Stock Market Crash 2018; Will it Prove to be Another Buying Opportunity

Stock-Markets / Stock Market 2017 Oct 07, 2017 - 02:56 PM GMTBy: Sol_Palha

I guess the definition of a lunatic is a man surrounded by them. Ezra Pound

I guess the definition of a lunatic is a man surrounded by them. Ezra Pound

Since Trump was elected we noticed something interesting; economic news seems to have less of an impact than Geopolitical developments. Polarisation has had the effect it was intended to trigger; the masses and the markets are focusing on the wrong issues, and so we can expect a slew of legislation favouring the corporate world to be passed with little to no resistance. This, in turn, will help push stocks even higher as corporations will have even less to worry regarding being liable for using questionable methods to boost their earnings.

In the last Market update, we spoke of how the markets are operating in a way that appears to make no sense; how they are working more and more like an insane person. Ask a madman how he is, and he might respond by telling you that “ the road needs to be fixed”. The answer has nothing to do with your question and on the surface has no pattern whatsoever, but if you turned around and looked at the road, maybe you would notice that it is in need of repairs. All you had to do was alter the angle of observance, and in doing so, you spotted something that most would have missed.

What if you asked him another question instead of declaring him insane, for example, “ Are you hungry?”. To which he responds “ I hurt my toe yesterday”. You learnt something from the first question, so instead of trying to figure out the answer, you decide to look down, and you notice he is not wearing a shoe on the right foot and the toe is wrapped up in a bandage. What is the pattern here? The guy is not responding at all to your inquiries; maybe he is not as insane as he appears, maybe he thinks your questions are silly. The second thing to conclude is that he is more concerned with reality as opposed to a possibility. Thus the information is not useless; it appears to be useless because most would be ready to evaluate this person based on what they deemed to be a sane or insane response. In other words, they would be following SOP (standard operating procedure).

This is what is going in the markets today. If you ask the market a question based on what worked in yesteryear, then answer is going to sound insane. However, the answer is not insane. The person asking the same question over and over again and expecting a new outcome is the one that is insane. The markets spoke years ago and continued to speak, but no one listens; experts keep asking the same question. Markets march to their drumbeat, not yours. The logical way to examine this market is to stop looking at what it should be doing and instead focus on what it’s doing and why it's doing this. The reason the markets are erratic is that people today are acting as if they are insane. Everyone has an emotional stake in every possible outcome. A market is nothing but a seething cauldron of emotions. The crowd is insane so don’t expect anything different from the market.

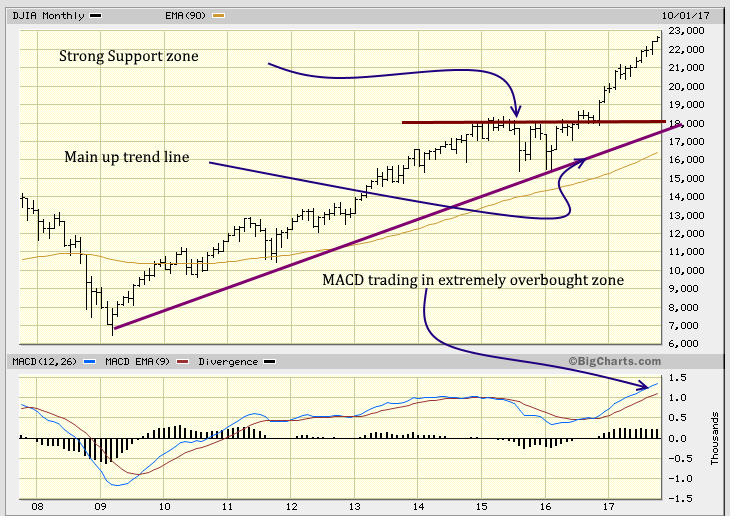

Markets are extremely overbought

The chart speaks for itself; the markets are trading in the extremely overbought ranges. Traders should be cautious when it comes to committing too much money to this market. Open positions in oversold stocks or stocks that have taken a beating but whose future appears to be turning around. Make sure you have stops in place. Having said that markets can trade in the overbought ranges for months on end. Each bar in the above chart represents a month's worth of data, and you can see that this phenomenon that we just mentioned occurred from Oct 2012 until Aug 2015.

