The 3 Best P2P Lending Platforms For Investors In 2017—Detailed Analysis

Companies / Investing 2017 Sep 15, 2017 - 12:51 PM GMTBy: John_Mauldin

BY STEPHEN MCBRIDE : Peer-to-peer lending (P2P) is a new method of debt financing that allows people to borrow and lend money without a financial institution. Harnessing technology and big data, P2P platforms connect borrowers to investors faster and cheaper than any bank.

BY STEPHEN MCBRIDE : Peer-to-peer lending (P2P) is a new method of debt financing that allows people to borrow and lend money without a financial institution. Harnessing technology and big data, P2P platforms connect borrowers to investors faster and cheaper than any bank.

P2P lending has grown rapidly in recent years and is a new source of fixed income for investors (download our new special report on investing in P2P loans for more). Compared to stock markets, P2P investments have less volatility and a low correlation. They also offer higher returns than conventional sources of yield.

With interest rates at all-time lows since 2008 and many historically “safe” investments like government bonds offering measly returns, investing in P2P loans in 2017 is a no-brainer.

Here, I take an in-depth look at the three best P2P lending platforms for investors, including their default rates, interest rates, and other important metrics.

Lending Club

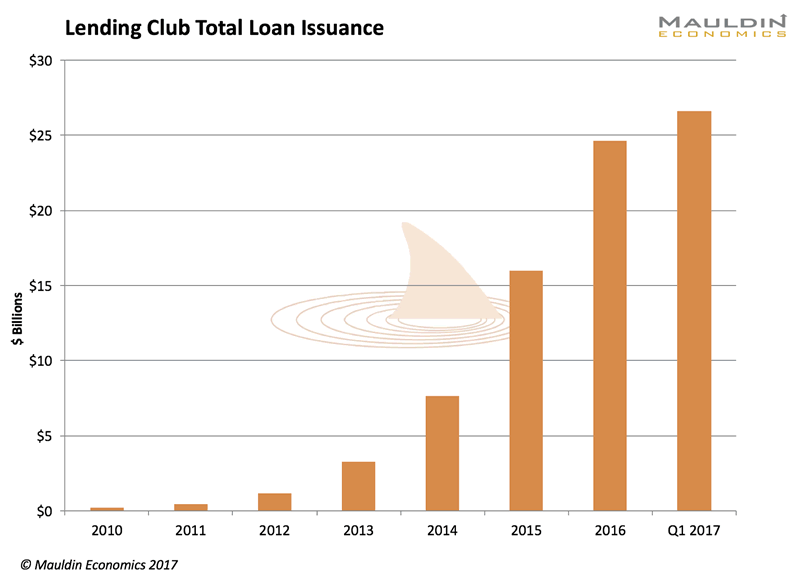

Founded in 2007, Lending Club is the world’s largest peer-to-peer lending platform with over $26 billion in loan issuance. It offers both consumer and small- and medium-sized enterprise (SME) loans over fixed periods of 36 or 60 months.

Source: Lending Club

Lending Club has grown exponentially and currently has a 45% market share. It raised over $900 million from its IPO in 2014, but its share price has since fallen 77%.

In 2016, the company was embroiled in a scandal surrounding founder Renaud Laplanche. He was forced to resign after an internal investigation found improprieties in the company’s lending process, including the altering of millions of dollars’ worth of loans.

Although the event damaged the reputation of Lending Club and the industry, the company is well capitalized. The company prospectus states that in the event of bankruptcy, a backup system will come online and function as the intermediary.

Lending Club operates on a notary business model, meaning it acts as an intermediary between borrowers and investors. Once a loan has been funded, the money is released to the borrower by a partner bank.

Lending Club then issues a note to the investor that is essentially a security. Lending Club and Prosper (reviewed below) both use Utah-based WebBank. Lending Club offers loans from $1,000 to $40,000 for individuals and from $15,000 to $300,000 for businesses.

