Precious Metals Monthly Charts

Commodities / Gold and Silver 2017 Oct 03, 2017 - 09:23 AM GMTBy: Jordan_Roy_Byrne

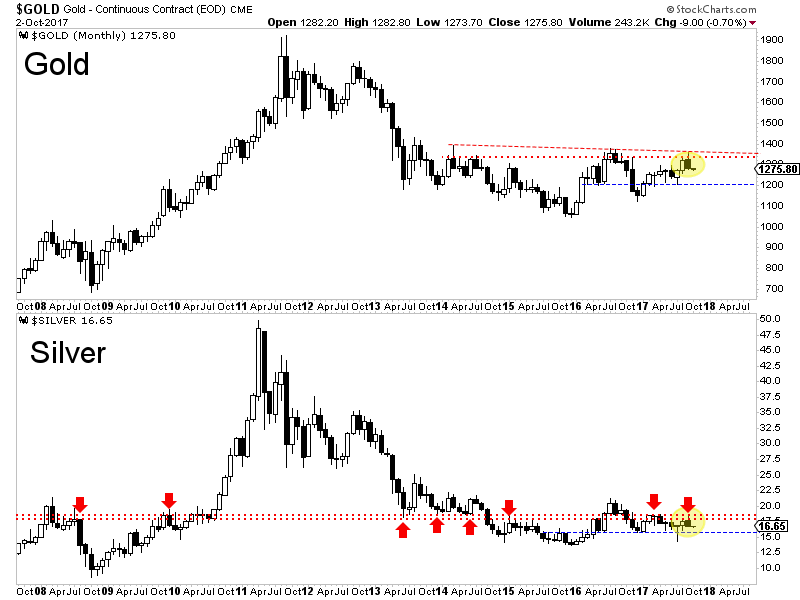

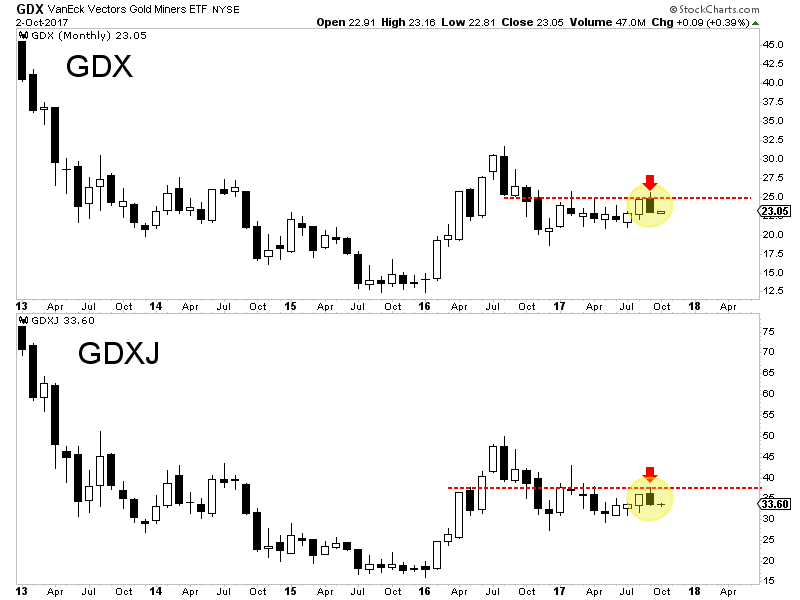

The precious metals sector started September with a bang. Gold, which had already eclipsed $1300/oz, pushed to $1360/oz while Silver broke its downtrend line (from its late 2012 and 2016 peaks). Unfortunately, precious metals would soon reverse course and more. Gold ended September down nearly 3% and below $1300/oz. Silver lost 5% and its breakout. The gold mining indices (GDX, GDXJ, HUI) lost 7% to 8%. The monthly charts argue the major breakout from multi-year bottoming patterns will have to wait until 2018 at the soonest.

The precious metals sector started September with a bang. Gold, which had already eclipsed $1300/oz, pushed to $1360/oz while Silver broke its downtrend line (from its late 2012 and 2016 peaks). Unfortunately, precious metals would soon reverse course and more. Gold ended September down nearly 3% and below $1300/oz. Silver lost 5% and its breakout. The gold mining indices (GDX, GDXJ, HUI) lost 7% to 8%. The monthly charts argue the major breakout from multi-year bottoming patterns will have to wait until 2018 at the soonest.

Gold’s bearish September reversal occurred at multi-year resistance. On a chart showing daily or weekly closing prices, Gold’s highest close in September occurred at the resistance line connecting its early 2014 and 2016 highs. In addition, Gold opened near $1330 (critical monthly and quarterly resistance), traded above it but then closed well below it. While it is difficult to see, Silver opened very close to key resistance at $17.80, traded up to $18.29 (near major monthly resistance) but closed the month well below $17.00. Silver failed in a resistance area that has been very important (note the arrows) for the past 10 years. Gold failed at a level that has been important since 2014.

The miners like the metals also failed at important resistance levels. GDX opened September around resistance at $25, traded above it briefly but closed the month down at $23. GDXJ tested resistance at $37 but closed the month down at $33. The monthly candle charts below show the importance of GDX $25 and GDXJ $37. A monthly close above those levels could trigger a major leg higher. However, the monthly charts argue that scenario is not close at hand.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.