Are You Ready to Profit From the US Dollar Collapse?

Currencies / US Dollar Aug 31, 2017 - 12:28 PM GMTBy: Graham_Summers

The US Dollar collapse has already triggered a major move in inflation plays.

The US Dollar collapse has already triggered a major move in inflation plays.

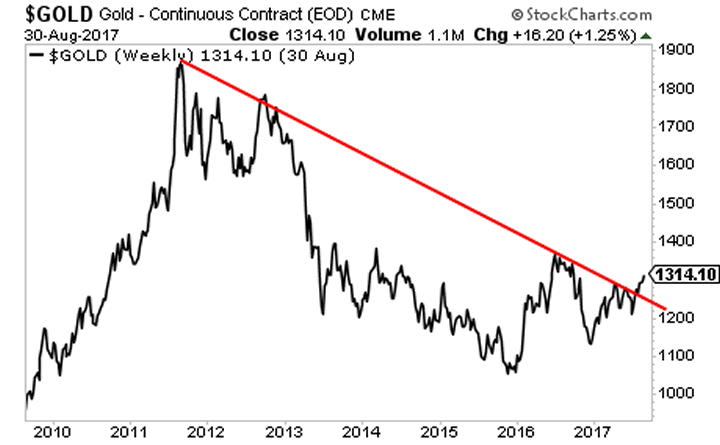

To whit, Gold has broken its SEVEN-YEAR downtrend.

As the US Dollar continues to drop hard over the next 12 months, Gold and other inflation plays will be exploding higher.

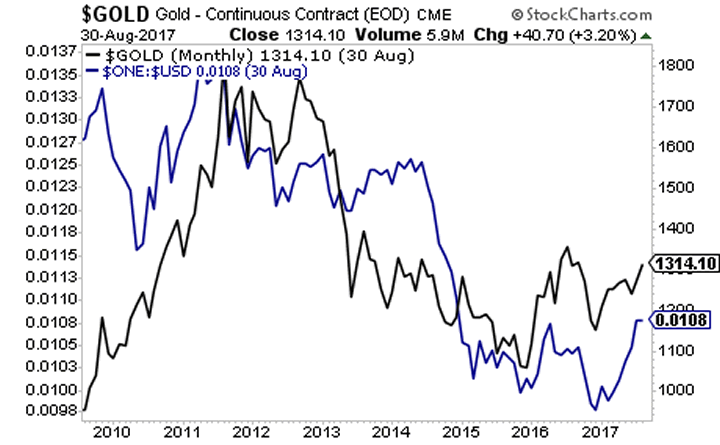

Below is a chart of an inverted US Dollar (blue line) and Gold prices (black line). As you can see, Gold is now leading. And as the US Dollar drops, Gold will be roaring even higher.

Smart investors will use this trend to make literal fortunes.

If you’re not taking steps to actively profit from this, it’s time to get a move on.

We just published a Special Investment Report concerning a secret back-door play on Gold that gives you access to 25 million ounces of Gold that the market is currently valuing at just $273 per ounce.

The report is titled The Gold Mountain: How to Buy Gold at $273 Per Ounce

We are giving away just 100 copies for FREE to the public.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/goldmountain.html

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2017 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.