Currencies Surge Against Gold Led by US Dollar as Carry Trades Unwind

Currencies / US Dollar Aug 30, 2008 - 10:19 PM GMTBy: Ashraf_Laidi

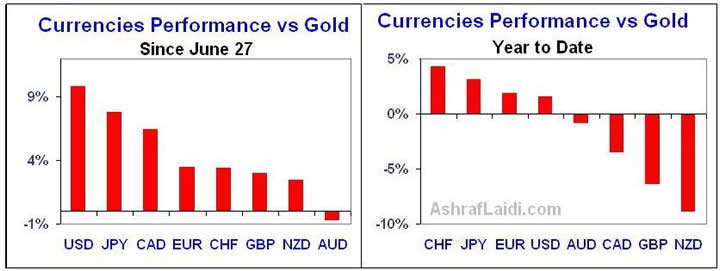

The events of the past three weeks in foreign exchange markets continue to be dominated by prolonged dollar strength and a fierce bout of selling in the British pound. The charts below show the secular performance of the major currencies, measuring their performances against gold -- whose price is determined by the forces of supply and demand rather than by central bank monetary policy or printing press.

The events of the past three weeks in foreign exchange markets continue to be dominated by prolonged dollar strength and a fierce bout of selling in the British pound. The charts below show the secular performance of the major currencies, measuring their performances against gold -- whose price is determined by the forces of supply and demand rather than by central bank monetary policy or printing press.

As the left charts shows--since the beginning of the second half of the year--the US dollar is the best performing currency against gold amid the major 8 currencies. The dollar's strength remains largely a manifestation of the same dynamics; deepening weakness outside the US rather than strength inside the US. More specifically, the confirmation that the Eurozone has seen its first negative quarterly GDP growth since the inception of the euro as well as the sharp decline in commodities resulting from slowing global demand have been the key catalysts to the dollar rebound. Speculative flows have also helped drive the dollar rally as futures traders unwound their dollar shorts vs the EUR, GBP and JPY. As the chart in the speculative futures section shows, short positions in EUR against USD are nearing their highest level in nearly 3 years .

Dollar Rises Above All Majors Despite Negative Trifecta

Although ECB president JC Trichet and his colleagues have not hinted at any interest rate cuts, their increased acknowledgment of the widely anticipated technical recession in the Eurozone is prompting bond markets to expect ECB easing to start in 2009, the same year in which the Fed is widely expected by fed funds futures to begin raising interest rates. Nonetheless, our view remains that the Fed will cut interest rates by at least 50 bps this year, while the ECB will follow suit in Q2 2009.

The reason to our US interest rate forecast is largely driven by the deteriorating trifecta of weakening macroeconomic fundamentals, worsening conditions in US credit markets and the persistent uncertainty with US financials. Slumping consumer demand and rising joblessness comprise the first part of the trifecta. Our view for the Fed to continue easing rates has been held ever since the central bank began hinting at a pause of its easing campaign earlier this spring. Now the Fed funds market is coming to terms with this trifecta, reducing odds of a 2008 tightening down to 20% from more nearly 60% one month ago. Our anticipated rate cuts are likely to provide support for EURUSD above $1.43 rather than subject it to renewed selling below that level.

From FOMC to FDIC

Aside from macroeconomic issues, the credit situation and impact on US banks will likely have an increasing impact on Forex markets. On Tuesday, the Federal Deposit Insurance Corp (FDIC) reported 117 "problem" banks as of June 30; up from 90 problem banks at the end of Q1. The FDIC says that lenders on the problem list had assets of $78 billion at the end of Q2, compared with $26.3 billion at the end of Q1.

The main question is how these figures reconcile with the fact that the FDIC has only $53 billion of funds, and has already used 15% of that to bail IndyMac. Conservative estimates place the number of troubled US banks at about 700 banks, which is 7 times greater than the number in the FDIC's "watch list".

As I argued in Eurozone vs US , none of these banking troubles constitute the challenges in the Eurozone, thus, will serve as the principal drivers for renewed Fed cuts, Treasury bailouts and falling US equities. The dollar impact remains largely negative against the Japanese yen. Indeed, owing to the escalating uncertainty with Fannie Mae and Fredie Mac and the persistent increase in LIBOR rates, the Japanese currency is the second best performer against gold due to frequent bouts of reduced risk appetite.

High Yielding Aussie, Kiwi and Sterling Underperfom

The Aussie, kiwi and sterling have fared the worst against gold during the same period. What do GBP, AUD and NZD have in common? They represent the 3 highest interest rates amid the 8 currencies with NZD at 8.00%, AUD at 7.25% and GBP at 5.00%. Unlike the Bank of England and Reserve Bank of New Zealand , the Reserve Bank of Australia has not yet cut interest rates. This renders the Aussie as the next likely victim of an interest rate cut. But it's more than that. The sharp tumble in the Aussie has been a result of unwinding carry trades (from all time highs against the USD) as well as rapid declines in commodities, especially gold and copper--two principal sources of Australian production and export revenue.

By Ashraf Laidi

CMC Markets NA

AshrafLaidi.com

Ashraf Laidi is the Chief FX Analyst at CMC Markets NA. This publication is intended to be used for information purposes only and does not constitute investment advice. CMC Markets (US) LLC is registered as a Futures Commission Merchant with the Commodity Futures Trading Commission and is a member of the National Futures Association.

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.