Stock Market Bubble Fortunes

Stock-Markets / Stock Market 2017 Sep 19, 2017 - 03:20 PM GMTBy: Raul_I_Meijer

A few days ago, former Reagan Budget Director and -apparently- permabear (aka perennial bear) David Stockman did an interview (see below) with Stuart Varney at Fox -a permabull?!-, who started off with ‘the stock rally goes on’ despite a London terror attack and the North Korea missile situation. His first statement to Stockman was something in the vein of “if I had listened to you at any time after the past 2-3 years, I’d have lost a fortune..” Stockman shot back with (paraphrased): “if you’d have listened to me in 2000, 2004, you’d have dodged a bullet”, and at some point later “get out of bonds, get out of stocks, it’s a dangerous casino.” Familiar territory for most of you.

A few days ago, former Reagan Budget Director and -apparently- permabear (aka perennial bear) David Stockman did an interview (see below) with Stuart Varney at Fox -a permabull?!-, who started off with ‘the stock rally goes on’ despite a London terror attack and the North Korea missile situation. His first statement to Stockman was something in the vein of “if I had listened to you at any time after the past 2-3 years, I’d have lost a fortune..” Stockman shot back with (paraphrased): “if you’d have listened to me in 2000, 2004, you’d have dodged a bullet”, and at some point later “get out of bonds, get out of stocks, it’s a dangerous casino.” Familiar territory for most of you.

I happen to think Stockman is right, and if anything, he doesn’t go far enough, strong enough. What that makes me I don’t know, what’s deeper and longer than perennial or perma? But it’s Varney’s assumption that he would have lost a fortune that triggered me this time around. Because it’s an assumption built on an assumption, and pretty soon it’s assumptions all the way down.

First, that fortune is not real, unless and until he sells the stocks and bonds he made it with. If he has, that would indicate that he doesn’t believe in the market anymore, which is not very likely for a permabull to do. So Varney probably still has his paper ‘fortune’. I’m using him as an example, of course, of all the permabulls and others who hold such paper.

Presumably, they often also think they have made a fortune, and presumably they also think that means they are smart. But that begs a question: how can it be smart to put one’s money into paper that is ‘worth’ what it is today ONLY because the world’s central banks have been handed the power to save the ailing banks that own them with many trillions of freshly printed QE? And no, there can be no doubt of that.

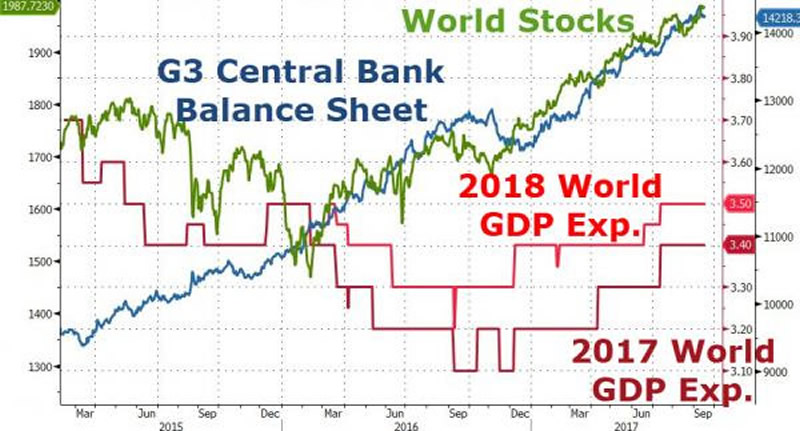

And there are plenty other data that tell the story. The world’s central banks have blown giant bubbles all over the place. That’s where the bulls’ “fortunes” come from. They are bubble fortunes. It has nothing to do with being smart. And of course, as I’ve said many times before, there are no investors left to begin with, because you can’t be an investor if there are no functioning markets, and for a market to function you need price discovery.

Which is exactly what central banks have killed. No-one has one iota of a clue what anything is really worth, what the difference between ‘price’ and ‘value’ is. Stockman at one point suggests people should hold on to Microsoft, but does he really believe that Bill Gates will remain standing when everyone around him crashes? That tech stocks are immune to the impending crash for some reason? If true, that would seem to indicate that tech stocks represent real value while -virtually- no others do. Hard to believe.

Please allow me to insert a graph. This one is from Tyler Durden the other day, and it paints a clear picture as much as it raises a big question. It suggests that until December 2016 the S&P and the ‘real economy’ were in lockstep. I think not. But one thing’s for sure: ever since January, i.e. the Trump presidency, the gaping gap between the two has grown so fast it’s almost funny.

Not that I would for one moment wish to blame Trump for that; he’s merely caught up in a wave much larger than an election or a White House residency. What is happening to the US -and global- economy goes back decades, not months. Which makes the graph puzzling, too, obviously. Just ask the new-fangled platoons of waiters and greeters with multiple jobs in America. And/or the 50-60-70% who can’t afford a $500 emergency bill, the 97 million who live paycheck to paycheck.. America’s already crashing, it’s just a matter of waiting for the markets to catch up with America’s reality. That’s what price discovery is about. Here’s another, similar, graph. Note: I don’t really want to go and find the best graphs, we’ve posted and re-posted so many of them it would feel like an insult to everyone involved.

But I digress. This was to be about Stuart Varney and the platoons and legions of permabulls out there. As I said, many of them, make that most, will feel they’ve made their fortune because they’re smart. Even if riding a Yellen and Draghi and Abenomics wave has zilch to do with intelligence. But there’s another side to that supposed smartness. And Stockman is on to it.

The large majority of people who think they got rich because they’re smart will also lose their ‘fortunes’ because they think they’re smart. It is inevitable, it’s a mathematical certainty. And not only because the central banks are discussing various forms of tapering. It’s a certainty because those who think they’re smart will hold on to their ‘assets’ too long. Because the markets will become much less liquid. Because the doors through which people will have to pass to escape the fire are too narrow to let them all though at the same time.

Fortunes built on central banks largesses are virtual. You have to sell your assets to make them real. But the same mechanics that blew the bubbles in housing, stocks, bonds et al also keep people from selling them. Until it’s too late. It may seem easier to sell stocks and bonds than homes, and it is, but in a crash it’s harder than one might think. And prices can come down very rapidly in very little time.

So perhaps the right way to look at this is to tell yourself you were not smart at all when you made that fortune, but now you’re going to smarten up. There will be a few people who do that, but only a few. Most will feel confident that they can see the crash coming in time to get out. Because they’re smart enough. After all, they just made a fortune, right?

It’s not just individuals. Pension funds have been accumulating huge portfolios in ever riskier ‘assets’. Which of them will be able to react fast enough if things start unraveling? And for the lucky few that will, what are they going to buy with the money? Bonds, stocks? Gold perhaps? Crypto? Everyone at once?

Don’t let’s forget that one of the main characteristics -and its consequences- of the everything bubble the central banks granted us is far too often overlooked: leverage. Low interest rates have made borrowing stupidly cheap, and so everyone has borrowed. As soon as things start crashing, there will be margin calls, lines of credit will be withdrawn, people and institutions will have to panic sell (everything including crypto) just to try to stay somewhat afloat, it’s all very predictable and we’ve seen it all before.

But yes, you’re right. The rally continues. And we can’t know what will trigger the downfall, nor can we pinpoint the timing. Still, it should be enough to know that it’s coming. Alas, for many it is not. They’re blinded by the light. But even that light is not real. It’s entirely virtual.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2017 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.