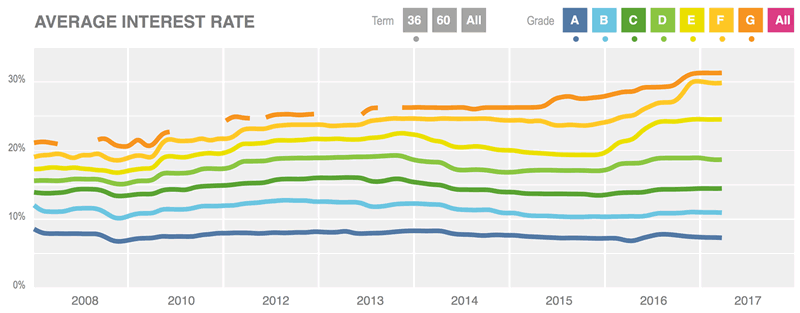

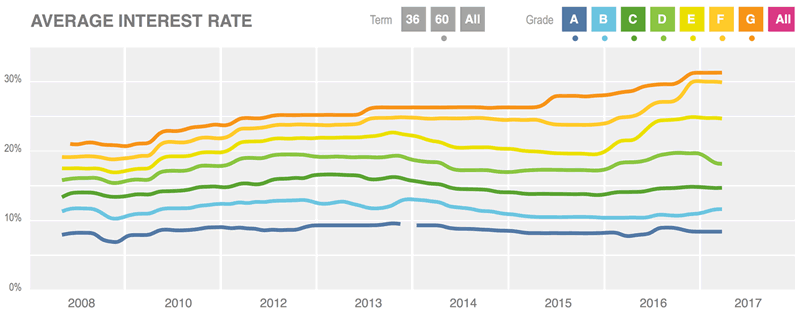

The next charts show the average interest rate charged to borrowers across all credit grades for 36- and 60-month loans.

Source: Lending Club

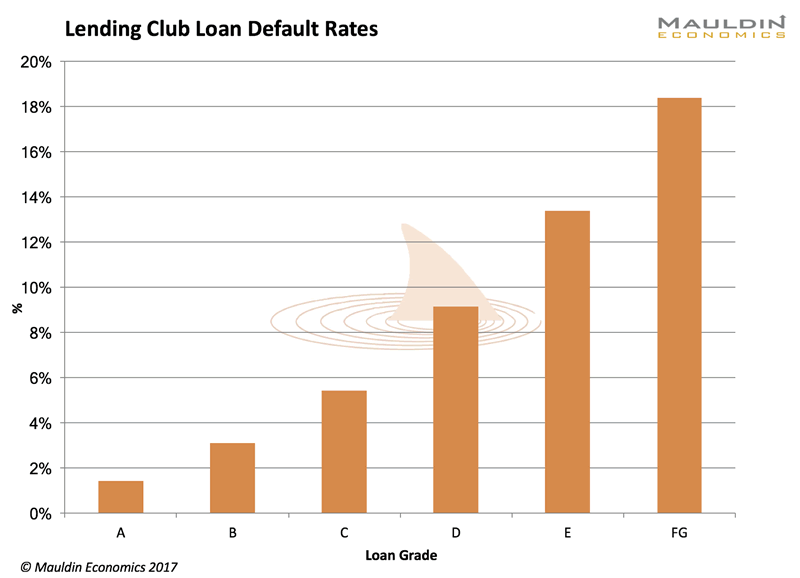

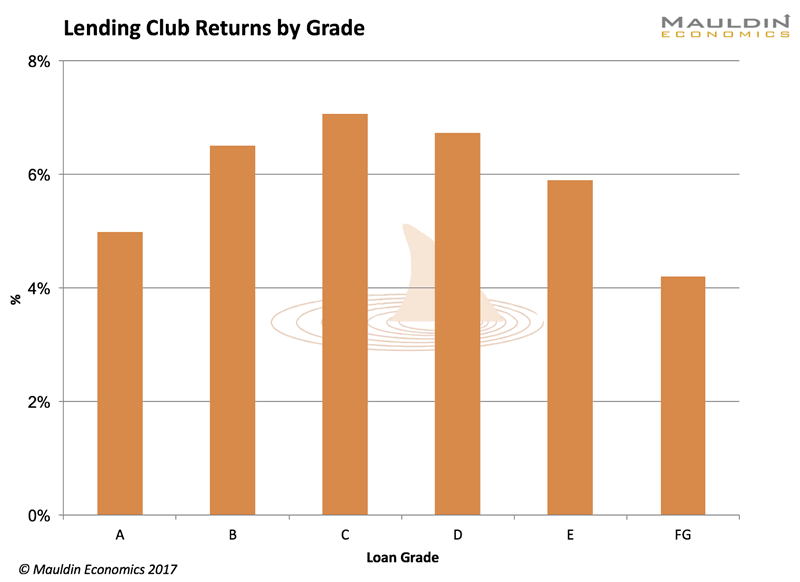

We can see from the variance in default rates that Lending Club’s grading system works as it should…

