$GOLD – Understanding and Dealing with Chaos

Commodities / Gold and Silver 2017 Sep 26, 2017 - 12:14 PM GMTBy: Spock

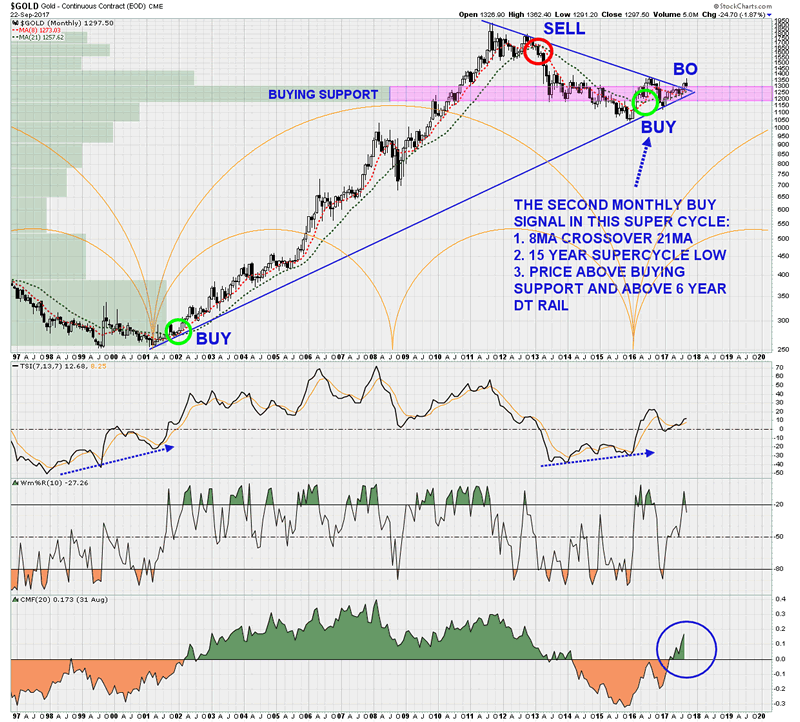

Everything in the PM sector hangs of this one $GOLD chart below, as its foundation.

Everything in the PM sector hangs of this one $GOLD chart below, as its foundation.

This is a monthly chart, using the 8 and 21 simple moving averages to generate the BUY and SELL signals. 8 and 21 are Fibonacci numbers.

There are only two BUY signals on this chart: 2001 and 2016, 15 years apart. The last SELL signal was in late 2012 for $GOLD. Do not expect the next SELL signal until at least 2026/27, 10 years from now, two thirds of the way into this new 15 year super cycle.

Why is this chart so important to an investor, wishing to survive in this sector?

Primarily its a master map, a framework, showing where we are, and where we are going … which is toward a higher level target 10 years in the future. With this framework as a basis, then its a matter of taking individual responsibility for getting from here, to there … to that higher level target in 10 years from now. Its the mental journey that’s more important, as the profits will come with the turf anyway. If focus on the money, and not the mental journey, the investor will NOT make it mentally, or with any profit. Its that simple.

Secondly, the framework allows the investor to deal with the market chaos, when it comes. And it WILL come. Chaos has to be accepted as an integral part of the game. If that cannot be accepted, and dealt with, when it arrives, the investor will not reach the objective, and will forego any potential profits as a result.

This is a powerful concept, as it then means that the chaos, when it arrives, becomes irrelevant to achieving that higher level target in 2026. If the chaos is irrelevant, it can be dealt with mentally, and will not result in the investor bailing from all the long positions in the sector. Not before 2026/27 anyway, assuming the 8 and 21 simple moving averages stay properly aligned on a BUY signal until then.

The investor is not playing the game with others in the market. The game is within the individual. Understand that concept and thrive in the markets.

There is a lot of noise and chatter out there about another correction in $GOLD, before the real move begins. Applying the above concepts, all that noise, chatter and opinion is …. IRRELEVANT.

Ask yourself these questions: Do I make trading and investment decisions as an individual, and take full responsibility for them? As an individual, have I conceptualized a higher level target for the PM sector in 5 to 10 years time? Have I accepted that market chaos is a given? When the chaos arrives, not if it arrives, but when….how will I deal with it, in the context of my higher level target which I have conceptualized?

Note: One has to ask these questions voluntarily of oneself. Otherwise, there is no point, and best to just go back to the same old habits of primordial reactions in the markets. And best of luck with that, as I know where it ends up, and its not a pretty place, mentally, or financially.

Be good. Spock

© 2017 Copyright Spock - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.