Gold Price Surges 2.6% After Jackson Hole and North Korean Missile Launch

Commodities / Gold and Silver 2017 Aug 29, 2017 - 02:43 PM GMTBy: GoldCore

– Gold surges as N. Korea fires ballistic missile over Japan

– Gold surges as N. Korea fires ballistic missile over Japan

– Safe haven buying sees gold break out to 10-month high after Jackson Hole and rising North Korea risk of attack on Guam

– South Korea’s air force dropped eight MK 84 bombs near Seoul; simulating the destruction of North Korea’s leadership

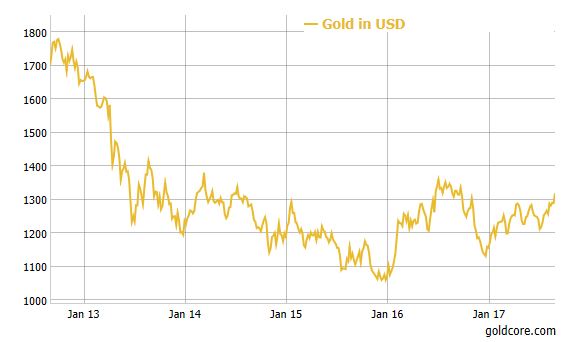

– Gold rises from $1,291 to $1,325; Silver surges 3.2% from $17.05 to $17.60

– Volatility as seen in VIX surges as stocks fall; FTSE -1.1%

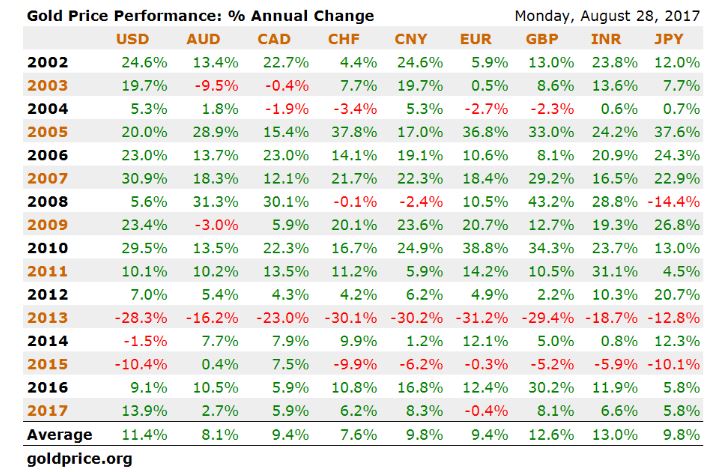

– Yen rises in short term but no safe haven in long term with gold haven risen 9.8% per annum in JPY (see chart)

– Gold was moving higher after Jackson Hole and had broken through crucial $1,300/oz level

– Asian geopolitical risk allied to U.S. political instability increasing safe haven bid