Source: Lending Club

… with corresponding increases in returns.

Source: Lending Club

Lending Club charges investors a fee equal to 1% of the amount of borrower payments received within 15 days of the due date. The borrower pays an origination fee that ranges from 1% to 5%, depending on the grade. Investors can get started for as little as $25.

Lending Club uses a model rank system to grade borrowers. The system uses a combination of a proprietary scoring model, FICO score, and other credit features of the applicant. For non-performing loans, Lending Club charges investors 18% of any amount collected if no litigation is involved.

If litigation is needed, investors must also pay 30% of hourly attorney fees.

Prosper

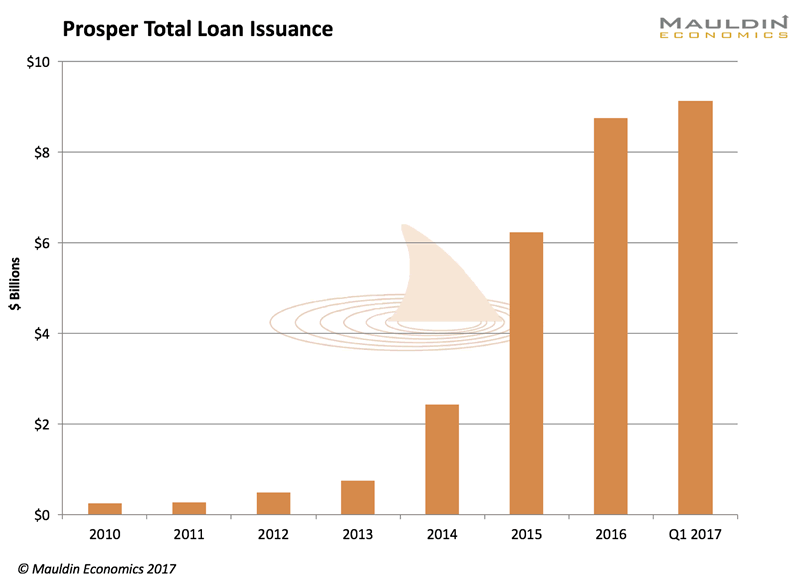

Launched in 2006, Prosper was the first P2P lending platform in the US. It has since funded over $9 billion in loans. Prosper only offers unsecured consumer loans and does not make SME loans.

Like Lending Club, Prosper offers 36- and 60-month loans with amounts ranging from $2,000 to $35,000. It also operates under the notary business model.

Source: Prosper, PeerCube

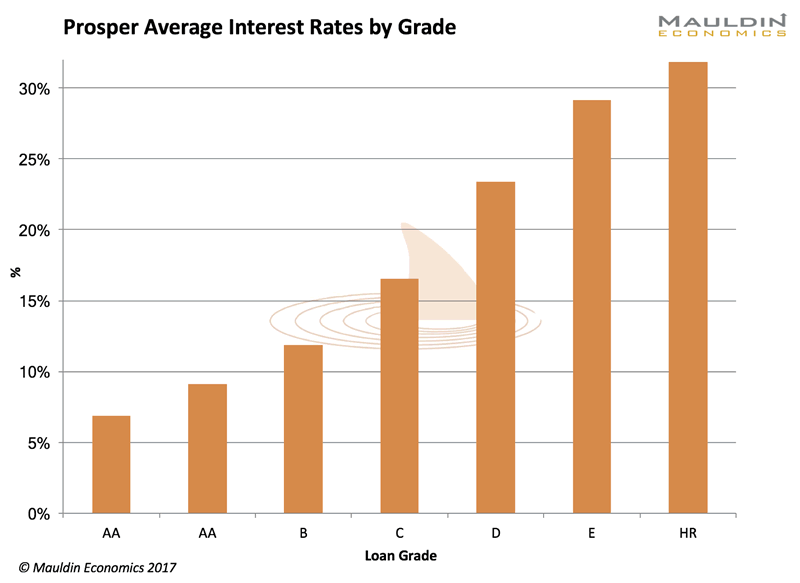

Prosper offers its loans on a grading scale:

