Trump’s Fall - The Eclipse of the Presidency?

Politics / US Politics Aug 24, 2017 - 03:12 PM GMTBy: Dan_Steinbock

As violent demonstrations linger domestically and nuclear risks loom abroad, the White House has flamed new domestic divisions, while paving the way for international trade wars. The coming fall will be the hottest - and potentially most violent - in decades in America.

As violent demonstrations linger domestically and nuclear risks loom abroad, the White House has flamed new domestic divisions, while paving the way for international trade wars. The coming fall will be the hottest - and potentially most violent - in decades in America.

America is amid a great unease. While Charlottesville’s white supremacists and violent riots brought forward old race divisions and seemingly new hate groups, North Korea’s nuclear threats prevail.

In the fall, the White House and the Congress must also cope with a set of political time bombs, including the impending fight for the nation’s debt ceiling (US debt amounts to $20 trillion, or 105% of GDP), the 2018 federal budget, polarizing tax reforms, infrastructure spending and possibly another effort to overthrow Obamacare (i.e., The Patient Protection and Affordable Care Act, ACA).

Internationally, these huge challenges will be coupled by the Trump administration’s ongoing attempt to confront China in intellectual property, re-negotiate the North American Free Trade Agreement (NAFTA) and re-define US relationship with its European NATO allies through deficit-targeting trade surpluses.

Meanwhile, special counsel Robert Mueller’s Russia investigation has zoomed on Trump’s businesses, while calls for Trump’s impeachment, resignation and assassination are escalating. Not surprisingly, economic prospects are now more uncertain and markets more volatile, as evidenced by light trading volumes after two weeks of losses in equities. Still, the cyclically-adjusted price-earning (Shiller CAPE) ratio remains close to 30 - as in October 1929 but higher than before the 2008 crisis.

Domestic Divisions

During the 2016 presidential campaign, Trump promised to increase real economic growth to 4 percent. At the time, I predicted that would never happen and, due to political destabilization, economic growth could take a hit. That’s now the case.

Growth will remain about 2-2.2 percent in 2017-18, although further destabilization could reduce it by 0.2-0.4 percent. The economy’s long-term potential growth rate is 1.8 percent, due to aging demographics and retiring big boomers. But if Trump will cut immigration by 50 percent in a decade, as he plans, growth and productivity will take another hit. According to a new Wharton School report, the immigration plan, dubbed the RAISE Act, would result in 4.6 million lost jobs by the year 2040.

In turn, Trump's tax reform plans would require the support of the Congress, which is highly unlikely. In effect, any effort by the White House to rely on congressional support is currently compromised, due to the ongoing Special Counsel Robert Mueller’s Russia investigation. In the absence of a repealed Obamacare, the Trump tax plan would raise federal government debt to 115-140 percent of GDP by 2027, and double it by 2047.

While bipartisan support prevails for corporate tax reforms (US rate is the highest among major advanced economies) and the simplification of personal-income taxes, Democrats will not tolerate a 15-percent corporate tax rate or huge personal-income tax reductions for the rich. So Trump is likely to resort to moderate tax cuts that could amount to $500 billion in early 2018 - conveniently before the approaching mid-term elections.

One of Trump’s key initiatives has been the plan to address America’s crumbling infrastructure by spurring $1 trillion in investment over time. But thanks to the Mueller investigation, the plan is on hold. Initially, the multiplier effect of the investment was still expected to be substantial but lessen over time as the economy strengthens. But time is money. According to projections, a $1 investment in the infrastructure in 2015 could have added $1.70 to U.S. GDP in just a few years. But as the economy has continued to strengthen, the multiple is now estimated at $1.30.

Since the expected fiscal expansion is late, even in the most benign scenario it will amount and achieve less than anticipated. As Trump dreams turn to realities, the glitter is fading and only rust remains.

International Nightmares

After the Trump-Xi Florida Summit in early April, U.S. and China announced a 100-day Action Plan to improve strained trade ties. Yet, just two weeks later, Trump issued a Presidential Memorandum, which directed Commerce Secretary Wilbur Ross to investigate the effects of steel imports on national security grounds.

