Credit Crisis Pushing World Economy Into a Soft Depression

Economics / Credit Crisis 2008 Aug 31, 2008 - 02:32 AM GMTBy: John_Mauldin

It's All About the Spread

It's All About the Spread- The Coming Bank Credit Crunch

- More Thoughts on Fannie and Freddie

- Who Is Holding the Old Maid?

When is the credit crisis going to end? How will we know? The credit crisis is getting ready to enter its second phase. This week we examine what that means, and what the economic environment will look like over the coming quarters. We also (sadly) re-visit Freddie and Fannie and examine the risks that they put into the markets.

Risks, by the way, that were sanctioned by regulators and encouraged by a Congress that took in hundreds of millions in campaign contributions and lobbying fees. We (the US taxpayer) have taken on a huge risk and potential loss for that paltry few hundred million. Sadly, those who encouraged that risk will by and large be voted back into office rather than ridden out of town on a rail (an old US custom, rather barbaric, but one which should maybe be revived for this purpose). It should make for an interesting letter as we count down the last days of summer.

But first, last winter I mentioned that I am looking for private equity and venture capital funds and investment professionals who specialize in those deals, and asked those who would be interested in looking at the potential deals I see from time to time to write me. I had a nice response, but my filing system is somehow inadequate to the task and I seemed to have misplaced about half the respondees. If you have not heard from me lately and would like to be "at the table," just drop me a note at this email address. And now, let's jump into the letter.

It's All About the Spreads

Credit spreads have been increasing and getting ever more volatile. We are going to look at them in detail this week, as one of the signs that the credit crisis is waning will be when spreads start behaving more normally.

Briefly, when we talk about credit spreads we are generally talking about the difference between a benchmark cost of a bond or index and the higher cost for another unrelated loan or bond. As an example, as of Wednesday, a high-grade corporate bond yielded 3.15% more than US Treasury bonds, based on a Merrill Lynch index. Very roughly speaking, in finance terms that means a typical corporation paid 315 basis points more than a similar longer-dated US Treasury. Thus we talk about the spread being 315 basis points or bps. (A basis point is 1/100 of a percent, which means that there are 100 basis points for each 1% difference in interest rates.)

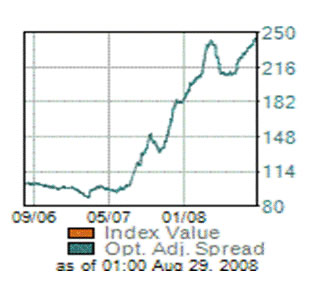

To see how much credit spreads have moved over the past year, let's look at a few charts (I apologize for some of the fuzziness, but I had to resize them). The data is from www.investinginbonds.com . First, let's look at the cost for a typical US financial firm. The cost has gone from 70 bps to 390 bps! That is over a 500% move - a big hit to margins and profitability.

Merrill Lynch US Financials Index

And it can get much worse for some banks. In the "for what it's worth" department, Iraq's bonds are now considered safer than those of many US banks. The country's $2.7 billion of 5.8% bonds due 2028 have gained 45% since August 2007, according to Merrill Lynch & Co. indexes. Investors demand 4.84 percentage points more in yield to own the debt instead of Treasuries, down from 7.26 percentage points a year ago. The spread is narrower than for notes of Ohio banks National City Corp. and KeyCorp, suggesting Baghdad may be safer for bond investors than Cleveland. National City and KeyCorp, based in Cleveland, have debt ratings of A and spreads of 959 basis points (9.59%) and 7.55 basis points (7.55%), respectively. Iraq debt has no ratings. Clearly the market is ignoring the rating agencies which give the banks an "A" rating. Their debt is priced at the junk level. Go figure. (Source: Bloomberg)

Utilities, which you would think would be somewhat immune to the economic crisis and the recession, have seen their borrowing costs rise by almost 300%.

Merrill Lynch US Utilities Index

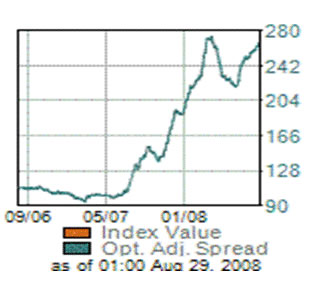

Your basic investment-grade corporate bond has risen threefold, from just over 90 bps to almost 280 bps. Again, that puts a real squeeze on profits.