Source: Prosper, PeerCube

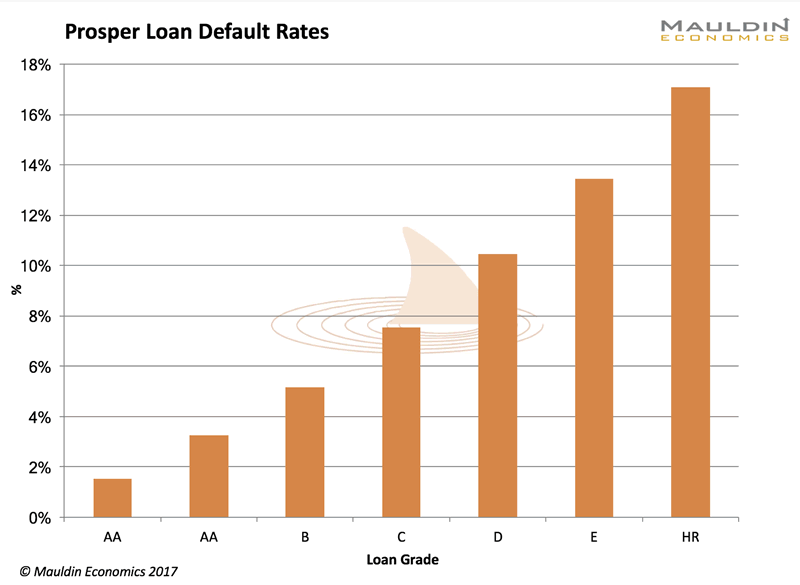

Default rates on Prosper loans:

Source: Prosper, PeerCube

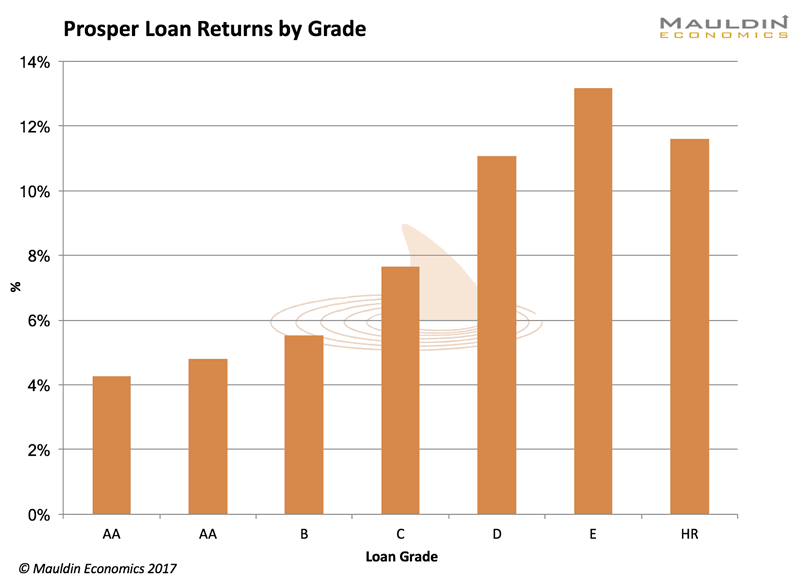

Returns across all grades:

Source: Prosper, PeerCube

Prosper charges borrowers a “closing fee,” which ranges from 0.5% to 5%, depending on the grade. Investors are charged a 1% annual fee based on current outstanding loan principal. The minimum investment is $25.

Prosper grades borrowers through its Prosper Score. This proprietary system focuses on criteria such as debt-to-income ratio and other “soft checks” conducted by credit bureaus. Prosper uses both the custom score and the credit reporting agency score to assign the borrower grade. Prosper bundles all non-performing loans and sells them to a third party. The affected investors then receive an amount proportional to their defaulted loan.

