’ on your computer, or you can even use them to make purchases.

Learning to send coins gives you the freedom to use them in a myriad of ways, including trading.

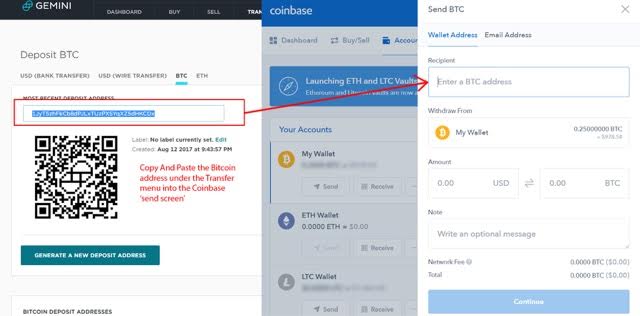

To move your assets, you need to find the receiving address from the account you want to send to and copy and paste it into the send screen where you have the coins. Below is an example for sending coins from Coinbase to trade on Gemini.

Figure: Finding the receiving address in Gemini copied into Coinbase.

To trade the coins, you need to go to an exchange that trade crypto pairs. And, this part should be more familiar to most. The exchanges based in the US that we have used are Bittrex, Kraken, Gemini, Poloniex, and Coinbase’s GDAX.

Giving a review of each of the exchanges is beyond the purview of this article. I encourage you to read plenty of reviews of the pros and cons of each of the exchanges, and then opening a few accounts to test them for yourself. Cryptocompare and Reddit are some of the sources for reliable reviews. Also note that some states, like NY, WA, and HI, have restrictions on which exchanges you can use.

Trading

Trading is not dissimilar to FOREX trading. You’ll realize quickly that all the symbols are pairs. BTCUSD and BTCEUR are an example of Bitcoin priced in US dollars and the Euro respectively. Another common example is ETHBTC, which is Ether traded in bitcoin.

Buying the ETHBTC pair means you are buying Ether and must have sufficient Bitcoin to make the trade. Unlike Forex, these trades are not on margin, unless you are approved for a margin account, and, even then, you need to specify your use of margin for a specific trade.

While you might think that buying Bitcoin (BTC) at its current price over $4000 is too rich for your blood, the beauty of this market is its cost of entry. You see, you can buy BTC in fractional increments, perhaps buying $10 or $20’s of bitcoin at a time. And, commission on most exchanges is a set fraction of the transaction, regardless of size. So, you can skip your morning cappuccino and, instead, use the money to buy crypto. This is the same with all cryptos, but the minimum size of the fractional purchases depends on the asset and the exchange.

Conclusion

In conclusion, getting involved in the crypto market is not hard, and doesn’t require much tech knowledge. But it is a new use case and requires setting up new accounts for exchanging, trading, and sending crypto currency assets. Despite the new behaviors, it is a market with an extremely low cost of entry so one need not accept much risk to transact within this market.

Next Article: Characterizing the Crypto Trading

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of ElliottWaveTrader.net (www.elliottwavetrader.net), a live Trading Room featuring his intraday market analysis (including emini S&P 500, metals, oil, USD & VXX), interactive member-analyst forum, and detailed library of Elliott Wave education.

© 2017 Copyright Avi Gilburt - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.