By June, Europe’s NATO leaders launched an extraordinary lobbying campaign against an anticipated US crackdown on steel imports, which, they said, would hit US allies more than China. Instead of a long legal battle at the WTO, European trade chiefs are considering more immediate and consequential measures, such as punitive tariffs on agricultural products like corn, soy or rice. The goal is to turn U.S. farmers, many of whom voted for Trump, against the White House.

As the G20 Summit ended, Washington was left isolated on climate change. While the G20 vowed to continue to fight protectionism, the U.S. managed to include in the final communique terms, such as “all unfair trade practices” and “legitimate trade defense instruments” - which could serve as pretext for protectionist measures in the future.

In late June, amid a contentious internal debate on trade and tariffs in the Roosevelt Room, Trump overruled his own Cabinet, even at a risk of a global trade war. Supported by two hawks, trade policy director Peter Navarro, senior policy adviser Stephen Miller (and then-chief adviser Steve Bannon who was not in the meeting), the plan was opposed by 22 top White House officials who spoke for moderation.

More followed soon. When the Trump administration’s first US-Sino Comprehensive Economic Dialogue (CED) ended in Washington in July, it could agree on nothing; not even on a joint statement. Then, the Trump administration seized steel as a “a national security threat,” moving spotlight to its NAFTA partners. China produces almost half of the world’s steel, but its US market share is less than 2%. In America, the largest steel importers are Canada (17%) and Mexico (9%).

NAFTA matters. Ever since it was implemented, the value of U.S. agricultural exports alone to its NAFTA partners has risen from $8.7 billion in 1992 to $38.1 billion in 2016. NAFTA has also contributed to a large increase in trade in vehicles and auto parts within North America. Since 1994, the vehicle supply chain has become fully integrated, with parts manufacturing and assembly in all three countries.

Whatever happens to the NAFTA is not just the concern of North America. As a legacy agreement, it has served as a template for the new generation of free trade agreements (FTAs) that the United States has later negotiated, and as a template for certain provisions in multilateral trade negotiations as part of the Uruguay Round. Consequently, whatever the NAFTA will ultimately become will overshadow Washington’s future FTAs with the rest of the world.

Moreover, as new trade conflicts will extend to imported aluminum, semiconductors, paper, and household appliances, trade friction will spread to China and other major importers - as evidenced by the new debate on intellectual property and technology.

After mid-August, Trump directed the U.S. Trade Representative Robert Lighthizer, a veteran Reagan administration trade hawk, to open an investigation into China's intellectual property (IP) practices, including forced IP transfers and theft. The linkage between the investigation and the US intelligence community - and new meaning of the term “trade war” - was highlighted by the role of Admiral Dennis Blair, co-chair of the U.S. IP Commission - and former Director of National Intelligence and a retired admiral who served as the commander of U.S. Pacific forces.

As Lighthizer’s investigation will proceed under Section 301 of the Trade Act of 1974, some 40-year old legislation that was seized in the 1980s to deter the rise of Japan, the investigation could lead to steep tariffs on Chinese goods.

“This is just the beginning,” Trump told reporters after he signed the executive memorandum. Days later, the White House set a tough tone in the NAFTA talks with Canada and Mexico.

And so the Pandora’s Box of trade wars has been opened.

Incumbency, Impeachment, Resignation, Assassination

Meanwhile, special counsel Robert Mueller has impaneled a grand jury in the investigation of Russia’s alleged interference in the 2016 U.S. election. In practice, it means that Mueller has the power to issue subpoenas and to put witnesses under oath, while the investigation is reaching to Trump campaign’s contact with Russians, and the real estate deals by him and his son-in-law Jared Kushner.

