Self Employed? Understanding Business Insurance

Companies / SME Sep 19, 2017 - 04:17 PM GMTBy: Submissions

Joanna Stovic writes: The number of people choosing to become self-employed is gradually rising. Those people strive for independence, control and freedom from the stress inflicted on them by their previous employers. Since the start of the economic downturn, there has been a 10% growth in the self-employment sector. While venturing into self-employment has its own challenges, it can be rewarding if you know the right steps to take.

Joanna Stovic writes: The number of people choosing to become self-employed is gradually rising. Those people strive for independence, control and freedom from the stress inflicted on them by their previous employers. Since the start of the economic downturn, there has been a 10% growth in the self-employment sector. While venturing into self-employment has its own challenges, it can be rewarding if you know the right steps to take.

If you’re thinking about becoming self-employed or freelancing, there are a few fundamental issues that you need to consider before setting out. One of the most important but mostly ignored by many self-employed individuals is business insurance. Here are a few things you should know about business insurance for the self-employed.

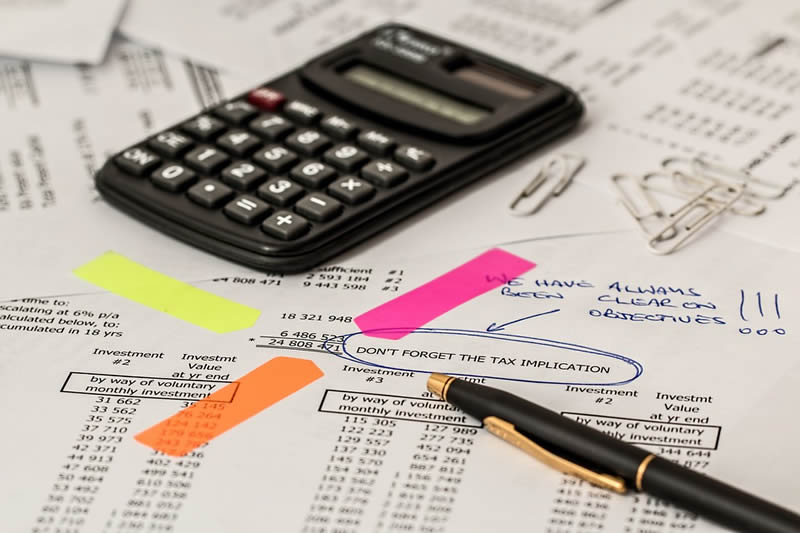

Business Insurance is Tax Deductible

Business insurance is considered as one of the necessary costs of running a business. It is up to you to protect your business through public liability insurance. Freelancers and the self-employed can enjoy tax deductions from their business insurance when calculating taxes. A business expense is deductible if it meets two criteria:

-

It must be a common day-to-day expense in your line of work

-

It must be both appropriate and helpful to your business

Business insurance meets both criteria. While it may seem like an additional cost to you, business insurance is critical as most client contracts, industrial regulations and leases will require that you have coverage. Being able to write off business insurance costs helps you make additional savings as a self-employed.

Homeowner’s Insurance Doesn’t Cover Business Assets/Activities

Considering that a large number of self-employed individuals work from home, it’s important to understand that your homeowner’s insurance policy doesn’t cover your home-based business. Don’t assume you’re safe with your homeowner’s insurance. You need to have a separate business insurance to cover your home-business assets and activities.

For instance, if a delivery guy slips at your doorstep and breaks an ankle while dropping off a package, your homeowner’s insurance will not cover the injury. Without self-employed business insurance, you may as well be facing potential legal costs if someone sues you as well as unexpected medical expenses.

Insurance Requirements Vary with Business Industries

The type of business insurance you take may depend on your line of work. For instance, if you provide professional services like architecture, clients may require you to have professional liability insurance. This ensures that you’re liable for possible mistakes that may happen in your line of work such as failing to follow industry standards.

For general contractors, you’ll need to have general liability insurance to cover for potential mishaps or damages that may happen as you work. You may also be required to have your own worker’s compensation insurance to cover injuries on-the-job. Getting health coverage for the self-employed also offers additional cover.

Lawsuits Can Hit You Directly

Being self-employed can come with certain risks of facing potential lawsuits over a project or projects you worked on. Considering that a sole proprietorship business structure is less protected without separate business cover, it’s important to have business insurance to shield yourself from lawsuits that may target both your personal and business assets.

With business insurance, you can settle any disputes without worrying about losing your personal assets.

Conclusion

Anyone venturing into self-employment should follow certain rules on running a self-employed business, and this includes having business insurance. While you may be tempted to skip getting insurance for your self-employed business, because of the cost, going without coverage puts you at risk of losing everything in case something bad happens.

By Joanna Stovic

© 2017 Copyright Joanna Stovic - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.