Lending Club and Prosper are the big players in the industry and the only services open to retail investors. The platforms covered below are available to accredited investors only.

Upstart

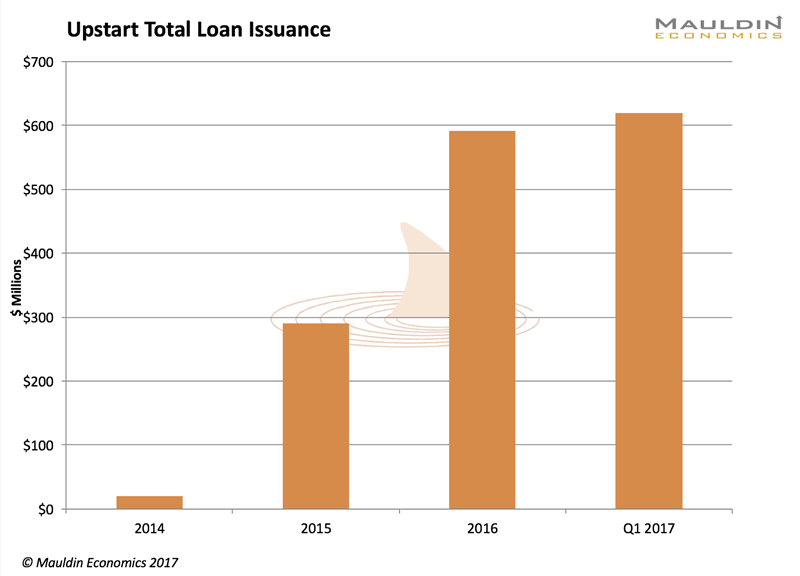

Launched in 2014 by a bunch of ex-Googlers, Upstart has originated more than $600 million worth of loans.

Source: Upstart

Upstart uses unique grading criteria. It looks at FICO scores but also considers educational background. The firm has the lowest default rates across the industry thus far. Around 92% of loans are on track to be repaid in full.

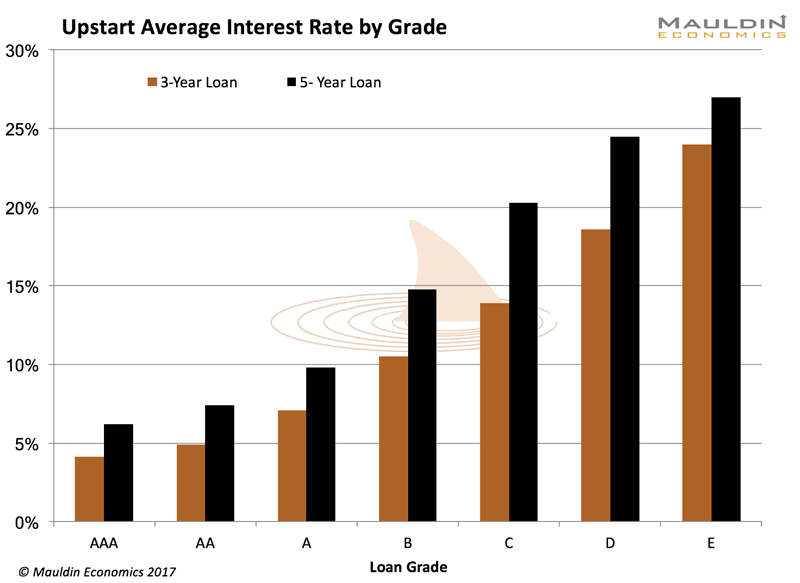

Upstart’s target niche is young professionals—over 90% of borrowers are college graduates—and small-business start-ups. It offers loans between $3,000 and $35,000 for fixed periods of three to five years. Interest rates range from 4% to 26%, depending on grade.