The ultimate objective, which is supported by both Republican neoconservatives and Democratic internationalists, seems to be to impeach Trump. Ultimately, the “Russiagate” is likely to be legitimized on the basis of alleged evidence, which will not be released in public on “national security” grounds. And while grand jury testimony officially takes place in secret, leaks are guaranteed to keep the story in headlines, especially by media that is strongly opposed to the Trump presidency. However, due to the broader-than-expected investigation, its results are not likely to be available anytime soon.

The more benign scenario, which was recently presented by Tony Schwartz, the ghost-writer of Trump’s 1987 bestseller Art of the Deal , is that if the Mueller investigation corners the incumbent president, he would resign to avoid public humiliation, thus trying to turn a failure in the White House into a political victory - in such conversions Trump does have a long track-record.

Veteran Republican Ron Paul predicted a darker scenario in January: the assassination of Trump by the U.S. “deep state” (i.e., the U.S. industrial-military complex and intelligence community). Recently, the threat was seconded by Mueller’s former deputy, Philip Mudd, the ex-deputy director oft he CIA's Counterterrorist Center and the FBI's National Security Branch, who currently serves as CNN counter-terrorism analyst.”The government is going to kill this guy because he doesn't support them," he said recently; on air.

In turn, some Democratic senators and representatives have openly advocated Trump's execution. As Democratic Senator Maria Chappelle-Nadal recently wrote in Facebook: “I hope Trump is assassinated!” Afterwards, she apologized for her hope but only to deter an impending U.S. Secret Service investigation of the incident.

And yet, recently, U.S. Secret Service affirmed that it can no longer pay hundreds of agents it needs to protect the incumbent president – in large part due to Trump´s multiple travel destination, the sheer size of his extended family, and efforts to secure multiple residences.

In this extraordinarily heated political environment, the Democrats could capitalize on the Trump debacles, if they were not amid a meltdown of their own.

After the 2016 elections, the Clinton Foundation shut down the Clinton Global Initiative (CGI), which critics openly called a “crime syndicate,” since it funded mainly the Clintons’ personal ventures rather than Haiti or other destinations of abject need. The political force behind Senator Hillary Clinton, the Democratic Leadership Council (DNC), has been plagued by a series of scandals, including collusion with mainstream media (e.g., CNN, New York Times, Washington Post), corrupt Ukrainian officials, alleged fraud to subdue Bernie Sanders’ campaign, manufactured allegations about Russian interference, controversial liquidation of millions of dollars in real estate assets, the crimes of former DNC chair Debbie Wasserman-Schultz, the indictment of her IT aide Imran Awan in a huge bank-fraud scheme and so on.

Moreover, a dozen Democrats that have leaked emails to the Wikileaks and those Republicans who have sought to disclose the Clintons' fraud have died in suspicious circumstances in the past year. Not surprisingly, conspiracy stories continue to proliferate from the left to the right.

Presidency at the Crossroads

According to U.S. mainstream media, Trump has lost all support in America and now governs without the consent of the governed. However, that’s fake news, as evidenced by longitudinal Gallup polls.

President Trump’s job approval was relatively highest when he arrived in the White House last January, when 45 percent of Americans still believed he would do a good job, and another 45 percent did not. Thereafter, Trump’s performance has eroded. Today, almost 40 percent of Americans approve his performance but nearly 60 percent do not (Figure 1). These results are actually more moderate than those of President Obama. When he arrived in the White House in 2009, most Americans had faith in him; when he left, he had lost almost half of his political capital.