Merrill Lynch US Industrials Index

That's the short-term view. Now, let's drop back and look at what has happened since 1997. Credit spreads are now much higher than even in the worst of the last recession. (Source: Bespoke)

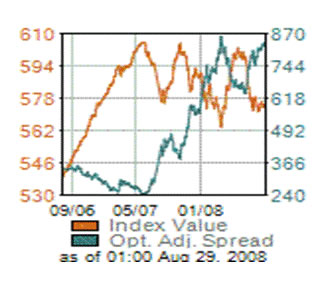

And if you have to go into the high-yield market, which is now once again referred to as the junk bond market, you have really been hit. Your spreads, on average, have risen from 240 bps to over 860 bps in the last year. That means IF (and that is a Big IF) you can find someone to loan you money, you will likely be paying an interest rate close to 13% for your money. (The spread is the green line in the chart below.)

Merrill Lynch US High Yield Index

One last chart. This one is the spread between LIBOR and the Fed funds rate. LIBOR is the London Inter Bank Offer Rate. This is what banks charge each other to lend money among themselves. (This chart courtesy of my friends at GaveKal.) Notice the spikes since 1988: the recession of 1991, the 1998 Long Term Capital Management crisis, and then the lead-up to Y2K. After that, LIBOR went flat.

LIBOR may be the most important rate of all, as so many contracts, including many US and European mortgages, are based on LIBOR. Hedge funds, mortgage banks, large and small corporations, and a host of interest-rate-sensitive investments borrow money based on LIBOR. Few of them anticipated such wild swings.

Bottom line? One of the clues as to the end of the credit crisis will be when credit spreads move back closer to historical norms. And we are not close to that yet.

The Coming Bank Credit Crunch

Banks in the US are going to need to roll over almost $800 billion dollars in medium-term debt in the next 16 months. Banks borrowed heavily in 2006, a lot of it in 2-3 year floating-rate notes, and now they must refinance those notes. Say a bank borrowed at LIBOR plus 50bps. In today's environment, many banks are not going to be able to borrow at such low rates. Remember the two Ohio banks mentioned earlier? These regional banks will have to pay spreads of 7-9%, based on the price of their debt today. If you have to pay 12% to borrow money when prime is at 5% and you are lending at 6-8%, you clearly cannot make a profit. That means they will have to sell assets or raise very expensive equity capital.

There are a lot of small and regional banks that are in trouble. The FDIC has a list of 117. Out of (I think) 8500 banks that does not sound bad. But remember, Indy Mac, which failed a few months ago, was not on that list. Banks can get into trouble rather quickly if they cannot raise capital, sell assets, or borrow money due to perceived distress.

The problem is that these banks will have less money to lend and will be calling loans from otherwise good customers, which of course makes the economic situation even worse. It is a vicious cycle.

Even many mainstream economists are now suggesting we will be in a recession by the 4th quarter, if we are not in one now. (The 2nd quarter revised GDP was 3.3%. This is an anomaly, and is highly unlikely to be repeated.) The recovery, when it comes, will be tepid until credit spreads signal an end to the credit crisis. It is going to be Muddle Through for 2009. This is NOT going to be good for the stock market. When will it be safe to get back into the water? Pay attention to credit spreads.

One other thing to watch. When the Fed feels it is no longer necessary to offer "temporary" Term Auction Facilities (loans) to commercial and investment banks, that will be a significant event. Notice that these were to be temporary. These auctions will last well into 2009 and maybe longer.

More Thoughts on Fannie and Freddie

First, let me correct an error. It was not JP Morgan that Treasury Secretary Hank Paulson asked to come up with a plan to fix Fannie and Freddie. It was Morgan Stanley. Sorry.

Warren Buffett has stated that Freddie and Fannie are toast, as have many establishment analysts. Buffett told CNBC that the firms had no net worth and would need tens of billions of capital to shore up their balance sheets. Since their combined capitalization is less than $6 billion, it is unlikely that there is any way they could get even a sovereign wealth fund to come to their aid in the form of stock.