Source: Upstart

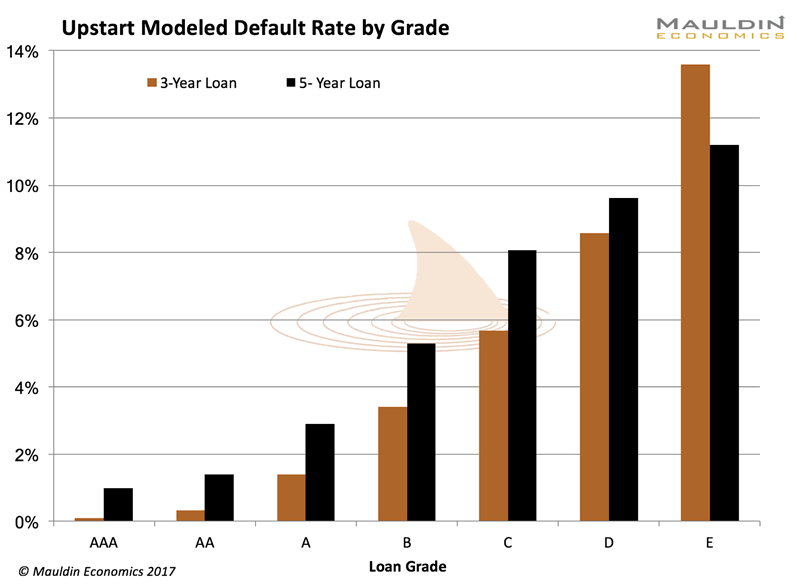

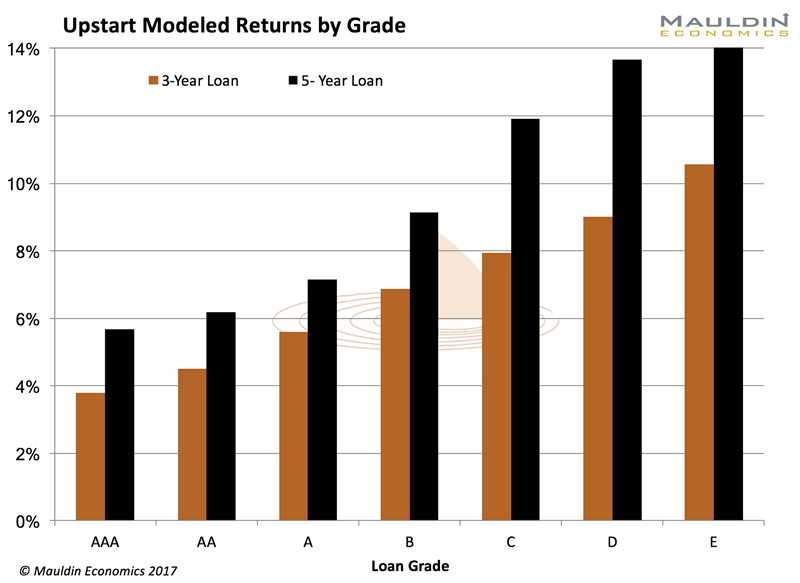

Upstart employs a modeling system that has so far been remarkably accurate at predicting future defaults.

Source: Upstart

… and returns.

Source: Upstart

The way Upstart operates differs in many ways from other P2P lenders. To start, investors do not pay fees. The company makes its money solely on origination fees from the borrower. If a loan defaults, Upstart refunds the investors using the origination fee. This means if loans go bad, Upstart loses. It has skin in the game.

Loan selection also differs in that investors cannot cherry-pick individual loans. Instead, they choose to invest in a specific grade or loans with set criteria. The minimum investment is $100.

How to Get Started

Based on our research, here is our recommendation on the best way to get started in peer-to-peer lending.

While Prosper offers higher returns and lower default rates on low-grade loans, Lending Club offers the same on high-grade loans. Each platform can earn investors outsized returns, so you should follow a key principal of P2P lending and diversify your investments across both platforms.

Accounts on Lending Club and Prosper can be set up in just a few minutes. If you want a representative to walk you through the process, both platforms have helplines that are open Monday to Saturday, 8:00 am–5:00 pm PT.

Free Report: The New Asset Class Helping Investors Earn 7% Yields in a 2.5% World

While the Fed may be raising interest rates, the reality is we still live in a low-yield world. This report will show you how to start earning market-beating yields in as little as 30 days... and simultaneously reduce your portfolio’s risk exposure.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.