– $20 trillion U.S. debt ceiling storm looms

Editor: Mark O’Byrne

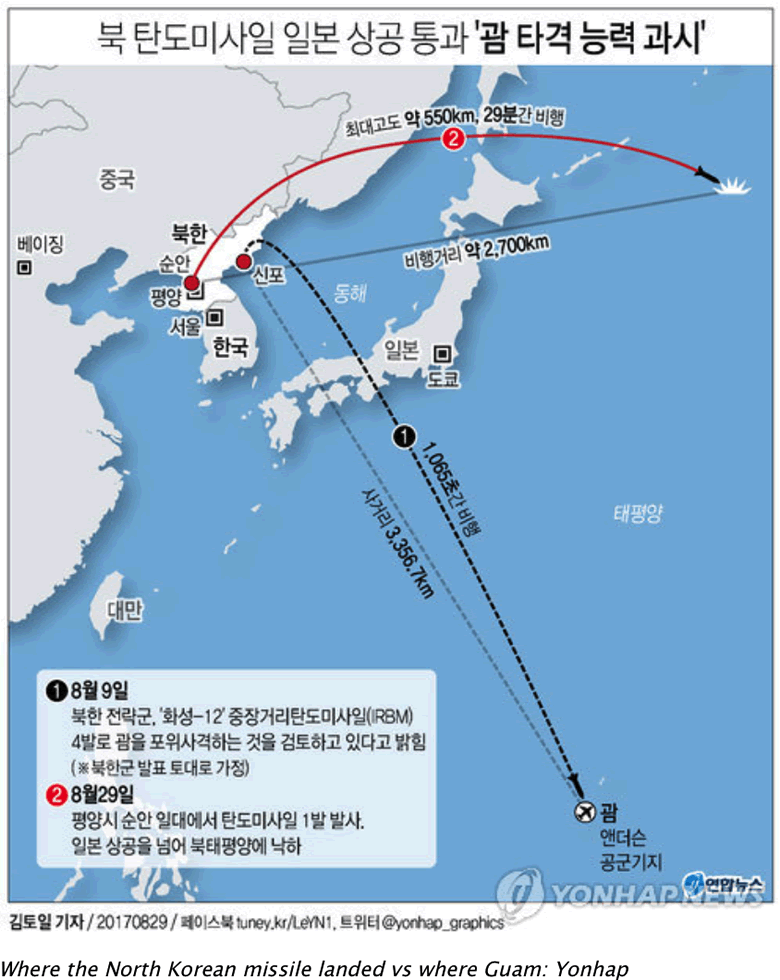

This morning the price of gold has rallied to its highest point since the Trump’s election. North Korea’s firing of a missile over Northern Japan which landed in waters off Hokkaido in the Pacific, has sharply escalated tensions in the Korean peninsula and in Asia.

This latest move by Kim Jong Un was intended to show that an attack on Guam is possible at any time, according to North Korea’s Mun-hwan.

Source: Yonhap via ZeroHedge

There had previously been concern that the war of words between Trump and Kim Jon-Un would result in others getting caught in the crossfire. This was confirmed this morning when Japan was made a clear target.

“North Korea’s reckless action is an unprecedented, serious and a grave threat to our nation”

– Japanese Prime Minister Shinzo Abe

Immediately after the missile launch was detected the Japanese government’s J-Alert system interrupted radio and TV to warn citizens of the possible missile and urged them to take refuge in solid buildings or underground shelters. Bullet train services were temporarily halted and warnings went out over loudspeakers in towns in Hokkaido.

South Korea’s air force has staged a live-fire drill simulating the destruction of North Korea’s leadership. Earlier this morning four South Korean fighter jets bombed a military firing range north of Seoul after President Moon Jae-in asked the military to demonstrate capabilities in a show of strength to North Korea.

North Korea refers to these missile launches as ‘tests’. But they are more than tests of the equipment, they are also tests on the patience, nerves and self-control of those who feel threatened by Kim Jong-Un. Observers and surrounding countries believe this saber-rattling is growing ever more serious and dangerous by the day.

As Yonhap notes, “the North’s provocation is another slap in the face to Moon and U.S. President Donald Trump as they have sought to resume dialogue, and could bring tensions on the peninsula to a new high.”

Trump is also left red in the face after his comments that Kim Jong Un “is starting to respect us.” Yet another idiotic comment from the current incumbent of the White House.

Safe havens rise as risk assets fall from record highs

Fear in the markets has been expressed by the climb in price of gold and the ongoing support for the Japanese Yen, Swiss Franc and US Dollar.

While the yen has risen in the short term, the notion that it is a ‘safe haven‘ in the real sense of that term – as a medium and long term hedge for investors – is inaccurate. This is clearly seen in the table above and the chart below which show that the yen has fallen nearly 10% per year versus gold in the last 15 years.

Gold rose in yen prior to the crisis from 2002 to 2007 and again during the height of the crisis from 2009 to 2012.