Congressional oversight committees estimate losses for Fannie and Freddie to be $25 billion, given current housing values. As home values drop, those estimates keep going up. Also, as the economy gets worse, those losses will increase. Independent estimates are double that or more. If only that were the extent of the problem.

There is $36 billion in preferred shares as of June 2007. Then there is $19 billion in subordinated debt. These firms back $5.2 trillion in mortgage securities. As an aside, that means even a 1% loss from foreclosures would mean a $50 billion portfolio loss. Care to make an over/under wager on a 1% loss by this time next year? I don't think I would want the under.

Gretchen Morgenstern reported last week that there are - drum roll - $62 trillion (with a "T") in credit default swaps written against Fannie and Freddie debt, or somewhere near 12 times the actual debt. Even if you cut this in half - because technically, when a buyer and a seller enter into a single transaction they create twice the value of the transaction in credit derivatives - this is a huge sum, far out of proportion to the underlying assets.More on this later.

The team at Morgan Stanley has a very interesting problem to solve. It is not just about putting $25 to $50 billion into Fannie and Freddie (assuming that would be enough). If that's all it was, just issue preferred shares, wipe out the current shareholders and, as the smoke cleared in a few years, even with less leverage the actual value of the two companies might actually approach that number and some private equity firms could take out the US taxpayer. But it is not that simple.

What do you do with the current preferred shares? A significant portion is held by banks in their capital base. JP Morgan Chase just wrote down $600 million in Fannie and Freddie preferred shares this week. Many other banks will be doing so as well. As noted last week, there are banks that have more than 20% of their capital base in these shares. In today's current environment, do we want to deal with the costs to the FDIC of even more failed banks? And even if you don't force a bank into outright failure, you at best limit its ability to function as an efficient market lending agency to local businesses and consumers.

But you can't just say, "We will cover the preferred shares in banks but not in personal accounts or in the accounts of other institutions." It is an all or nothing proposition. A $36 billion proposition. It is a potential Hobson's choice. Wipe out the preferreds or wipe out the shareholders of a lot of banks and have the FDIC pick up the costs. By the way, Congress and bank regulators encouraged banks to buy preferred shares by giving them special status and tax breaks.

But what about the $19 billion subordinated debt? That $19 billion is actually on the banks' books as capital for Fannie and Freddie and not as debt, because there is a clause in the bond that says if the bank is in a situation where it must be bailed out, the interest payments on those bonds can be postponed for five years. That allows them to count the debt as capital. If the companies are declared insolvent by their regulators, it could trigger the credit default swaps.

I say could, because depending on how the "credit event" is characterized, it may allow the seller of the insurance to postpone payment for five years as well. Just a technical loophole that I am sure most buyers of said credit insurance did not notice.

And even then, I think it is unlikely that many of the sellers of such credit insurance could make anywhere close to the amount of payments they have contracted for. And since the subordinated debt is precisely what you would want to buy credit insurance on, I bet a disproportionate amount of that $62 trillion in credit default swaps is on the lower-rated debt.

Who Is Holding the Old Maid?

And here's the ugly truth. No one knows who is ultimately on the hook for these derivatives. If I sell a credit default swap (CDS) to you and then buy a CDS on the same issue from Joe down the street for a small profit, my "book" looks neutral. And as long as Joe has the capital, I am. But at 12 times the actual underlying debt instruments, there are not just three parties to my mythical transaction, but at least 10. Joe sells to Mary who sells to Bill, etc., etc. Where does the real guarantee ultimately reside?

Like the children's card game, someone is stuck with the Old Maid at the end.

If there is a problem, you are going to come to me but I am going to tell you to go to Joe who will tell you to go to Mary and on down the line until someone tells you to go to hell. Then you come back at me and take me to court. That's the way it works.

This is why I keep pounding the table that CDS transactions must be moved to a regulated exchange. There has to be transparency and provisions for adequate capitalization of these instruments. Bear Stearns was too big to fail not because it was too big, but because of its derivative book of $1.9 trillion. We would have awoken on that Monday morning and, if Bear had been allowed to fail, the markets would have been frozen, because no one knew who was on the hook to Bear (and vice versa) and for how much. And if you don't know, you don't invest or lend to any financial institution or fund, because you put yourself at more risk.