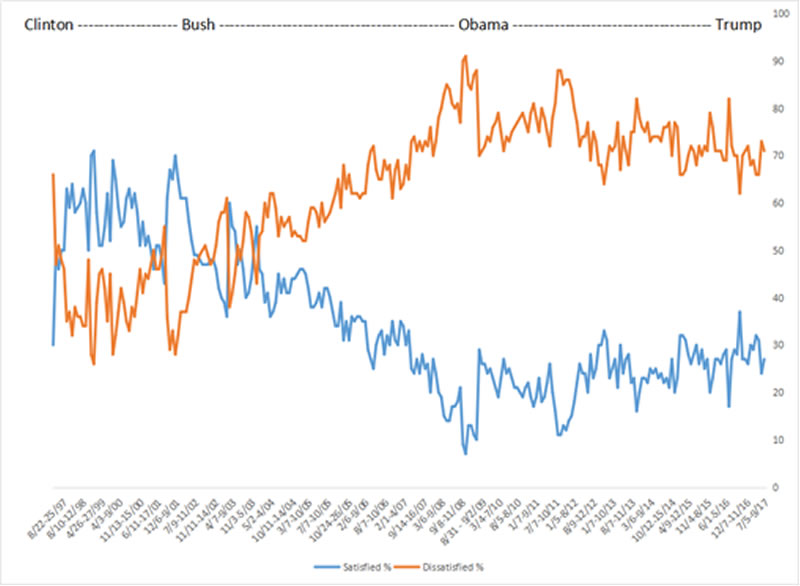

Figure 1 President Trump’s Performance

America’s deep polarization originates from the neoconservative wars against Iraq, Afghanistan and the War on Terror, which have divided the nation ever since. It peaked in the end of the George W. Bush era and the beginning of the Obama rule, when nine of ten Americans disapproved the direction of the nation. Even in mid-2016, toward the end of the Obama era, more than 80 percent of Americans disapproved that course. Today, a year later, more than 70 percent of Americans disapprove the course of the nation (Figure 2).

Figure 2 Direction of the Country, 1997-2017

Source: Gallup Poll. July 5-9, 2017. N=1,021 adults nationwide. Margin of error ± 4.

Now the White House is at the crossroads. "The Trump presidency that we fought for, and won, is over,” said Steve Bannon, Trump’s highly controversial chief strategist who had a critical role in his presidential triumph and as the chairman of the far-right Breitbart News, in a recent interview.

Today, critics of the Trump administration argue that it is a “Goldman Sachs” presidency since the bank’s senior executives control the key economic posts, such as Secretary of Treasury (Steven Mnuchin) and Chief of the National Economic Council (Gary Cohn). But the administration still has a fair number of trade hawks, including Peter Navarro, Robert Lightheizer and Dan DiMiccio, former CEO of steel giant Nucor, plus a group of senior advisers.

“We’re at economic war with China,” Bannon claims, “one of us is going to be a hegemon in 25 or 30 years and it’s gonna be them if we go down this path. Korea.. is just a sideshow.” After that interview with the center-to-left American Prospect, he resigned from the Trump administration to avoid being fired.

Now Bannon has pledged to support the Trump administration against the “globalists” through Breitbart. But in the White House, he did have enough time to contribute to the new deficit-targeting trade policies. Bannon’s plan of attack included the complaint under Section 301 of the 1974 Trade Act against the alleged Chinese coercion of technology transfers from U.S. companies in China, and follow-up complaints against steel and aluminum dumping.

In America, the coming fall will be the most challenging - and possibly most violent - in decades, perhaps since the early 1970s. That’s when the United States coped with the withdrawal from the gold standard, soaring deficits, the oil crisis and Vietnam’s aftermath, economic threats to dollar hegemony, student demonstrations and inner-city riots, resurgence of terrorism, a highly polarized nation, Watergate and, ultimately, the resignation of Richard Nixon.

At the time, the rest of the world was not immune to America’s chaos. Today, the heavily indebted and militarily overstretched America seeks to “unilateralize” the world trading system and its security alliances that it helped to multilateralize after the devastation of World War II. In the process, America is challenging its allies in Europe and Asia, even its own NATO partners.

But economically, America’s new policies threaten most those nations that now fuel global growth prospects, including China and the emerging economies. Ironically, America is now the greatest global risk.

This commentary was released by The World Financial Review on August 22, 2017. The online version will be followed by a print version (September-October 2017).

Dr Steinbock is the founder of the Difference Group and has served as the research director at the India, China, and America Institute (USA) and a visiting fellow at the Shanghai Institutes for International Studies (China) and the EU Center (Singapore). For more information, see http://www.differencegroup.net/

© 2017 Copyright Dan Steinbock - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.