Cryptocurrencies Hit All-Time Highs, Gold Spikes Higher As Investors Flee The Stock Market

Currencies / Bitcoin Aug 29, 2017 - 12:19 PM GMTBy: Jeff_Berwick

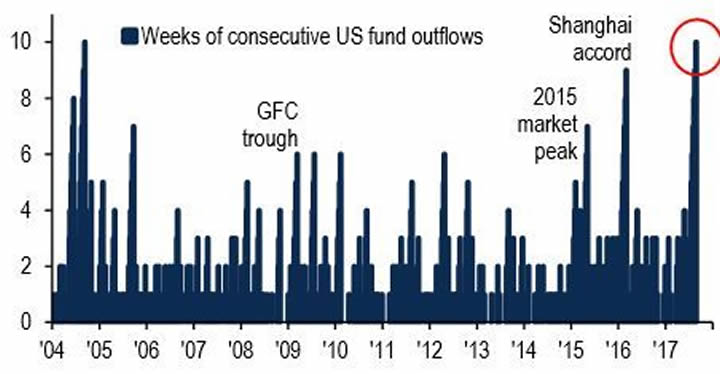

Bank of America Merrill Lynch reported this week that investors had pulled $30 billion from US stock funds over the last ten weeks. And, the latest week of outflows marks the 10th straight week of withdrawals, the longest in more than a decade.

Bank of America Merrill Lynch reported this week that investors had pulled $30 billion from US stock funds over the last ten weeks. And, the latest week of outflows marks the 10th straight week of withdrawals, the longest in more than a decade.

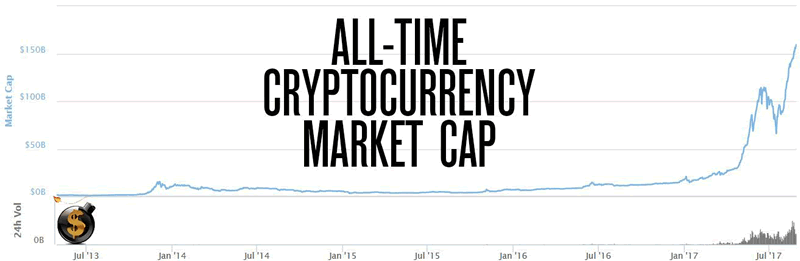

Investors pulling $30 billion from the stock market in the last ten weeks is very interesting as the value of all cryptocurrencies has simultaneously surged by $47 billion in the last ten weeks.

Could it be that investors are, smartly, getting out of the stock market and into cryptocurrencies?

It’s possible. The Dollar Vigilante’s Senior Analyst, Ed Bugos, has sensed as much, noting in a personal post last week that while he does not, “see much competition between gold and the cryptocurrencies, [he] definitely [sees] some between the NASDAQ and the crypto space.”

By that, Ed means that there is competition over increasingly scarce investment capital.

And, Ed had already figured that a fair amount of the capital coming into cryptocurrencies was coming from the stock market.

Ed warns, most notably to subscribers, that a lot of investment has come from Wall Street and the establishment, which to him merely emphasizes the vulnerability of the crypto bull to the Federal Reserve’s monetary policy and the wider boom created by the record interest rate suppression.

In other words, during the next stock market crash, we could see a serious drop in the cryptocurrencies. TDV subscribers (subscribe HERE) will be fine though because we are prepared for the crash in other financial assets by hiding out in the precious metals, which have sat out most of the boom, as well as by shorting the US dollar and the stock market.

Certainly, someone is investing heavily into the cryptocurrencies as they continue to hit all-time highs. The value of all cryptocurrencies now sits at the cusp of $160 billion.

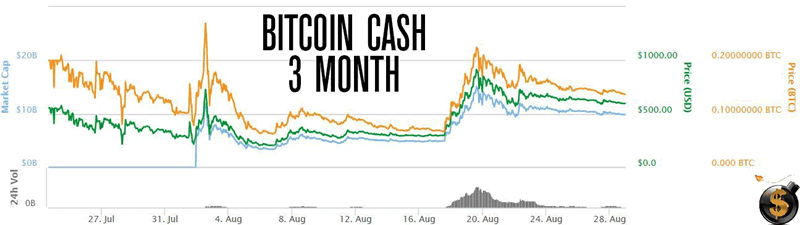

Bitcoin itself has just hit a new all-time high $4448 on August 25th.

And, gold finally caught some wind under its sails after lagging the cryptocurrencies badly for years. It rose to over $1,320 today; its highest level in nearly a year.

In the next few days we’ll release our next issue of the TDV newsletter where I’ll speculate that what we are seeing are the pre shocks to a fall crash… And, unbeknownst to many, this September may be the end of the Jubilee year, not last year.

We’ll have our eyes focused closely on all that as we enter into an interesting autumn period. What’s another word for autumn? Fall. And we may see the US stock market do just that in September and October.

Still not prepared? Make sure to subscribe to get all of our latest analysis and advice HERE.

And if you are still behind on learning about cryptocurrencies, check out our free four-video webinar HERE. If you accept our offer at the end of the webinar, we’ll even send you your first $50 in bitcoin directly from me, personally.

In the meantime, here at TDV, we are enjoying the end of summer with more spectacular gains to add to our already ridiculously spectacular gains.

Who would have thought that watching the whole system burn to the ground could be so much fun?

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2017 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.