Will North Korea Boost Gold Prices? Part2

Commodities / Gold and Silver 2017 Oct 03, 2017 - 04:15 PM GMTBy: Arkadiusz_Sieron

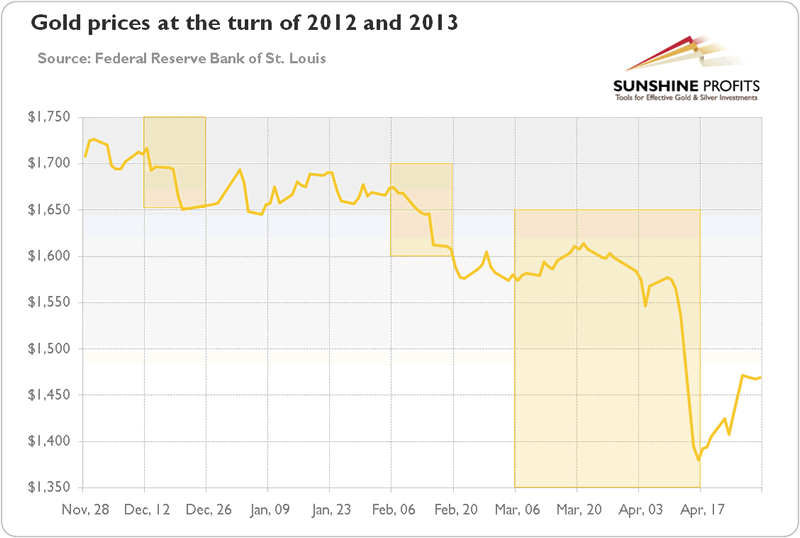

The turn of 2012 to 2013 was a time of escalated tensions between North Korean and the U.S, comparable to recent strains. Hence, the analysis of that period should be valuable for gold investors curious whether (and how) the latest crisis on Korean Peninsula would affect the precious metals market. On December 12, 2012, North Korea successfully launched a long-range rocket, testing a banned ballistic missile and raising nuclear stakes. In response, the U.N. Security Council approved the broadening of sanctions. But North Korea ignored them and on February 12, 2013 it undertook an underground nuclear bomb test. As the test triggered another, even harsher sanctions, North Korea threatened the U.S. with a preemptive nuclear strike on March 7. On March 30, North Korea declared a “state of war” against South Korea, and Kim Jong-un said that “rockets were ready to be fired at American bases in the Pacific.” On April 2, the North Korean military declared that the war could break out “today or tomorrow”. Tensions remained elevated until May, but they did not boost gold prices. Actually, in April there was a historic slide, as the next chart shows. Hence, if history is any guide, the fresh unease about North Korea will not provide any sustained support for the gold prices.

The turn of 2012 to 2013 was a time of escalated tensions between North Korean and the U.S, comparable to recent strains. Hence, the analysis of that period should be valuable for gold investors curious whether (and how) the latest crisis on Korean Peninsula would affect the precious metals market. On December 12, 2012, North Korea successfully launched a long-range rocket, testing a banned ballistic missile and raising nuclear stakes. In response, the U.N. Security Council approved the broadening of sanctions. But North Korea ignored them and on February 12, 2013 it undertook an underground nuclear bomb test. As the test triggered another, even harsher sanctions, North Korea threatened the U.S. with a preemptive nuclear strike on March 7. On March 30, North Korea declared a “state of war” against South Korea, and Kim Jong-un said that “rockets were ready to be fired at American bases in the Pacific.” On April 2, the North Korean military declared that the war could break out “today or tomorrow”. Tensions remained elevated until May, but they did not boost gold prices. Actually, in April there was a historic slide, as the next chart shows. Hence, if history is any guide, the fresh unease about North Korea will not provide any sustained support for the gold prices.

Chart 1: Gold prices at the turn of 2012 and 2013.

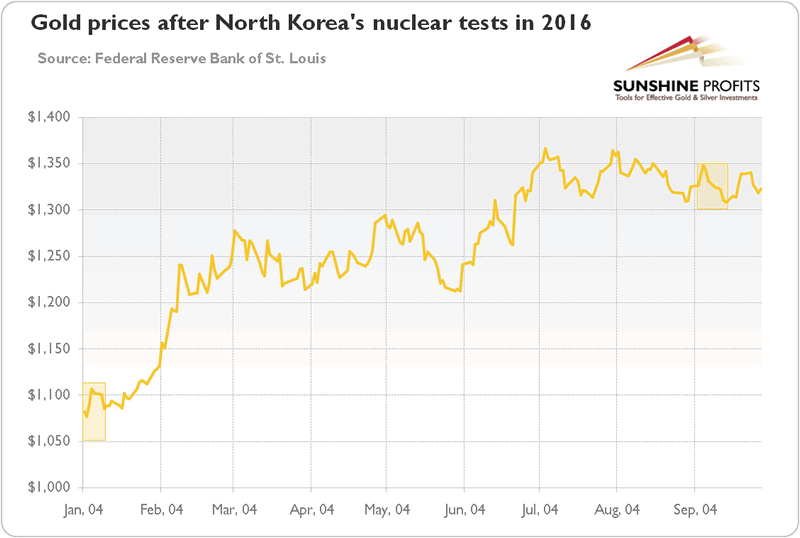

In 2016, North Korea conducted another two nuclear tests. As one can see in the chart below, the January test triggered only limited and temporary upward gold’s reaction, while the September test failed to do even that.

Chart 2: Gold prices after North Korea’s nuclear weapon tests on January 6, 2016 and on September 9, 2016.

And finally let’s turn to the latest “war of words” between North Korea and the U.S.