Seeing as Japan is at risk of a nuclear attack and being sucked into a war – wars are expensive things – the yen is actually vulnerable and will likely fall in the coming months.

Gold in JPY – 15 Years – Goldprice.org

The rise in the price of both gold and silver is expected given the events of last night, however they do not come without support elsewhere.

The outcome of Jackson Hole and growing concern over the looming US debt ceiling have been providing growing support for the climb in gold and silver.

Where does it end?

Currently there are two major drivers for the price of gold, both of them related to President Donald Trump himself.

These are: US political instability and tensions in Asia including with North Korea.

Following Trump’s election markets had expected Trump’s plans for fiscal stimulus to do great things for the economy. A planned $500 billion infrastructure spending program was expected to lead to strong US economic expansion, higher interest rates and a more robust dollar.

However, nothing has materialised and Trump now has the problem of a potential government standoff as the $20 trillion debt ceiling issue looms in September.

Many might argue that Trump inherited these huge economic challenges that will likely lead to political instability. But, one problem he has definitely made worse and arguably added to (in the short-term) is that of North Korea.

A major difference with the North Korea problem is that for the first time in modern history the US has a president who is happy to be confrontational and threatening. He does not appear to want to be conciliatory and work to find a multi-lateral solution. With this in mind it is near impossible for investors to know how this will end.

At the time of writing there has been no official response from the White House or tweets from President Trump. How the situation with North Korea will unfold relies heavily on what happens in Washington. No doubt, If Trump decides to tweet and escalate the matter the situation will become even messier prompting a sharp sell off in risk assets.

Uncertainty drives the gold price

Once again the short-term support for gold is being solidified by uncertainty. This combined with the long-term support that is driven by the irrevocable damage governments have done to our markets and currencues, means that we are left with a strong basis for an ongoing climb in the gold price.

Investors are turning to gold today because one of the world’s most advanced economies is under threat by one of the last closed-dictator regimes.

The situation will be helped or hindered by others in the western world who are also concerned for their own country’s safety. We are very much on the brink of something which could affect lives for generations to come, much like the last two major wars that dragged every corner of the globe into them.

In previous scenarios when countries’ safety and sovereignty have been under threat, gold has acted as a safe haven for those who are concerned about the safety of their assets, currencies and wealth. They have invested in gold, safe in the knowledge that it cannot be deleted by a cyber attack or told it cannot be used when they cross borders. They know that it is the ultimate safe haven.

The market reaction to events overnight shows again that diversification is key. Gold should be treated as a currency and added to a balanced, diversified portfolio to ensure financial insurance in the coming months and years.

Gold Prices (LBMA AM)

29 Aug: USD 1,323.40, GBP 1,020.34 & EUR 1,097.36 per ounce

28 Aug: No LBMA prices today as UK holiday

25 Aug: USD 1,287.05, GBP 1,003.90 & EUR 1,090.90 per ounce

24 Aug: USD 1,285.90, GBP 1,003.26 & EUR 1,090.44 per ounce

23 Aug: USD 1,286.45, GBP 1,004.33 & EUR 1,091.68 per ounce

22 Aug: USD 1,285.10, GBP 1,000.71 & EUR 1,091.95 per ounce

21 Aug: USD 1,287.60, GBP 999.82 & EUR 1,096.52 per ounce

Silver Prices (LBMA)

29 Aug: USD 17.60, GBP 13.59 & EUR 14.62 per ounce

28 Aug: No LBMA prices today as UK holiday

25 Aug: USD 17.02, GBP 13.26 & EUR 14.40 per ounce

24 Aug: USD 16.93, GBP 13.20 & EUR 14.36 per ounce

23 Aug: USD 17.06, GBP 13.32 & EUR 14.48 per ounce

22 Aug: USD 17.02, GBP 13.27 & EUR 14.48 per ounce

21 Aug: USD 17.02, GBP 13.20 & EUR 14.48 per ounce

Mark O'Byrne

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information containd in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.