Gold and Silver Analysis - Have it Your Way

Commodities / Gold & Silver Mar 25, 2007 - 12:13 AM GMTBy: Dominick

by Joe Nicholson (oroborean) - “I n the end, it's not always the facts that determine the market's reaction, but the context… The best advice for markets like these is to shut out the noise and trade the charts.”

~ Precious Points: Lackluster, But Not Tarnished

The gold chart below is an updated version of the one shown here last week. Clearly there's something to those channels, and it can only be interpreted as bullish that gold caught support at the centerline and moved higher last week.

Silver, while still in the bottom channel had plenty of room to run last week and it showed, with the white metal again outperforming sector as a whole. We had been focusing on the 50-day moving average on the weekly chart for support in the recent downturns, but a member in the forums last week pointed out that silver was moving to, and ultimately closed at, the 50-day mark on the daily chart.

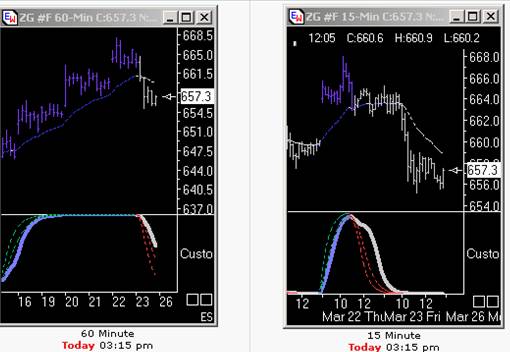

But, the trend cycle charts at TTC really had a fantastic week and provided the most frequent, tradable insight. In the sample below, the chart on the left shows the hourly trend line hitting the top of its channel right before the Fed announcement and pegging, a bullish indicator. The chart to the right represents a full cycle in the 15-minute trend, which hinted at midday Thursday of a possible move lower, ultimately confirmed by the 60-minute chart, saving the well-armed trader more than 5-points of decline.

Though the metals again closed the week with a somewhat less than totally enthusiastic performance, the big picture continues to look attractive, particularly for long term holders of precious metals. Remember, only gradual appreciation over time is sustainable – unless there's a rapid shift in supply or demand, or catastrophic failure in another asset class, then all parabolic leaps created by speculators will come crashing down when the investment landscape flattens and the big money moves on to the next best thing. But, if the metals can creep higher while staying under the radar, letting supply and demand take their toll, more of the inherent value of these commodities can be unlocked for longer.

The short term in both gold and silver continues to curiously resemble the earlier timeframes referenced in this update over the last two weeks, and is therefore quite bullish, but not without its obstacles. Again, sentiment, emotion and the context created by economic data are likely to create a tug of war in metals without regard to the fundamentals. While it's always fruitful to trade the charts in these environments, finding the best risk/reward entry and exit points, it's not exactly advisable to completely ignore the economic terrain ahead.

So, while there's a certain futility in analyzing last week's hopelessly noncommittal FOMC statement, it is nevertheless the official roadmap we're all given for the short term and bears some investigation. Last week's update depicted the Fed as merely leaning one way or the other to keep the economy in check, rather than moving to actually change rates. That spectacle continued to unfold last week as, in a commendable act of transparency or, for lack of a better word, honesty, the Fed backed a bit from its hawkish tilt, but stopped well short of a dovish, or even neutral, inclination. However slightly, the statement does crack open the door for eventual policy accommodation and gives the committee room to either develop this position or not, as the situation unfolds. Time would seem to favor a rate hike, but the factors at play are now clearly laid out before us.

As the statement reads, the significant obstacle to an immediate campaign against inflation is the “adjustment” in housing, but particularly the “mixed” effects on the rest of the economy. Existing home sales were strong last week, but inventories are again swelling as so-called “phantom” supply hits the various markets at the slightest hint of buying interest. Next week's new home sales will be a bit more forward looking, but inventories will still be the most crucial number for gauging the future. Realtors can currently say they're not yet feeling adverse effects from mortgage defaults and repossessions, but the true test has not yet arrived. The Fed, for its part, seems content to let the market forces regulate freely. Going forward, a resilient consumer and moderate GDP growth, regardless of the housing market, will at least keep the Fed from being forced into cutting.

By its own admission, and rightfully so, the Federal Reserve has significant inflationary forces to contend with, not the least of which is its own expansion of the money supply, a brisk 9% annual rate over the past three months. That's nearly half again 2006's substantial 6.1% pace. Though it never makes the headlines, money supply expansion is the foundation underpinning all valuations from stocks to gold.

But there are also other very real factors such as employment, wage inflation and productivity that influence the degree to which new money appears as higher prices. A certain degree of unemployment spilling over from housing construction could ease the inflationary pressure, but ironically, construction is overrun with undocumented workers that may never appear in official jobs data, for good or ill. A surprise in any of these, or related numbers, however, carries the potential for a profound impact on market outlook.

The price at the pump is an inflationary factor that hits across the board and is already unseasonably high heading into a period of peak demand. Oil has hovered stubbornly around $60, but production bottlenecks at refineries have kept gasoline expensive. It's difficult to say with certainty, but the less than impressive fourth quarter in retail might be directly related to last year's wild rise in energy prices. While the economy as a whole has so far been resilient, add in potential loss of wealth effect from falling home prices, at least in some local markets, and the straws on the camel are mounting.

Over the last two weeks this update, as well as posts in the forums, had attempted to establish an argument for metals rallying on lower interest rates provided they were not prompted by recession. Consistent with that position, stocks and gold took a big step up on a less hawkish Fed that maintained its optimistic outlook for growth. However traders chose to read the statement initially, the hype about the Fed removing its hiking bias was short lived, particularly as evidenced by the yield curve, which made significant normalizing moves on Wednesday only to reverse over the following two days.

Ultimately, when, or rather if, the Fed ever finds itself free of the competing forces keeping it fixed at the current target rate, precious metals could benefit from a policy move in either direction under the right conditions. As detailed in a previous update, the current bull market began in earnest at the end of 2005 as Greenspan began his incremental rate hikes which, the current dilemma proves, never quite caught up with inflation. If the economy emerges from the other end of the housing “adjustment” and incremental hikes again resume, there is every reason to believe that at least for an intermediate period, they would fail to overcome the significant wave of inflation building since at least 2002.

If, on the other hand, inflation somehow appears contained before housing fully recovers, or if an emergency demands a rate cut, gold could still rally, as it did on Wednesday, so long as a recession is not in the cards. Of course, as frequently mentioned in this update, the American economy is a fraction of the total global demand for precious metals, albeit a fraction that's exaggerated by vast leverage and liquidity.

So, rate hikes, rate cuts – take your pick. It's hard to make a long term bearish case for metals that actually seems likely. That said, gold and silver moved lower on Friday concurrent with a rally in the yen, signaling that liquidity concerns, and particularly as they pertain the carry trade, have not fully passed. While rate cuts are more bullish from a domestic inflation standpoint, they have bearish implications for the yen carry. Perhaps, though, it's not the Fed's interest rates, but how these interact with foreign central bank policy that will determine the global investment demand for gold and silver in coming years. In the meantime, the powerful growth engines of China , India and M2 will put a steady floor under price.

Oroborean

This update is provided as general information and is not an investment recommendation. TTC accepts no liability whatsoever for any losses resulting from action taken based on the contents of its charts, commentaries, or price data. Securities and commodities markets involve inherent risk and not all positions are suitable for each individual. Check with your licensed financial advisor or broker prior to taking any action.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.