Stock Market About As Crazy As It Gets...

Stock-Markets / Stock Market 2017 Sep 02, 2017 - 12:56 PM GMT NDX appears to have made its final high this morning. The Triangle formation tells us it is so. Triangles always precede a final high or low in a the trending direction.

NDX appears to have made its final high this morning. The Triangle formation tells us it is so. Triangles always precede a final high or low in a the trending direction.

SPX (and the Dow) have potentially peaked in hour 65 (64.5 in Cycle time) and have stalled beneath their all-time highs. The divergence between the NDX and the blue chips is striking and indicative of a potential top. This has all the earmarks of a “sell the rally” retracement. Since it is Friday before a three-day weekend and only two weeks from a potential Master Cycle low, I’d say it’s time to make sure you are positioned where you wish to be in a potential panic decline.

The VIX is not going to help your comfort level, since it is beneath its already low 50-day Moving Average.

The Hi-Lo Index is also above its mid-Cycle support/resistance, so there’s no help there.

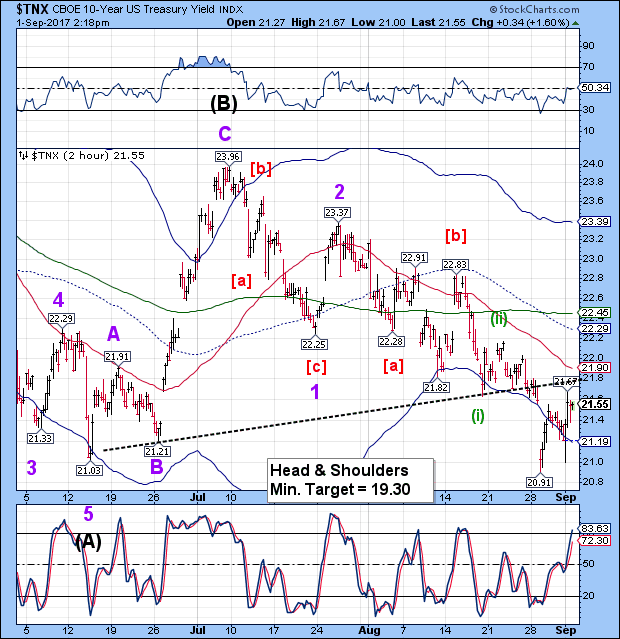

TNX has tested its Head & Shoulders neckline. As long as it stays beneath it at 21.80. Should it reverse back into a decline beneath 20.91, it may have a new Head & Shoulders target beneath 18.00.

This is an oddity, since short-term T-bills are going crazy. ZeroHedge writes, “While the politicians and the mainstream media are playing down any concerns about the US debt ceiling, Treasury Bill market participants are seeing chaos as the yield curve has snapped across the Sept-Oct divide with panic-buying in bills that mature ahead of the September-end (Q3-end liquidity needs), and dumping of October bills.”

A further observation, "But, but, but, rates have nowhere to go but higher..." is all we have heard for the past year.

But what if that is incorrect?

I am having trouble “reading” the pattern in TNX, but thus far it seems to be pointing lower. The Cycles Model indicates the next Master Cycle low may be near the end of September. Recession, anyone?

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.