Eastern Europe Is Becoming a Target for Capital from All Around the World

Economics / Eastern Europe Oct 06, 2017 - 01:32 PM GMTBy: John_Mauldin

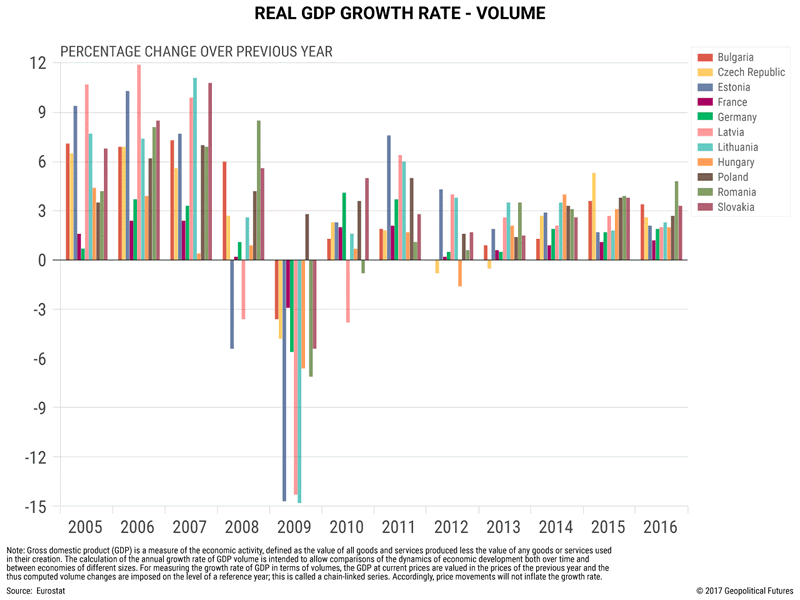

Eastern Europe has showed some impressive growth rates over the past decade.

But despite making up roughly 20 percent of the total population of the EU, the region accounts for only about 7.4 percent of the EU’s gross domestic product.

There are many factors that explain why, but among the most important is that these countries spent decades behind the Soviet Union’s Iron Curtain.

Capital Is Flocking to Eastern Europe

That Eastern Europe makes up only 7.4 percent of the EU’s GDP is not an indictment of its recent economic performance; it is an indicator of just how much of a head start the West had over the East.

But this lack of development has been in some ways a blessing for Eastern European countries. These countries have an abundance of skilled and cheap labor, which has fueled much of the economic activity in the region.

For example, in the 1990s and 2000s, as German manufacturers were trying to make their exports more competitive, they found countries on their doorstep—particularly the Visegrad Four countries (Hungary, Slovakia, Poland and the Czech Republic)—with low labor costs, favorable tax environments, and a productive and educated workforce.

Companies from around the world continue to target Eastern Europe for investment because of the human capital the region brings to bear. According to the latest European Investment Monitor, foreign direct investment in Eastern Europe has increased markedly.

In fact, they have risen by as much as 57 percent in the Czech Republic and 35 percent in Romania in 2016 compared to 2015.

Looking at jobs created by FDI, Poland is second only to the United Kingdom, while Romania holds fourth place, narrowly outpaced by Germany

Eastern Europe may still lag behind in terms of total FDI—Poland received about 20 percent as much FDI as Germany in 2016—but its recent gains are nonetheless impressive.

Grab George Friedman's Exclusive eBook, The World Explained in Maps

The World Explained in Maps reveals the panorama of geopolitical landscapes influencing today's governments and global financial systems. Don't miss this chance to prepare for the year ahead with the straight facts about every major country’s and region's current geopolitical climate. You won't find political rhetoric or media hype here.

The World Explained in Maps is an essential guide for every investor as 2017 takes shape. Get your copy now—free!

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.