Stock Market Crashes; the Greater the Deviation, the Better the Opportunity

Stock-Markets / Stock Market 2017 Oct 14, 2017 - 02:29 PM GMTBy: Sol_Palha

Ability is a poor man's wealth.M. Wren

Ability is a poor man's wealth.M. Wren

The reaction when the market starts to correct is the same; run for the hills, the world is ending or some variation of that theme. However, if you spend a little time on looking at the history of the markets; one thing becomes clear. Those that panic gets hammered and those that remain calm walk away with the spoils.

One way to visually see the “deviation factor” is through the use of standard deviation bands. Many software programs on the market will automatically fill in the Standard Deviation (SD) bands; Ideally, the setting should be set at 3SD from the norm, but settings of 2SD will suffice if you are unable to alter the settings manually. When the markets touch these ranges, and the trend is up, then backing up the truck is the thing to do.

Big Charts does not allow you to change the settings, they are fixed at 2SD, but there are sites out there that will let you adjust the settings. Despite this limitation, one can immediately spot two great opportunities; 2003 and 2009, clearly illustrating that fear never pays. As long as Fiat is in play, the Fed will attempt to reflate the economy. Naysayer after naysayer has stated that one day the masses will wake up, well they are still waiting for that day. Most don’t even know what Fiat stands for, and even fewer are willing to give it up. There is a saying don’t fight the Fed, and so far that saying has held true.

Strong corrections falling in the 2SD ranges and beyond should be embraced. From a long-term perspective, every back-breaking correction or crash has proven to be a buying opportunity. Knowing the trend does help and we put that to maximum usage; it's for this reason we have adamantly stated that the Bull Market the bears were calling an end for would not end shortly. Several years later, and the Bull as we foretold remains strong; the bull market will end but not before the crowd embraces it like a long lost love

Stock market crashes should be viewed through a bullish lens,

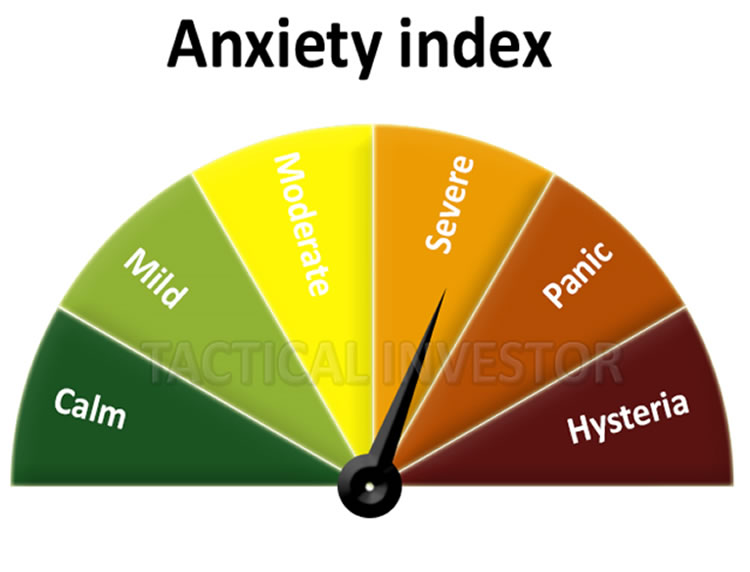

But how do you get out of the market at the right time, First of all, forget about trying to time the exact top, instead focus on the emotion? When the crowd turns euphoric, it is time to take money of the table and or tighten your stops. As you can see from the latest reading below the crowd is still antsy.

This is an old bull market, and it continues to trend higher because the crowd is still nervous and the most individuals think this market cannot and should not trend higher; that is why it probably will continue to trend higher. For almost several years on end we have been stating that this bull market would trend higher than the most ardent of bull’s expectations and so far that’s exactly what this bull market has done.

History never changes; the markets will experience one very strong correction before this bull keels over. The problem is that the masses have been waiting for a strong correction since roughly 2013. The ironical part is that the markets will pull back strongly, but most likely they will be trading at a higher level than they were at 2013. In 2013 the Dow was trading in the 12,800-13,000 ranges. While it is possible that the Dow could drop to this level, it is a low probability event as the masses are far from Euphoric at the moment. Most likely the Dow will shed 25%-30% from its highs. Assume the Dow trades to 22K; at the extreme end, the Dow could drop to the 15,600 ranges. Market Update June 18, 2017

Until the trend turns negative, we can only make educated guesses regarding the intensity of the next correction. As Fiat money rules the world, even more, money will be poured into the next created financial disaster, which will eventually push the market to new all-time highs. Until the people reject Fiat, the Fed will continue to create boom and bust cycles purposely; that is their primary agenda. Examine the history of the Fed, and you will see that they have gone out of their way to create these cycles. Volatility is a trader's best friend and the higher the market trends, the more volatile the ride. As the volume of the money supply increases so will the volatility.

Ability will never catch up with the demand for it.

Malcolm S. Forbes

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2017 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.