Gold and the U.S. Dollar

Commodities / Gold and Silver 2017 Sep 27, 2017 - 11:48 AM GMTBy: Clive_Maund

Technical analyst Clive Maund discusses the latest moves by gold and the U.S. dollar. The last Gold Market update, posted at its recent peak on the 11th, called for a significant reaction back by gold, and that is exactly what has since happened. It also called for a rally in the dollar, which hasn't happened—yet, but as we will see in this update, it looks likely to happen soon, and given that gold's COTs have barely eased on the current reaction to date, it therefore seems likely that gold will lose more ground on a dollar rally.

Technical analyst Clive Maund discusses the latest moves by gold and the U.S. dollar. The last Gold Market update, posted at its recent peak on the 11th, called for a significant reaction back by gold, and that is exactly what has since happened. It also called for a rally in the dollar, which hasn't happened—yet, but as we will see in this update, it looks likely to happen soon, and given that gold's COTs have barely eased on the current reaction to date, it therefore seems likely that gold will lose more ground on a dollar rally.

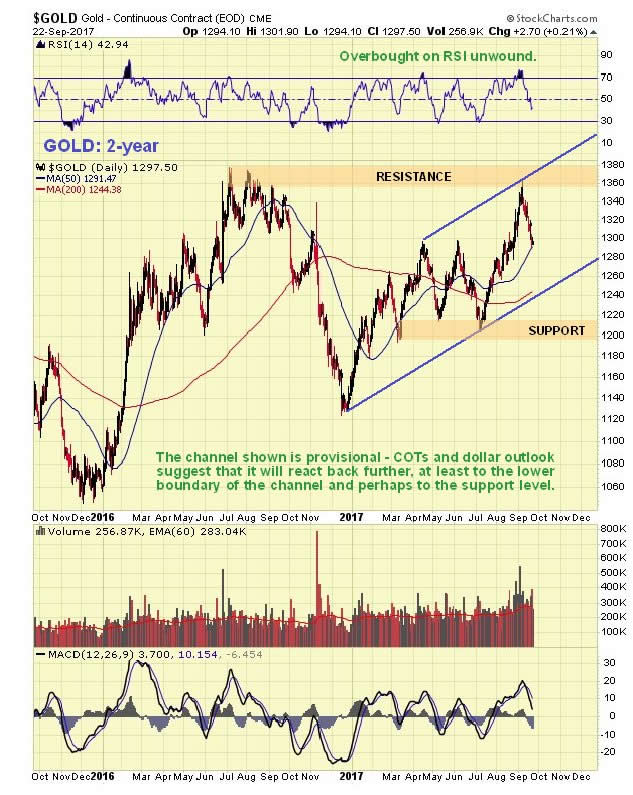

On gold's 2-year chart we can see that it was at a good point to reverse to the downside early in the month as it had risen into the zone of substantial resistance in the vicinity of its mid-2016 peak. A potential channel is shown, and if it should drop back to the lower boundary of this channel, as looks likely given the immediate outlook for the dollar, it would drop back to about $1250, and COTs suggest it could go lower still.

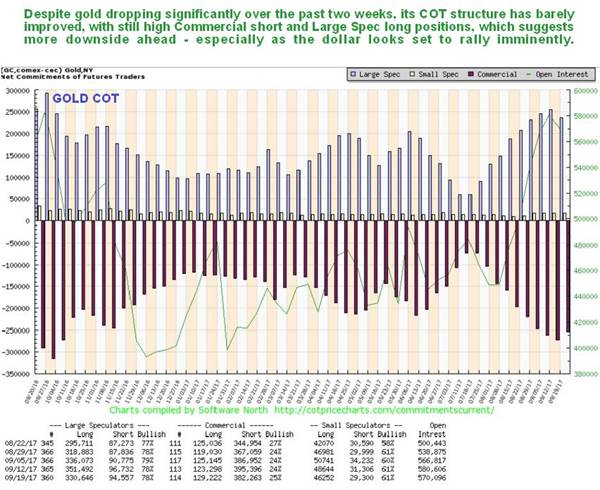

The latest COT chart shows that, as mentioned above, positions have barely eased on the reaction of the past two weeks—the Commercials still hold a high short position and the Large Specs a high long position. These positions will probably need to be "wrung out" before gold can resume the upward path, especially as the technical outlook for the dollar is for a significant rally over the short to medium term.

The key charts for us to consider in relation to gold are, of course, those for the dollar, now more than ever. On the 6-month chart for the dollar index we can see that it has become more "agitated" over the past week or so, with a number of larger white candles appearing on its chart. This is bullish, especially as the lows early this month were not at all confirmed by momentum—the MACD shows downside momentum dropping out at a time when the dollar and its 50-day moving average have opened up a large gap with the 200-day moving average, and at a time when the dollar has arrived at support at the lower boundary of its large Broadening Top formation—it's time for a last gasp "swan song" rally before the dollar makes a graceless exit from the stage through the trapdoor—that's when gold and silver will take off.

The dollar's arrival at the lower boundary of its large Broadening Formation is shown to advantage on the 4-year dollar index chart below. This looks set to generate the proverbial "dead cat" bounce.

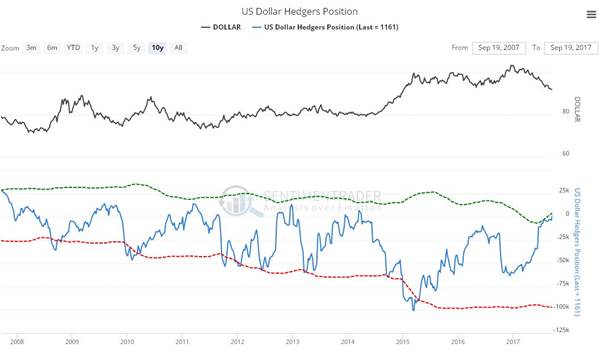

Underlining the high probability of an imminent dollar rally is the latest dollar Hedgers chart, which shows that large Commercial Hedgers, who are normally right, have progressively unloaded almost all of their short positions as the dollar has sunk lower and lower, to the point where they are now almost non-existent. Whenever this has happened in the past, as this chart makes plain, a significant dollar rally has followed. We should therefore be on the lookout for a substantial dollar rally soon—it hasn't started yet, but looks imminent.

Chart courtesy of www.sentimentrader.com

Although a dollar rally is expected to start soon, it is important to note that this will be just a "dead cat" bounce—it is not expected to get very far before it turns lower again, and then heads for a breakdown from the Broadening Top pattern leading to a severe decline, as the process of global de-dollarization being spearheaded by China and Russia for obvious reasons gathers pace, so that one day the dollar will be "just another currency" and it will be interesting to observe how the United States adjusts to the new reality of having to "live within its means" instead of on the labor of the rest of the world by swapping piles of intrinsically worthless paper (dollars and Treasuries) for goods and services that are the product of REAL WORK.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent articles with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Charts provided by the author.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.