British Pound GBP down 500 points, time for a corrective rally...

Currencies / Forex Trading Oct 07, 2017 - 02:35 PM GMTBy: Enda_Glynn

My Bias: short below parity in wave (5).

My Bias: short below parity in wave (5).

Wave Structure: continuing impulsive structure to the downside in wave (5)

Long term wave count: decline in wave (5) blue, below parity

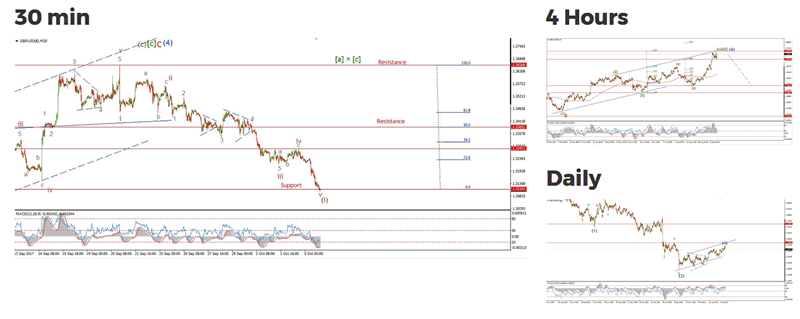

GBPUSD

Since catching the top in GBPUSD a few weeks back,

The market has dropped 500 points into the lows of the day.

As GBPUSD took another hit today, which brought the price through the 200MA on the 4hr chart.

This has prompted a rethink of the short term wave count.

I have re-labelled the decline as a higher degree impulse wave (i) to the downside.

A 50% retracement in wave (ii) will bring the price up to 1.3380.

So we can expect that corrective rally to begin next week.

For tomorrow;

A corrective rally in wave (ii) is now the main focus from this point.

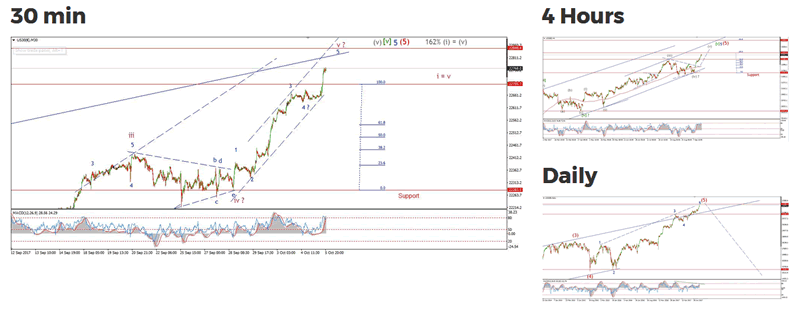

DOW JONES INDUSTRIALS

My Bias: market topping process ongoing

Wave Structure: Impulsive 5 wave structure, possibly topping in an all time high.

Long term wave count: Possibly topping in wave (5)

The Bulls marched hard again today,

Carrying the price right into the middle of the target range.

the high of the session has reached 22769 so far.

An adjustment of the trend channel surrounding wave 'v' pink allows for another push higher.

The upper target of 22848 is now quite likely.

And should complete a five wave pattern at 6 degrees of trend.

I have a real suspicion that the price is about to make an about turn and decline pretty hard from the high.

For tomorrow;

Watch for wave '5' to complete at the upper trendline of the trend channel.

Next week should bring with it the initial decline in the new bear market!

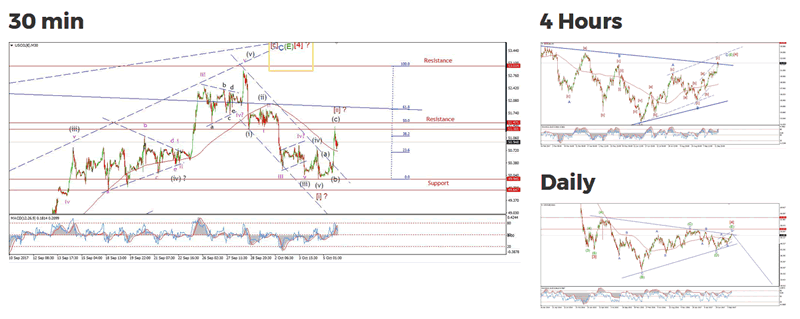

U.S CRUDE OIL

My Bias: topping in a large correction wave [4].

Wave Structure: ZigZag correction to the downside.

Long term wave count: Declining in wave 'c' target, below $20

Crude staged a sharp rally today

It looks like wave [ii] has arrived earlier than expected.

The 50% retracement level lies at 51.47.

The price reached a high of 51.22 and backed off again.

It is possible wave [ii] is complete at the high of the day.

If the price declines back below the high of wave (a) again tomorrow,

That will be a good indication that wave [ii] has completed.

For tomorrow;

I want to see another lower high form below todays high at 51.22.

If wave [iii] begins next week,

It will bring a significant decline with it.

Enda Glynn

http://bullwaves.org

I am an Elliott wave trader,

I have studied and traded using Elliott wave analysis as the backbone of my approach to markets for the last 10 years.

I take a top down approach to market analysis

starting at the daily time frame all the way down to the 30 minute time frame.

© 2017 Copyright Enda Glynn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.