That was just a lousy $1.9 trillion (admittedly at one institution). But $62 trillion? Where is it? Who owns it? Who thinks they are covered and may not be, but their balance sheet reflects a fully valued bond because "I have insurance?" How long will it take to find out where the real problems lurk?

So, let's add up the damage. $50 billion for loan losses in a market where home values will be down 20% at the least - but let's be optimistic here. Add in another $36 billion for the preferred shares, because if we let the banks go down, we just have to pay it through the FDIC. And add in another $19 billion for the subordinated debt, because the risk of setting off a firestorm in the CDS market may just be too great. That adds up to $105 billion.

Maybe those sharp guys at Morgan Stanley can figure out a way to get around these problems. The regulators recently forced buyers of Ambac CDS to take anywhere from $.13 to $.60 on the dollar. Maybe they can make everybody play nice in the sandbox, but this is a very big sandbox, far larger than Ambac.

And why? Critics have said that Fannie and Freddie were nothing but hedge funds with an implicit government guarantee. This is an insult to hedge funds. Hedge funds don't pay hundreds of millions in campaign contributions so that they can risk taxpayer dollars, prop up their profits, and pay huge bonuses to executives. They risk their own capital with no safety net.

Fannie and Freddie are banks that are levered between 40 and 50 times. I can think of two hedge funds, Carlyle Capital and Long Term Capital Management, that had leverage at those levels. They both went bankrupt, as will any such levered business.

As long as the prices of homes kept rising, Fannie and Freddie had no problems. That extra leverage allowed them to post record profits every quarter, boosting stock prices and keeping those bonuses and options for executives rising. And Congress let them do it. In fairness, there was a significant minority who wanted tougher regulations, including the Bush administration. But a bipartisan majority decided to take the campaign contributions and listen to the fabrications about how much Fannie and Freddie did for the country and how there was no risk.

And so now we are at a point where we are going to be forced to pick up the very expensive pieces. The alternative is to let the world as we know it go up in smoke. The mortgage market is dysfunctional now without Freddie and Fannie. The housing crisis would be far worse if you let them die. And once you determine to pick up the costs, you have gone down a very slippery slope. Yet if we don't do it, the systemic crisis will be far worse than the problems resulting from Bear, and those would have been horrific.

This is the Savings and Loan Crisis, Part 2. Maybe they can figure a way to lessen the cost. And the hope is that at some point the companies once again regain their value and the costs will be somewhat mitigated.

But if we don't get credit derivatives on an exchange, we are going to have to continue to do this. It is all so maddening. The only bright side to bailing out Freddie and Fannie is that it will make Bill Bonner wrong in his prediction of a soft depression.

Baltimore, La Jolla, South Africa, and London

On a personal note, things are going well. My arm is much better. The doctor said I tore a pronator muscle which broke a vein and resulted in some serious pain for about a week and a very ugly bruise along my whole arm. Who knew golf was such a rough sport?

My oldest son Henry just graduated from the University of Texas at Arlington with a degree in history, after going part-time for eight years. He has worked at UPS all that time, but kept at his school work. I am proud of him. He turned 27 yesterday. Tiffani is back from her honeymoon with Ryan. She says she will have pictures up in a week or two, and I will post a link.

Business is good. I am amazed at the opportunities out there. I will be in Baltimore next weekend for Bill Bonner's birthday. Then on to La Jolla to meet with my partners at Altegris (and drinks with Richard and Faye Russell). The next weekend I host Chuck Butler of Everbank and his compadres from the Sovereign Wealth Society at a Friday night Rangers game, and then take off the next morning for South Africa for a speech, then back to London for a day to meet with the team (and my partners) at Absolute Return Partners.

Life is busy but good. And this weekend I am going to take it easy and fire up the grill for some steaks and barbecue at Tiffani's new home. It will be a great weekend. And I hope your Labor Day will be as enjoyable. (There will be no Outside the Box on Monday.)

Your happy I don't have to figure out the Freddie and Fannie mess analyst,

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2008 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.