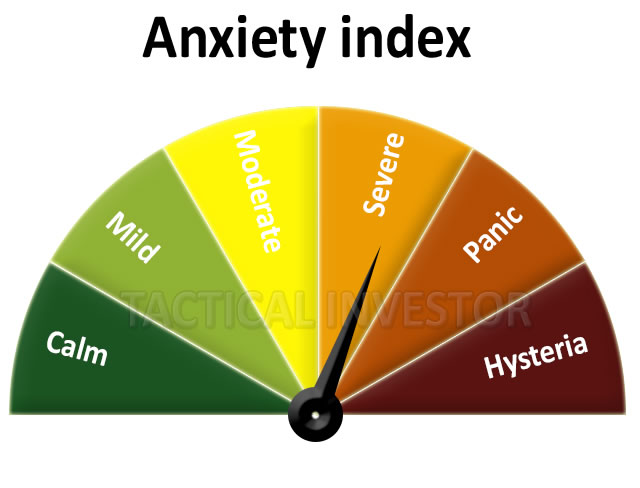

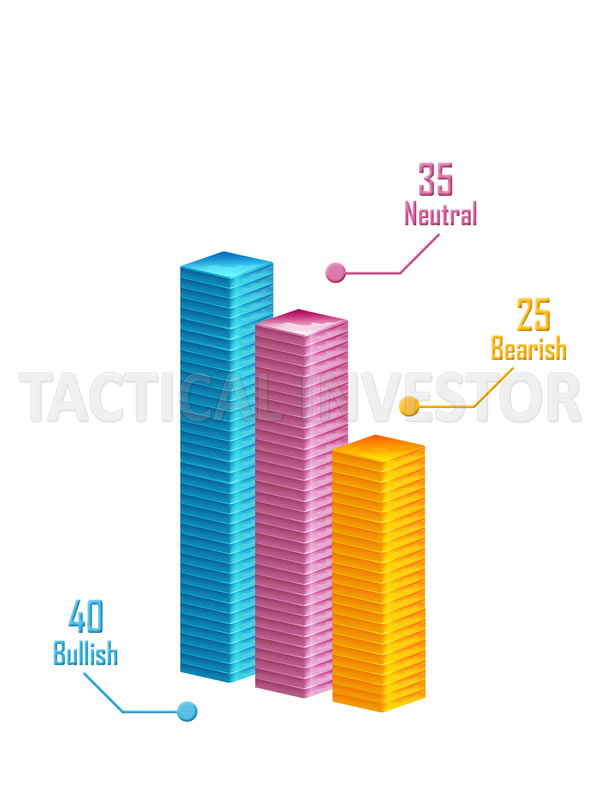

Market Sentiment is not Bullish so don’t expect a crash; a correction is more likely

Game plan for dealing with an extremely overbought Stock market

The stock market is trending in the overbought ranges for an extended period; so what’s the plan?. In such situations, you have only two options. We have already put the 1st option to work; forget what the markets are doing and just focus on the trend and wait for key Technical indicators to move to the oversold ranges.

What happens if our proprietary technical indicators refuse to pull back? Option 2 comes into play; focus on stocks that are trading in the extremely oversold ranges; the emphasis should be on the monthly charts. Most of the new plays we issue are trading in the oversold ranges on the monthly charts. It’s not an easy feat to spot stocks that are trading in the oversold ranges on the monthly chart, in such a mature bull market. Sometimes we have to go through 200 stocks just to find one possible candidate, and sometimes we find nothing.

If the indicators move into the oversold range and the markets don’t pull back strongly, then the follow-through reaction (upward move) is going to be very strong. Market Update Sept 1, 2017

In such conditions, we suggest that you buy some stocks but focus on stocks that are trading in the oversold to extremely oversold zones. But build up cash, so when the market pulls back, you have the capital to deploy into top stocks that will be selling for a discount.

We are almost positive that the masses will panic extremely fast during the next pullback and in doing so they will throw the baby out with the bathwater. Instead of the Dow pulling back 1500 points, it will probably shed double that amount before a bottom takes hold. But oh my what a great buying opportunity this will prove to be; provided the trend is up. At this time there is no indication at all that it will change even if the Dow were to shed 3000 points. If the markets crash in 2018, then like previous crashes they will prove to be a buying opportunity. Until the masses embrace this bull market, the most likely outcome is a correction and not crash.

In the past, men created witches; now they create mental patients.

Thomas Szasz

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2017 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.