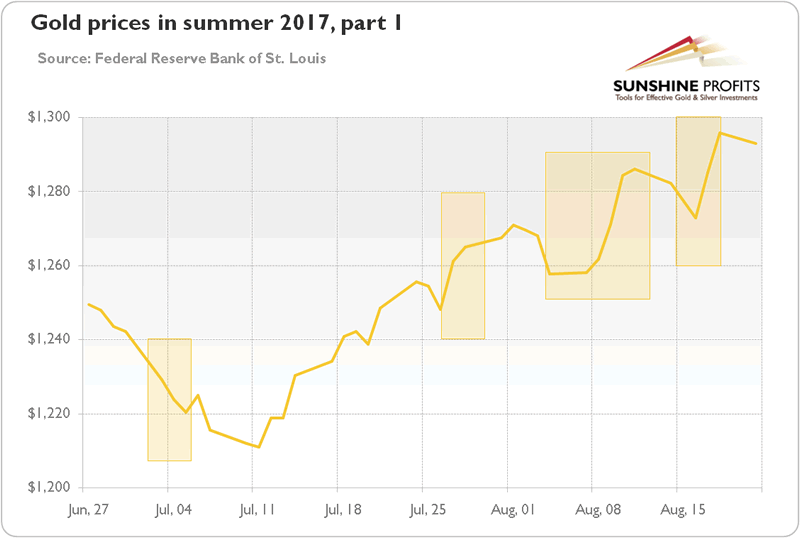

As a reminder, 2017 has been a year of rapid progress for North Korea’s missile program, as the regime fired 21 missiles during 14 tests this year, according to CNN’s statistics. The most important were two intercontinental ballistic missile tests, which occurred on July 4 and July 28, as the U.S. territory was within their ranges. These launches signaled an improved nuclear weapon capability, sparking anxiety around the world. On August 5, the United Nations Security Council unanimously passed new sanctions on North Korea, while on August 8, President Donald Trump promised that “fire and fury” will meet North Korean threats. In response, on August 10, the North Korean military declared that the regime was considering plans for a missile strike on the U.S. Pacific territory of Guam, so Trump replied the next day that “military solutions are now fully in place, locked and loaded”.

Despite a lot of fuss and fears about the nuclear war, these tensions did not make gold prices to soar. As the next chart shows, although gold prices gained after Trump’s “fire and fury” statement and the following developments, the impact was limited. And the price of the yellow metal actually fell after the first intercontinental ballistic missile test. Moreover, when North Korea backed down from attacking Guam on August 15 (the regime has a poor track record when it comes to delivering on its aggressive threats), gold prices did not decline, they continued higher. It implies that price movements in the gold market are caused by other factors than geopolitical developments.

Chart 3: Gold prices in summer 2017, part I.

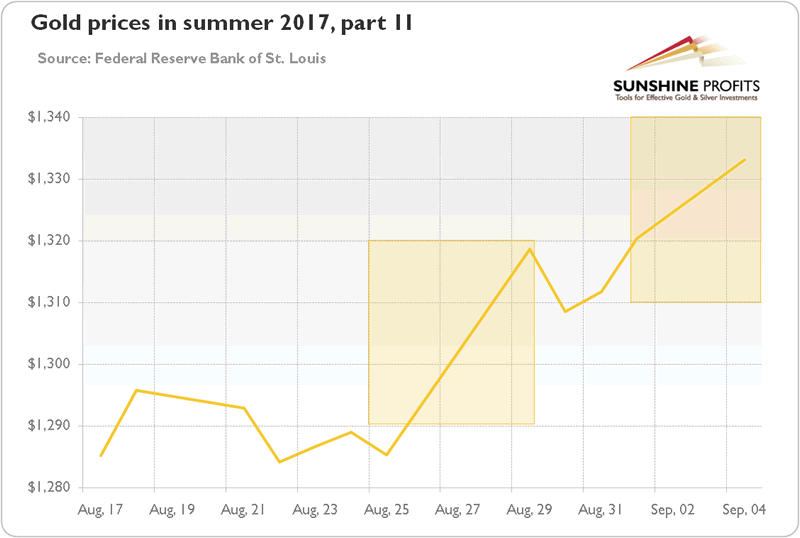

However, the ease of tensions after August 15 was only calm before the storm, as North Korea launched a few Scud missiles on August 26 and a ballistic missile over northern Japan on August 29. Moreover, on September 3, the regime conducted its sixth nuclear test. As one can see in the chart below, the price of gold reacted positively these times, presumably due to unprecedented character of these developments. Although there have been North Korean flights over Japan before, the latest missile was the first one with a potential nuclear capability which flew over the Land of the Rising Sun. Similarly, although North Korea has conducted nuclear test before, the recent one was likely a hydrogen bomb, which is much more powerful than regular atomic bomb.

Chart 4: Gold prices in summer 2017, part II.

Summing up, the historical analysis shows that incidents related to North Korea usually failed to ignite sustained gold rallies. The price of the yellow metal either increased only for a while, or even dropped after the geopolitical events analyzed. Although we have not examined all incidents – because of the limited length of the Market Overview – the conclusions are clear. Geopolitical risks in general, and threats from North Korea in particular, are not able to trigger anything but a short-term and limited response in the gold market. Having said this, investors should remember that until 2017 North Korea was a small and fusty country, but now it may be a nuclear power able to threaten the U.S. with the hydrogen bomb. Another important factor is that now not only the leader of North Korea seems to be unpredictable, but the U.S. president as well. Hence, gold’s reaction may be more decisive in the eventual conflict, but long-term trends will remain shaped by long-term cycles and fundamental factors, such as the U.S. dollar’s strength of the real interest rates instead of geopolitical threats.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.