Stock Market Lindsay 12 Year Interval

Stock-Markets / Stock Market 2017 Oct 17, 2017 - 02:10 PM GMTBy: Ed_Carlson

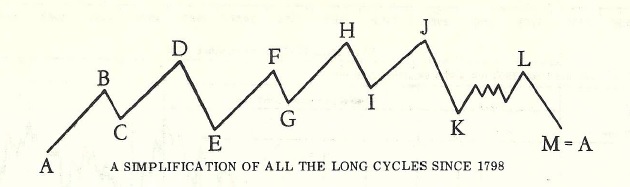

The failure of the 15-year interval high (counted from the 9/21/01 low) to appear on time does not mean the bulls are out of the woods yet. A 12-year interval is sufficient to pull the Dow down into its forecast low without the help of a 15-year interval. A 12-year interval forecasts a low in a time period extending from 12yrs, 2mo to 12yrs, 8mo. from a significant high. The 12-year interval counted from point B of the long cycle on 3/7/05 is active until approximately 11/7/17.

Once the correction is complete we expect the Dow to move to new highs and finish the secular bull market at point J in the period stretching from Dec’17 to Sept’18. We will narrow that forecast down considerably with the use of the standard time spans and counts from the middle section.

Try a "sneak-peek " this month at Seattle Technical Advisors.com

Ed Carlson, author of George Lindsay and the Art of Technical Analysis, and his new book, George Lindsay's An Aid to Timing is an independent trader, consultant, and Chartered Market Technician (CMT) based in Seattle. Carlson manages the website Seattle Technical Advisors.com, where he publishes daily and weekly commentary. He spent twenty years as a stockbroker and holds an M.B.A. from Wichita State University.

© 2017 Copyright Ed Carlson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.